ACCOUNTANT TRAINING NETWORK

Top 10 QuickBooks Mistakes Clients

Make and How to Fix Them

Copyright

Copyright 2008 Intuit, Inc. Intuit, Inc.

All rights reserved. PO Box 7850, MS 2475

Mountain View, CA 94039-7850

Trademarks

Intuit, the Intuit logo, QuickBooks, QuickBooks: Pro, Quicken, TurboTax, ProSeries, Lacerte, and

QuickZoom, among others, are registered trademarks and/or registered service marks of Intuit,

Inc. or one of its subsidiaries in the United States and other countries. Other parties’ trademarks

or service marks are the property of their respective owners and should be treated as such.

Notice To Readers

The publications distributed by Intuit, Inc. are intended to assist accounting professionals in their

practices by providing current and accurate information. However, no assurance is given that the

information is comprehensive in its coverage or that it is suitable in dealing with a client’s

particular situation. Accordingly, the information provided should not be relied upon as a

substitute for independent research. Intuit, Inc. does not render any accounting, legal, or other

professional advice nor does it have any responsibility for updating or revising any information

presented herein. Intuit, Inc. cannot warrant that the material contained herein will continue to be

accurate or that it is completely free of errors when published. Readers should verify statements

before relying on them.

Top 10 QuickBooks Mistakes Clients Make

TABLE OF CONTENTS

Top 10 Mistakes My Clients Make And How to Fix Them.......................................................... 5

Objectives.................................................................................................................................... 5

Notes about Approach.................................................................................................................. 7

Bonus Notes................................................................................................................................... 9

Chart of Accounts Error.............................................................................................................. 11

Errors & Symptoms................................................................................................................... 11

Chart of Accounts Fixes ............................................................................................................. 13

Edit Account Type..................................................................................................................... 13

Merge Accounts ........................................................................................................................ 13

Edit Account Details.................................................................................................................. 14

Sub-accounts ........................................................................................................................ 14

Inactive Accounts...................................................................................................................... 16

Accounts Payable Error.............................................................................................................. 17

Error & Symptoms..................................................................................................................... 17

Accounts Payable Fixes ............................................................................................................. 18

Accrual Basis – No Bank Reconciliation................................................................................... 18

Accrual Basis – Bank Reconciliation Completed...................................................................... 19

Step 1 – Correct Coding of Check........................................................................................ 19

Step 2 – Link Check to Bill.................................................................................................... 20

Cash Basis – Bills Not Needed................................................................................................. 21

Accounts Receivable Error......................................................................................................... 24

Errors & Symptoms................................................................................................................... 24

Accounts Receivable Fixes........................................................................................................ 26

Bank Reconciliation Not Completed ......................................................................................... 26

Step 1 – Delete Deposit........................................................................................................ 26

Step 2 – Receive Payment ................................................................................................... 27

Step 3 – Make Deposit.......................................................................................................... 28

Bank Reconciliation Has Been Completed............................................................................... 29

Step 1 – Receive Payment ................................................................................................... 29

Step 2 – Edit Deposit ............................................................................................................ 29

Deposit Data Entry Case Study ................................................................................................ 33

Accounts Receivable/Banking Bonus Tip ................................................................................ 34

Bank Deposit Errors.................................................................................................................... 36

Errors & Symptoms................................................................................................................... 36

Bank Deposit Fixes ..................................................................................................................... 38

1

Top 10 QuickBooks Mistakes Clients Make

Correct Coding on Receive Payment or Sales Receipt Form................................................... 38

Make Deposit Procedure........................................................................................................... 40

Non-Customer Deposits............................................................................................................ 42

Bonus Information: Vendor Refund of Overpayment................................................................ 42

Bonus Information: Refund From Vendor for Return................................................................ 42

Net Credit Card Deposits.......................................................................................................... 43

Net Credit Card Deposit Case Study ........................................................................................ 44

Payroll Liabilities Error ............................................................................................................... 46

Payroll Liabilities Fixes............................................................................................................... 48

Payroll Liability Payment........................................................................................................... 48

Correcting the Bank Register.................................................................................................... 49

Loan Balance Errors ................................................................................................................... 52

Loan Balance Fixes..................................................................................................................... 54

Journal Entry............................................................................................................................. 54

Correct Previous Errors............................................................................................................. 55

Find Feature.......................................................................................................................... 55

Fixed Asset Errors....................................................................................................................... 58

Fixed Asset Fixes ........................................................................................................................ 60

Journal Entry............................................................................................................................. 60

Fixed Assets Capitalization Policy ............................................................................................ 60

Fixed Asset Manager ................................................................................................................ 60

Prior Period Changes.................................................................................................................. 62

Prior Period Fixes........................................................................................................................ 64

Voided/Deleted Transactions.................................................................................................... 64

Audit Trail .................................................................................................................................. 65

Closing Date.............................................................................................................................. 65

Passwords................................................................................................................................. 66

Password Set Up .................................................................................................................. 67

Password Set Up Checklist....................................................................................................... 70

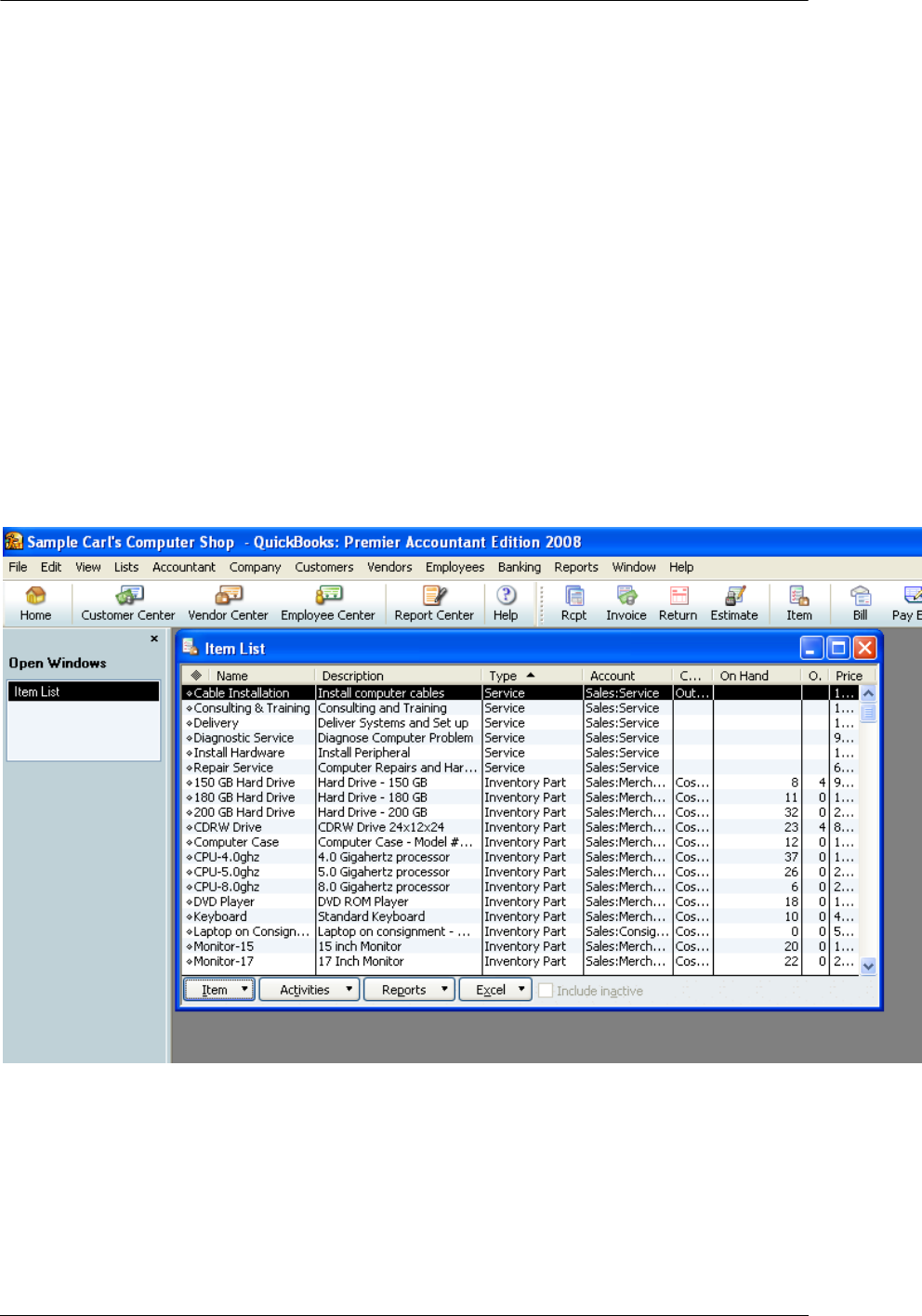

Inventory Errors........................................................................................................................... 71

Errors & Symptoms................................................................................................................... 71

Inventory Fixes ............................................................................................................................ 73

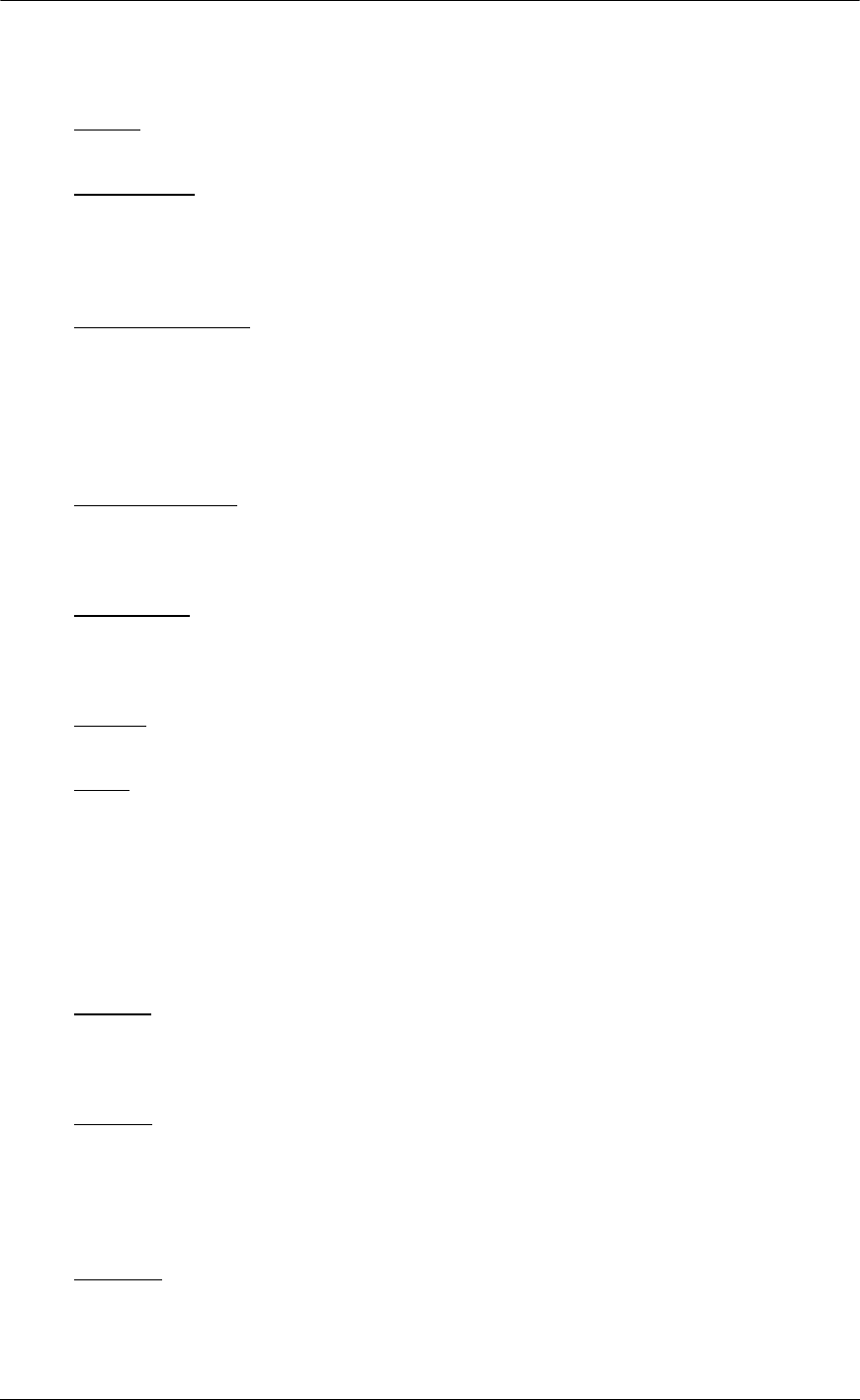

Items Overview.......................................................................................................................... 73

Item Types ............................................................................................................................ 73

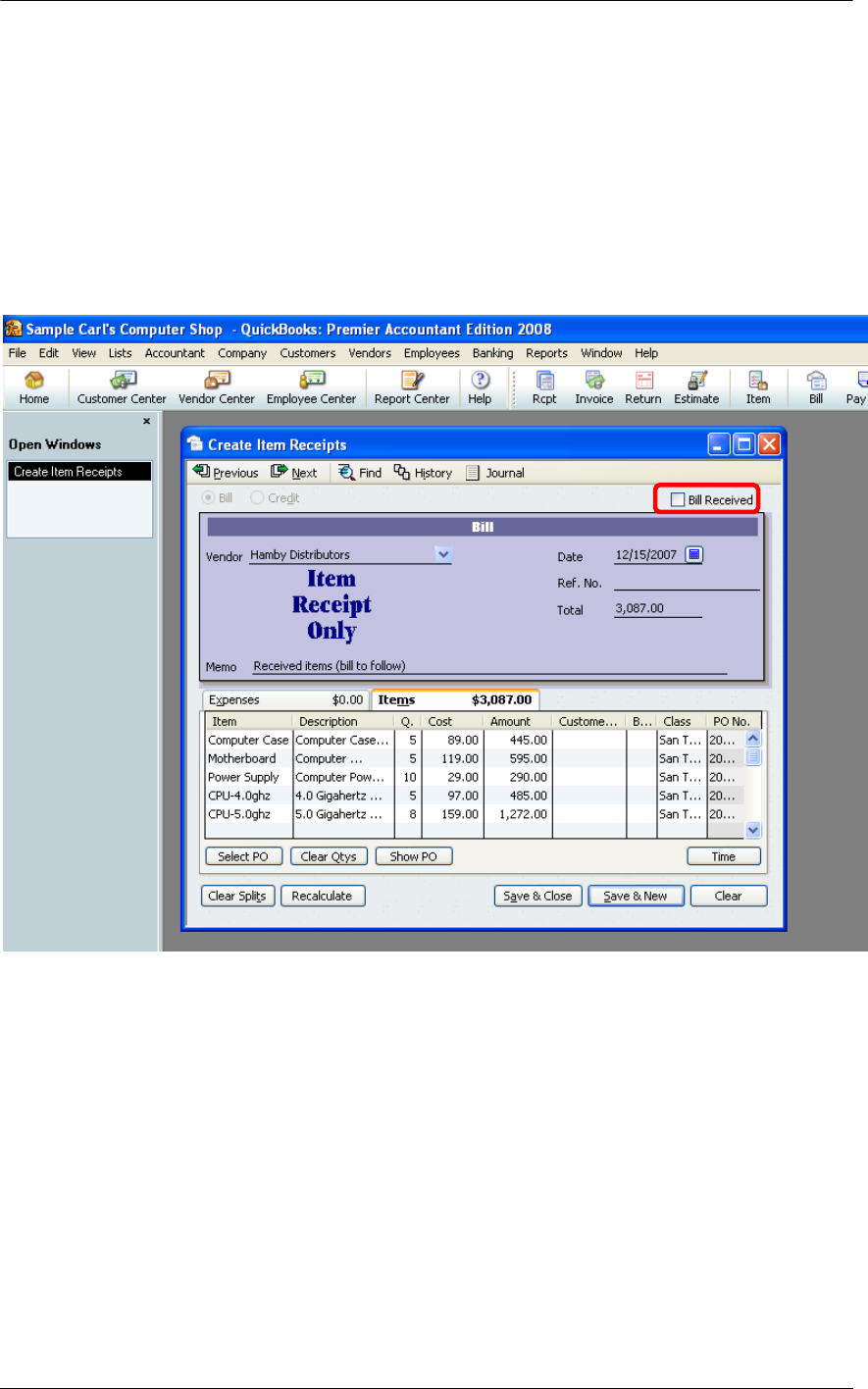

Inventory versus Non-inventory type parts ........................................................................... 75

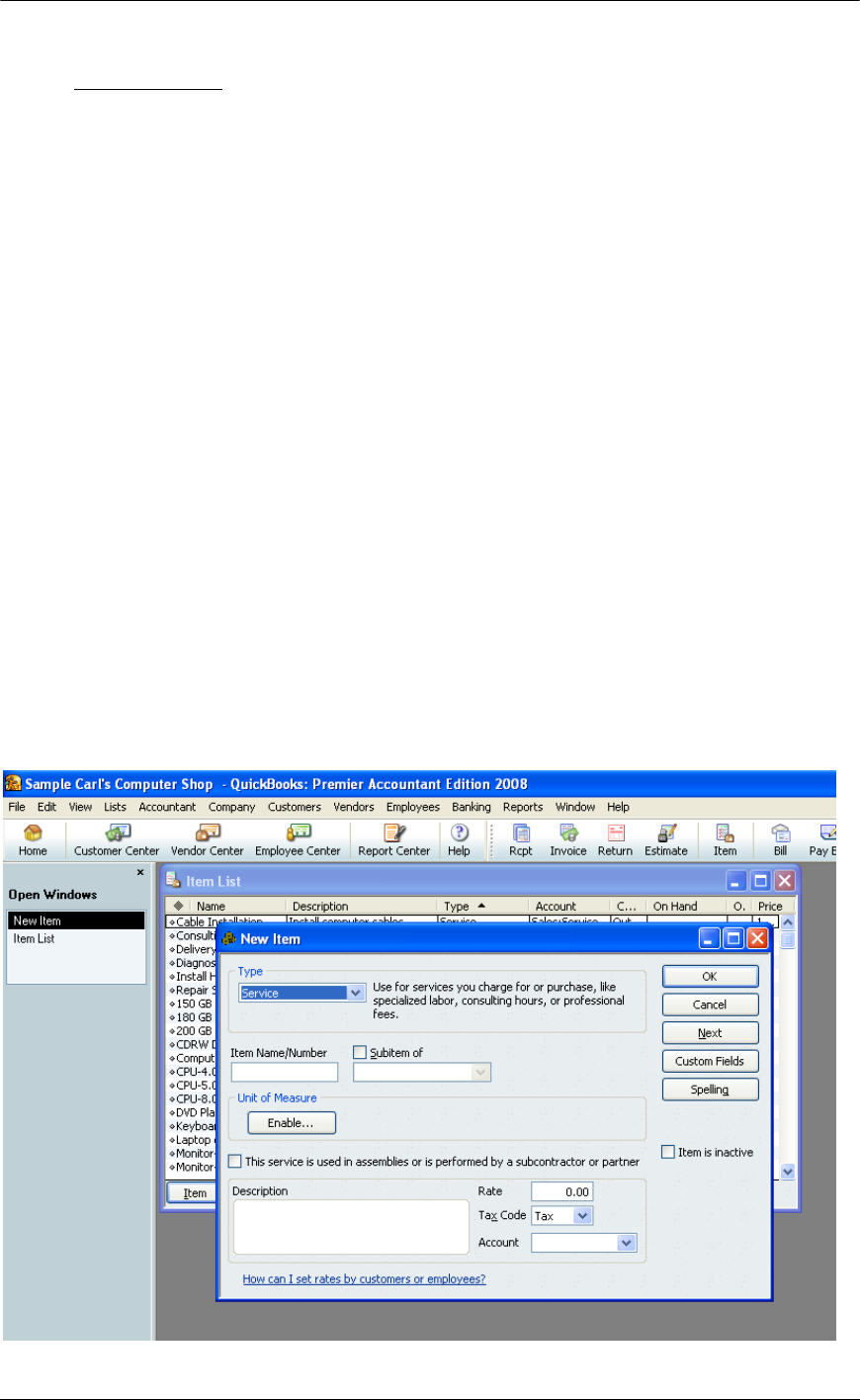

Inventory Purchases Versus Sales........................................................................................... 76

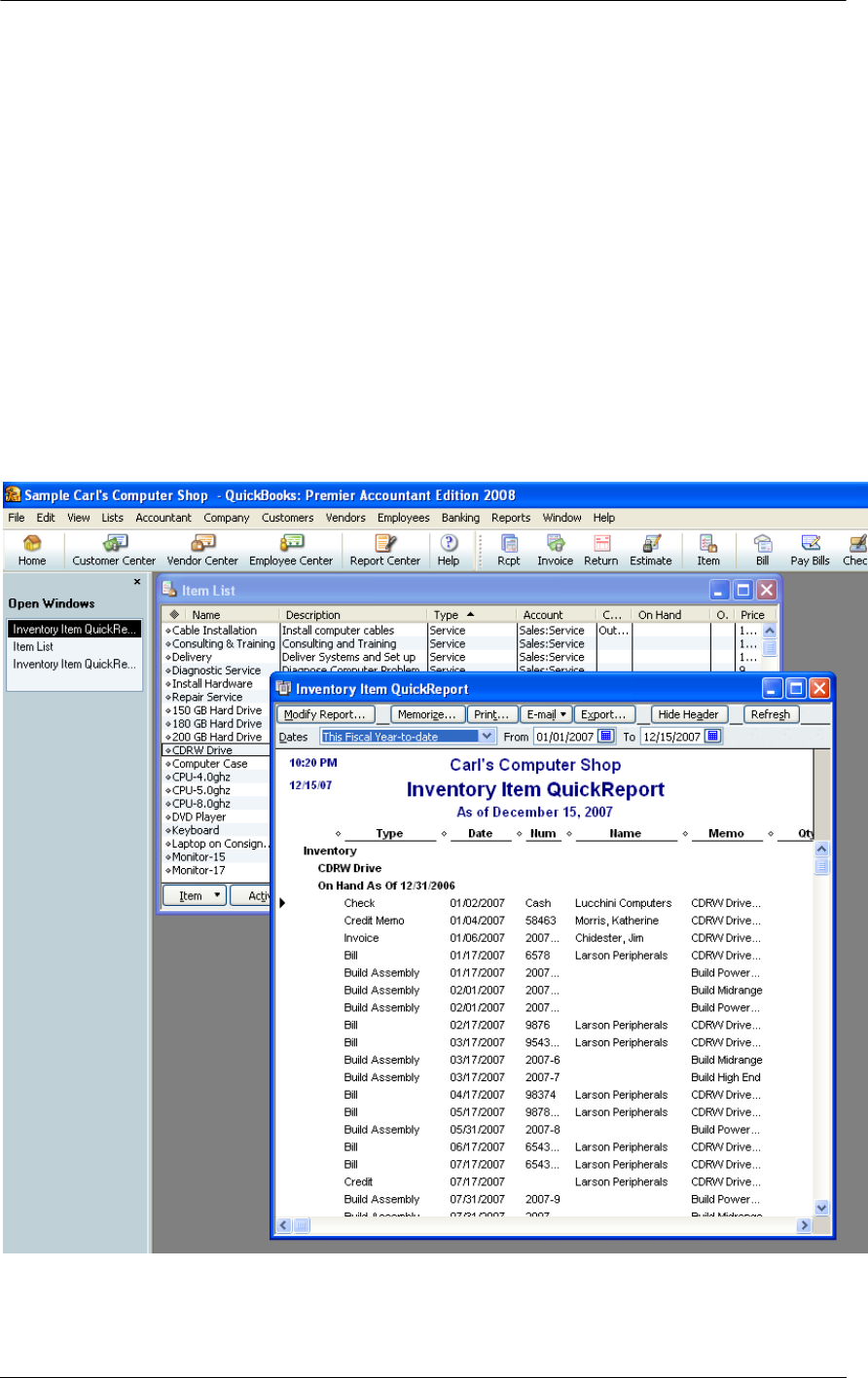

Item Receipts ............................................................................................................................ 77

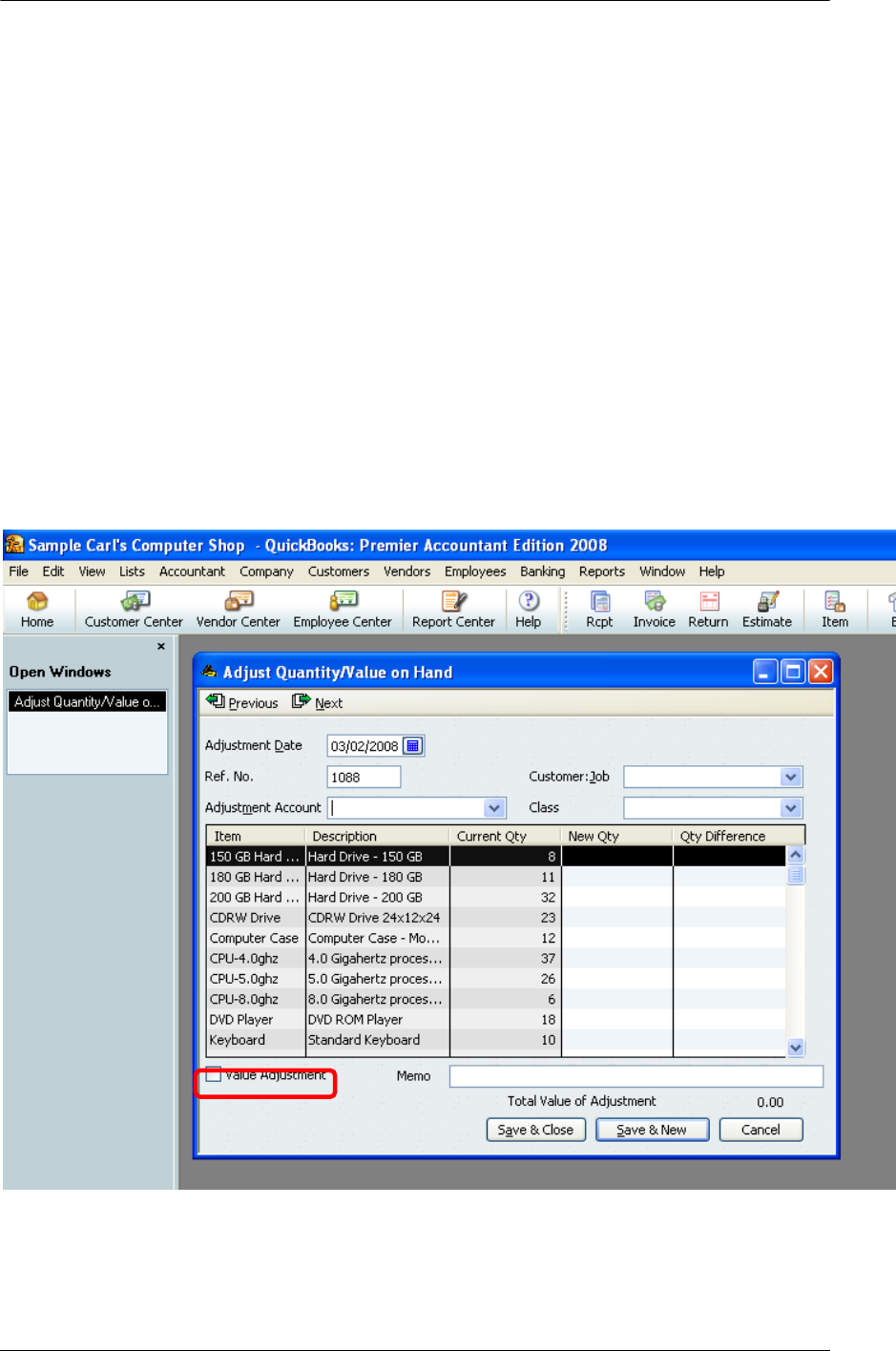

Adjust Quantity/Value on Hand................................................................................................. 78

2

Top 10 QuickBooks Mistakes Clients Make

Credit Card Use Errors................................................................................................................ 80

Errors & Symptoms................................................................................................................... 80

Credit Card Use Fixes ................................................................................................................. 82

Using Business Credit Cards Overview.................................................................................... 82

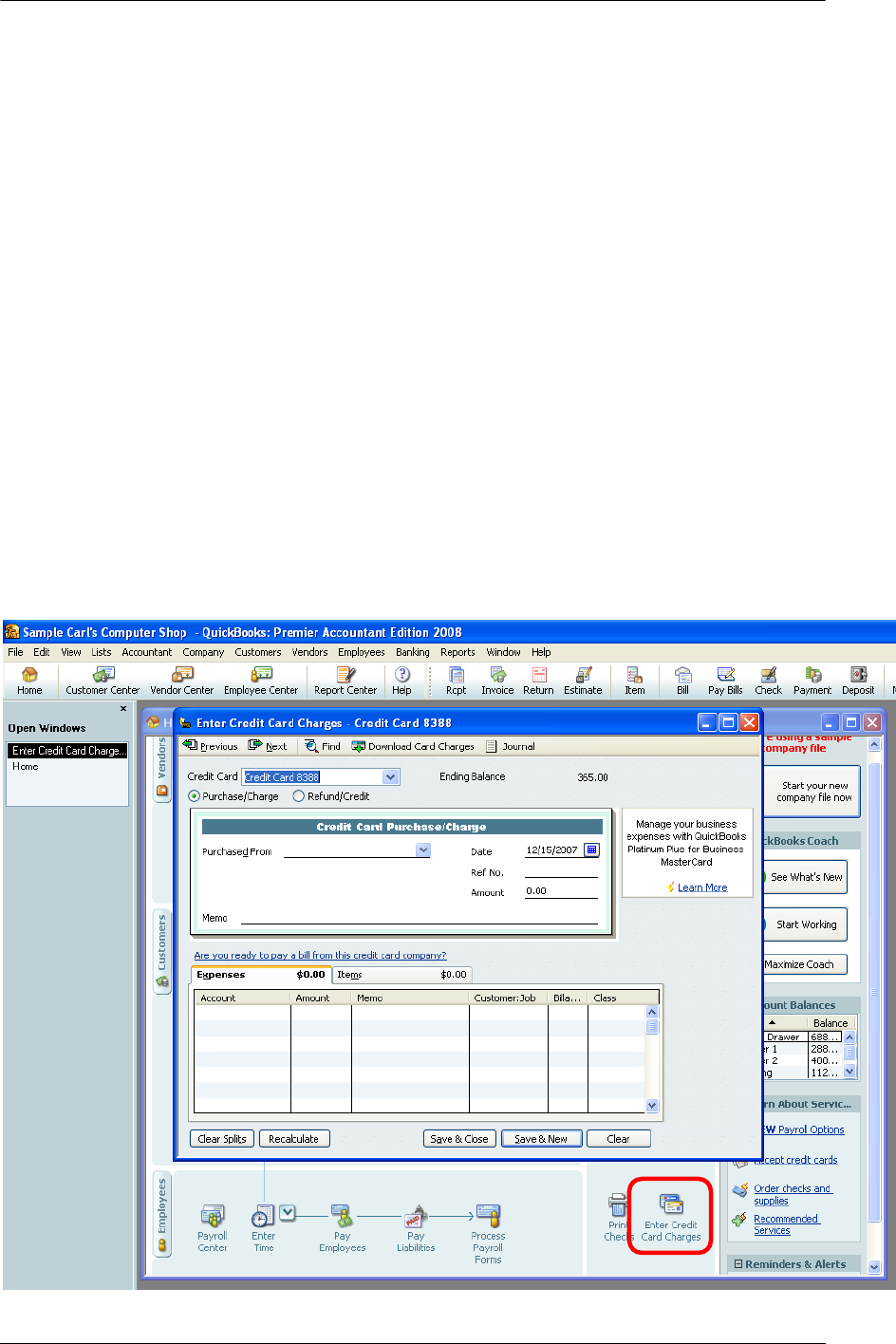

Credit Card Type Account......................................................................................................... 82

Credit Card transaction Entry - One Entry or Many?................................................................ 83

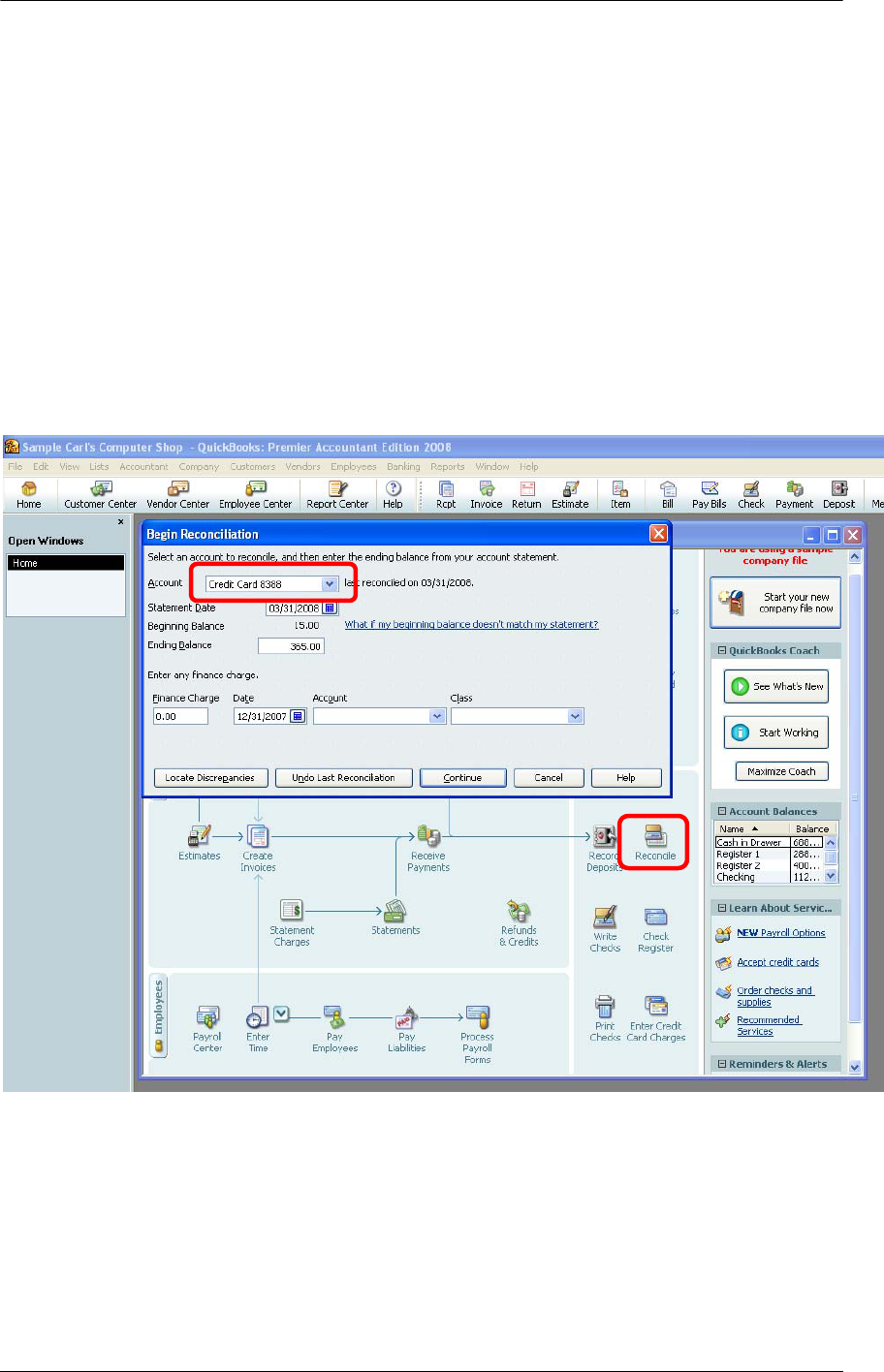

Credit Card Reconciliation ........................................................................................................ 84

Extra Payments......................................................................................................................... 85

Most Important Fix of All! ........................................................................................................... 86

Appendix A Inventory overview................................................................................................. 88

Average Cost ........................................................................................................................ 88

Appendix B Journal Entries overview....................................................................................... 90

Journal Entry Rules................................................................................................................... 92

Appendix C Fixed Asset List & Fixed Asset Manager....................................................... 94

Fixed Asset List......................................................................................................................... 94

Fixed Asset Entry...................................................................................................................... 95

Fixed Asset Manager ................................................................................................................ 96

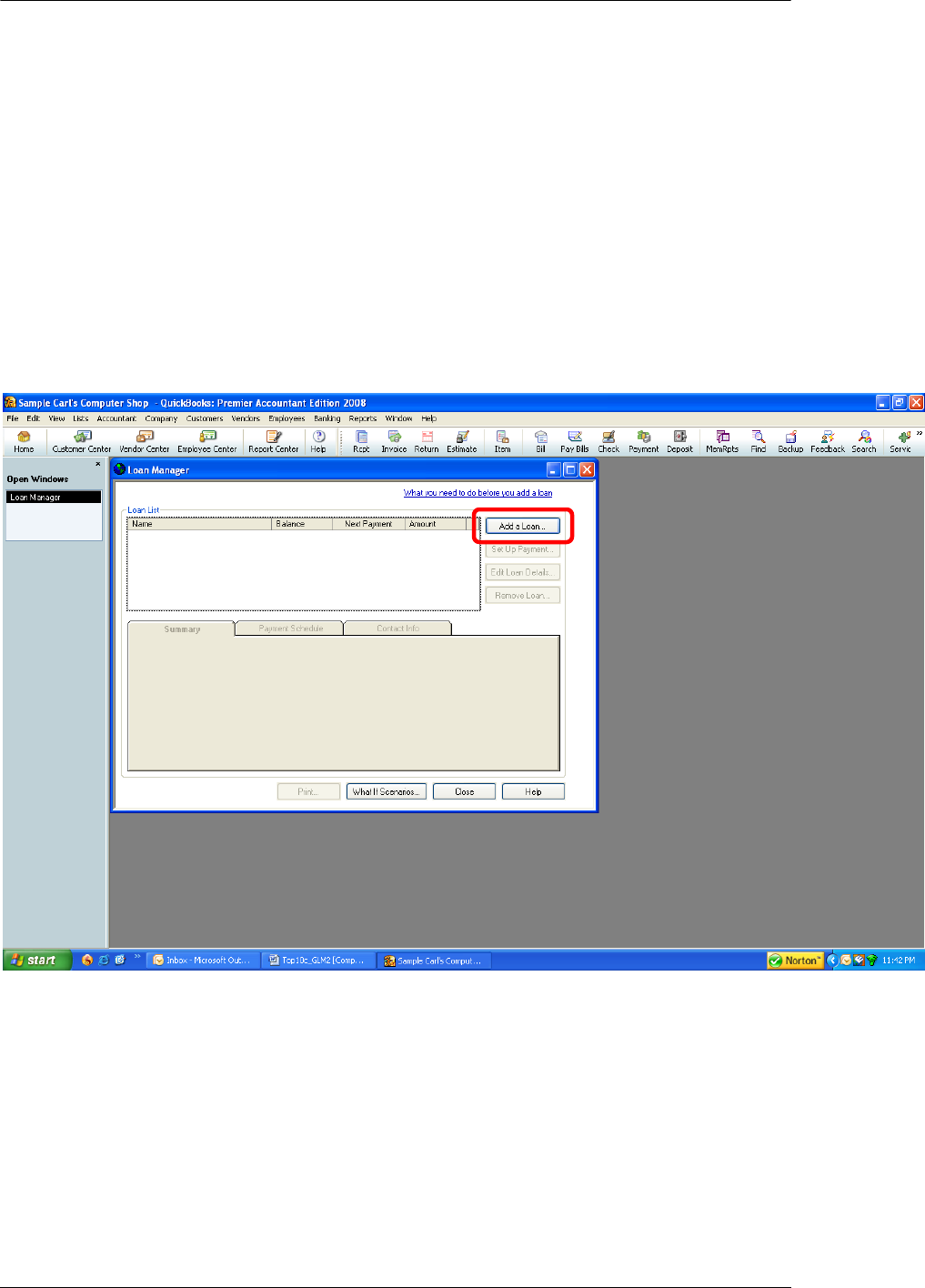

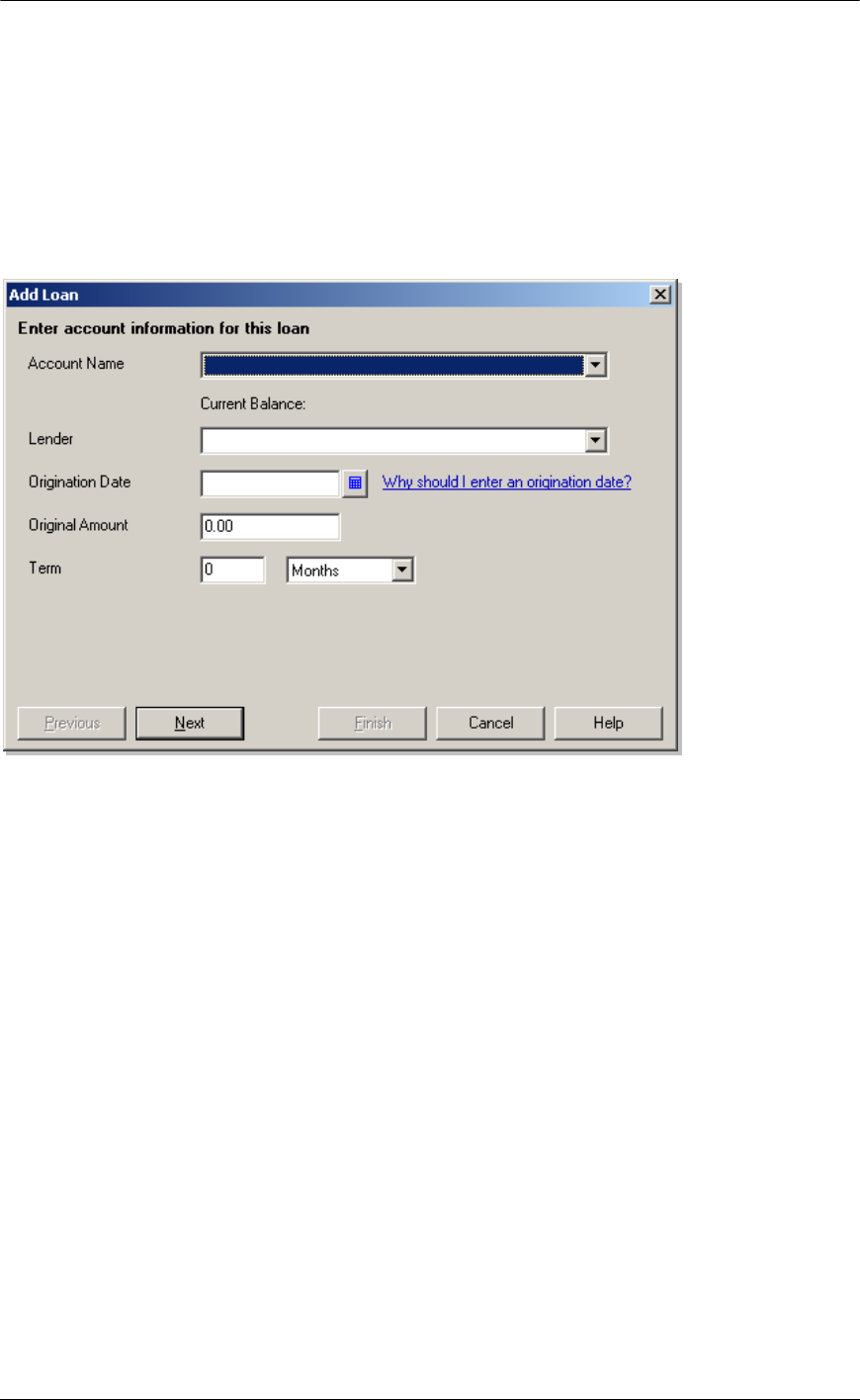

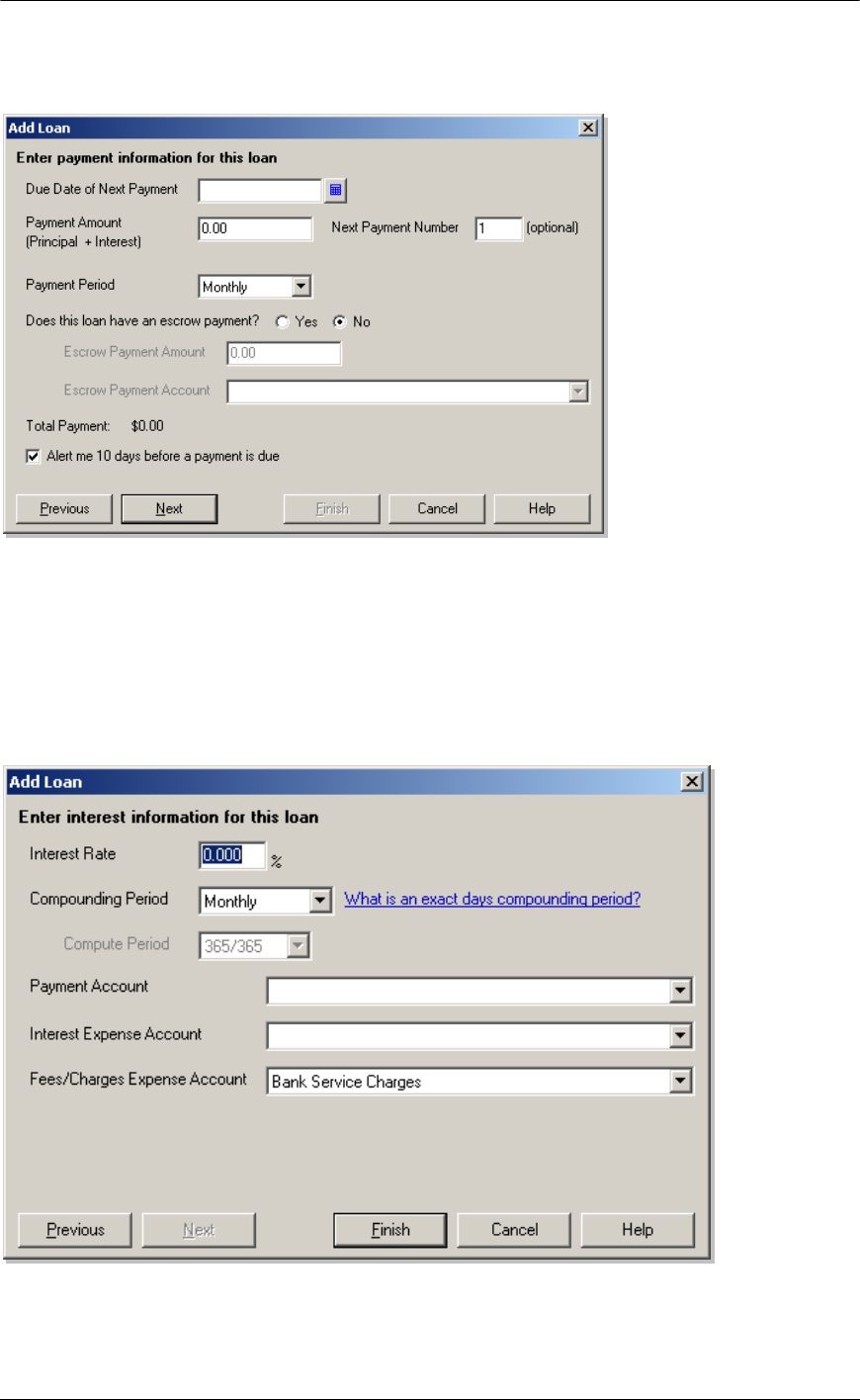

Appendix D Loan Manager......................................................................................................... 98

Add a Loan................................................................................................................................98

3

Top 10 QuickBooks Mistakes Clients Make

4

Top 10 QuickBooks Mistakes Clients Make

TOP 10 MISTAKES MY CLIENTS MAKE AND HOW TO FIX

THEM

We all have clients who are using QuickBooks but are they all using it correctly? Many of these

clients have learned to use the software by trial and error. Clients think that since a check looks

like a check and an invoice looks like an invoice; they too can be a bookkeeper. Without

accounting training and the time spent on looking at many of the different reports, quite often they

believe everything is fine. By going through the following 10 issues, and the related “fixes” you

will be better equipped to quickly and easily identify the most common errors and understand the

alternatives to effectively and efficiently correct the situation.

Although it is never fun to tell a client they have been entering information incorrectly, this reality

does provide you a great opportunity to develop a closer relationship with the client as their

QuickBooks expert and to train them how to use the software to provide better business

information for compliance and decision making purposes.

OBJECTIVES

• Determine if your client has done these 10 things wrong

• Obtain a basic understanding of the alternatives available to fix these errors

• Learn methods of working efficiently with QuickBooks client’s data files

• Explore the symptoms and causes of these common mistakes

• Discover the solutions to eliminate the errors in the future

5

Top 10 QuickBooks Mistakes Clients Make

6

Top 10 QuickBooks Mistakes Clients Make

NOTES ABOUT APPROACH

Because various users choose to use the navigators, or not, and may customize the icon bar, our

instructions will use the menu bar at the top of the software. QUICKBOOKS: PREMIER 2008:

ACCOUNTANT EDITION is the version of the software we will be using. While many of the fixes

will work with other versions, this is the most comprehensive and feature rich product that

includes reports and functionality accountants want and need. We are using the sample data file

included with the software to make it easy for you to test the solutions with your own copy of the

software back in your office.

Also, the majority of these fixes require that you have access to the live data file. Many solutions

cannot be implemented when using the Accountant’s Review Copy of the data. There are many

ways to access the live data including working at the client’s office, obtaining a back up of the

data to use in your office (don’t forget to remind the client not to enter any transactions while you

have it or your back up will overwrite their information), utilize the Accountant’s Copy or use

QuickBooks: Premier 2008: Accountant Edition feature of Remote Access. While we cannot get

into the details on all of these methods here, there is a free recorded webcast on remote access

that you may find valuable at

http://accountant.intuit.com/training_cpe/archived_webcasts.aspx#section1

7

Top 10 QuickBooks Mistakes Clients Make

8

Top 10 QuickBooks Mistakes Clients Make

BONUS NOTES

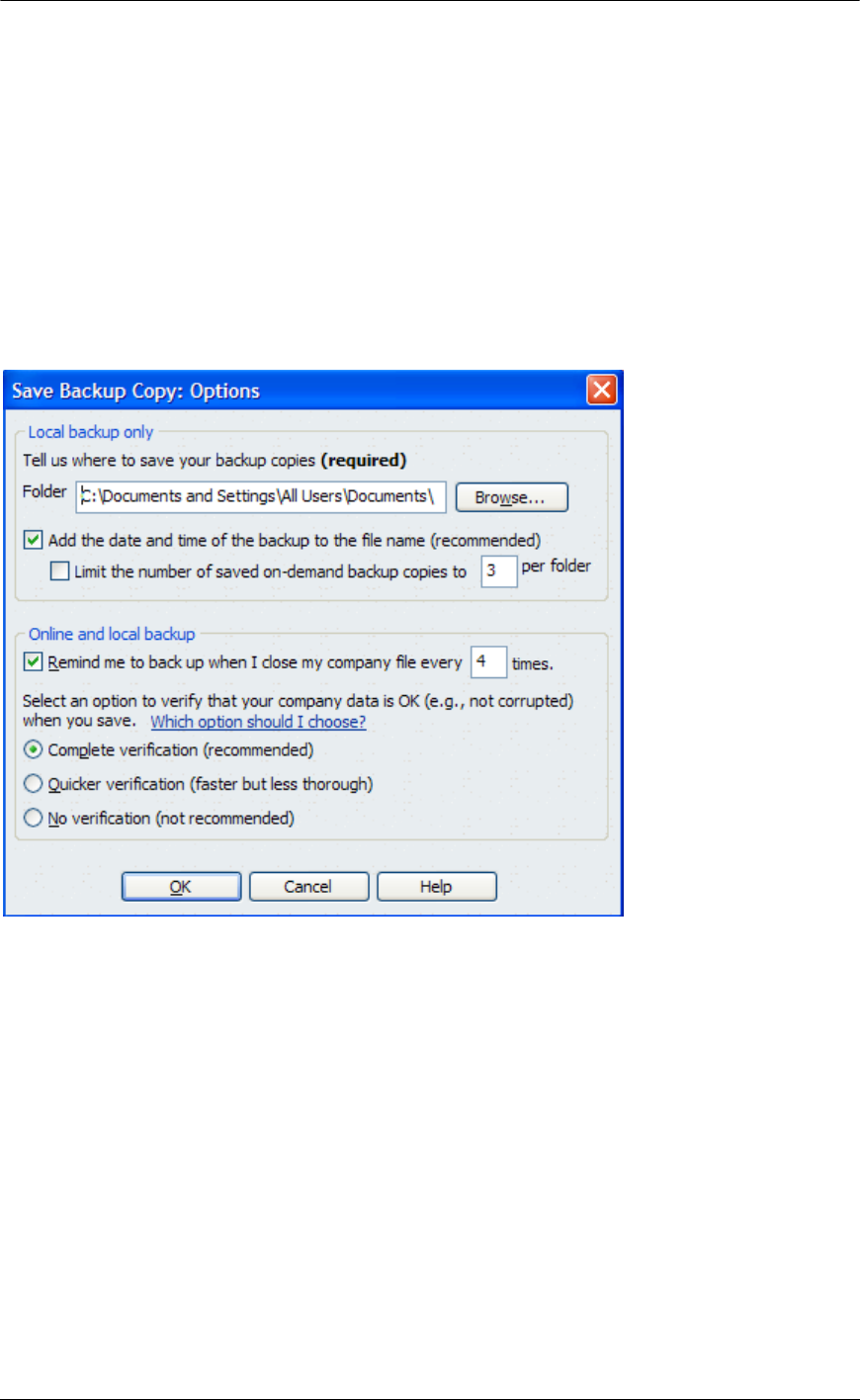

One thing you can never do enough is back up the data. Do not overwrite the previous backups.

Back up before you start and at every major step along the way. In most cases you will not need

to restore the back up, but if you do, being able to restore the data to a specific point in time is

critical. Backing up to the client’s hard drive is OK (but make sure you know where you have

saved the files), but it is recommended that you burn a CD or copy the backup files to a USB

drive so you can take them with you. What has worked well for me is to back it up using today’s

date then add a letter to subsequent backups, as the naming convention for the back-up file.

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: File > Save Copy or Backup

9

Top 10 QuickBooks Mistakes Clients Make

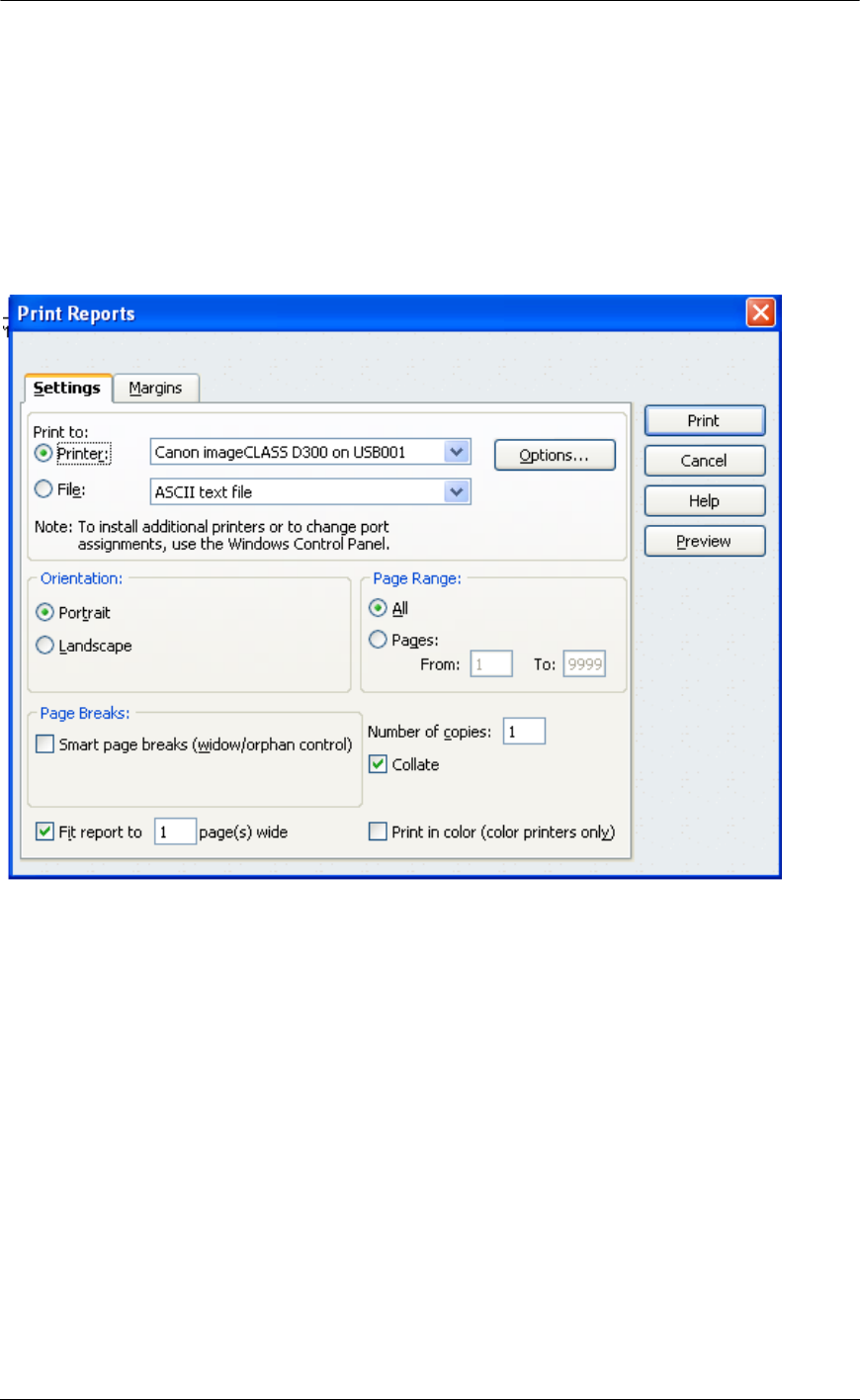

Within QuickBooks there is no undo, undelete, or any other way to say “Oops, I didn’t mean to do

that.” For this reason, in addition to the back ups, it is recommended that you print any

information you may need. This may be a report, it may be the journal entry associated with a

transaction, etc. When you print the report, don’t forget to print the report to one page wide,

landscape may increase the font size slightly, and to widen any columns that contain critical data

that may be cut off by moving the diamond to the right at the top of the column.

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: Invoice > Journal > Print Report

For major changes, those that will take considerable time, and the situations where information

has been entered incorrectly, have the client sit with you while the changes are made serves

three purposes:

They see the results of the situation they have created which will hopefully help them to do better

in the future.

They understand the changes that have been made in the file which will often eliminate the

subsequent calls about what you did or why things look different than before.

They know firsthand the amount of time it took for you to correct the problem which will hopefully

remove the “surprise factor” when they receive your request for payment.

10

Top 10 QuickBooks Mistakes Clients Make

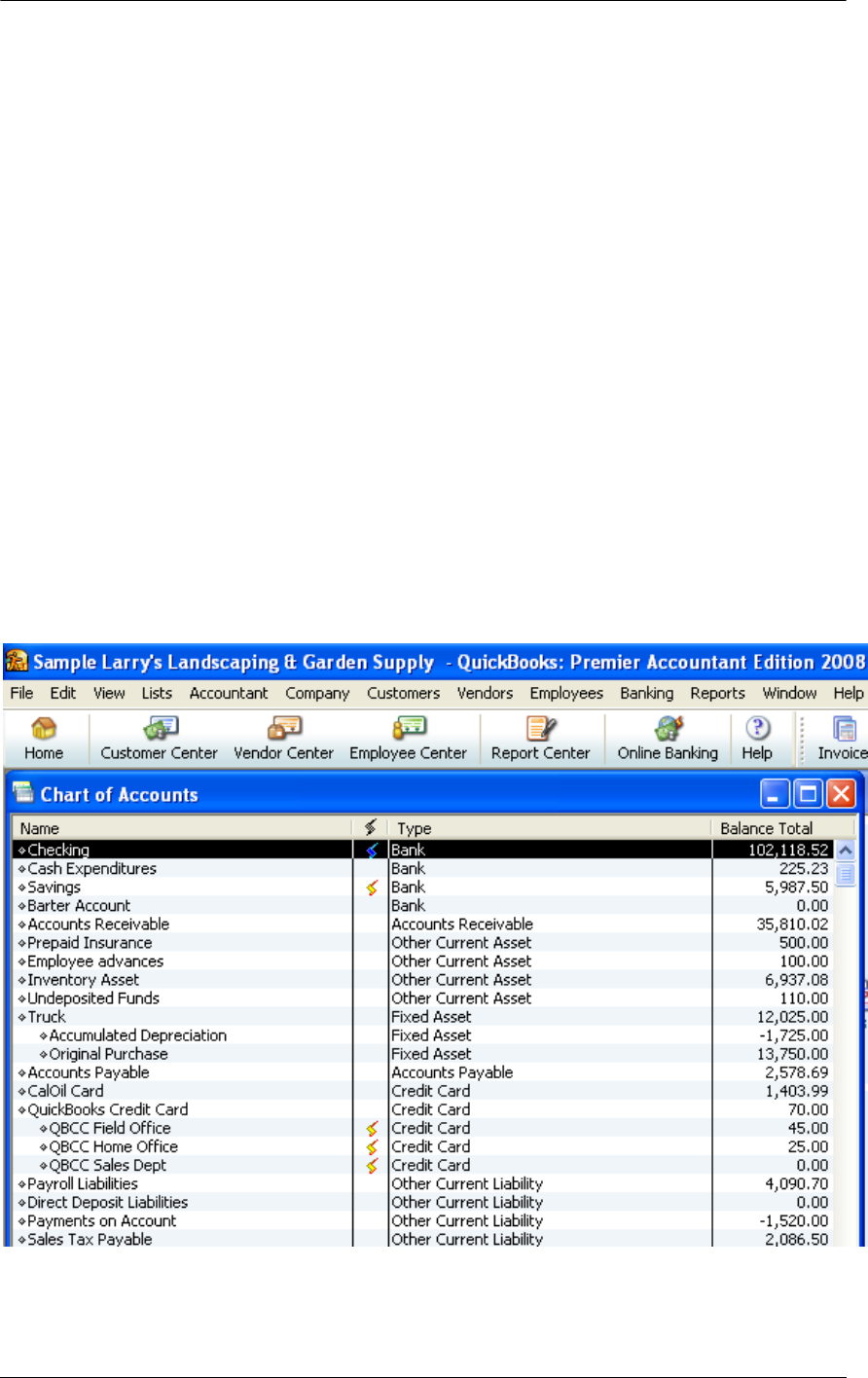

CHART OF ACCOUNTS ERROR

ERRORS & SYMPTOMS

• Common Errors:

o Duplicate accounts

o Accounts duplicate the function of customers, vendors, or items

• Primary Indication: Extremely long chart of accounts list

• Supplemental Symptom: The presentation on the Balance Sheet and Profit & Loss

reports looks wrong (i.e. accounts are set up with an incorrect type)

One of the easiest places for most accountants to start is to deal with chart of accounts issues.

Based on experience and training, it is usually quickly apparent if the chart of accounts is too

long, if there are duplicates, or if the accounts have been set up as the wrong type. The account

type controls the presentation for financial reports. In addition it is used for the highest level of

subtotals.

Looking over the chart of accounts list or creating the Balance Sheet and Profit & Loss reports will

provide an indication of the extent of the issue.

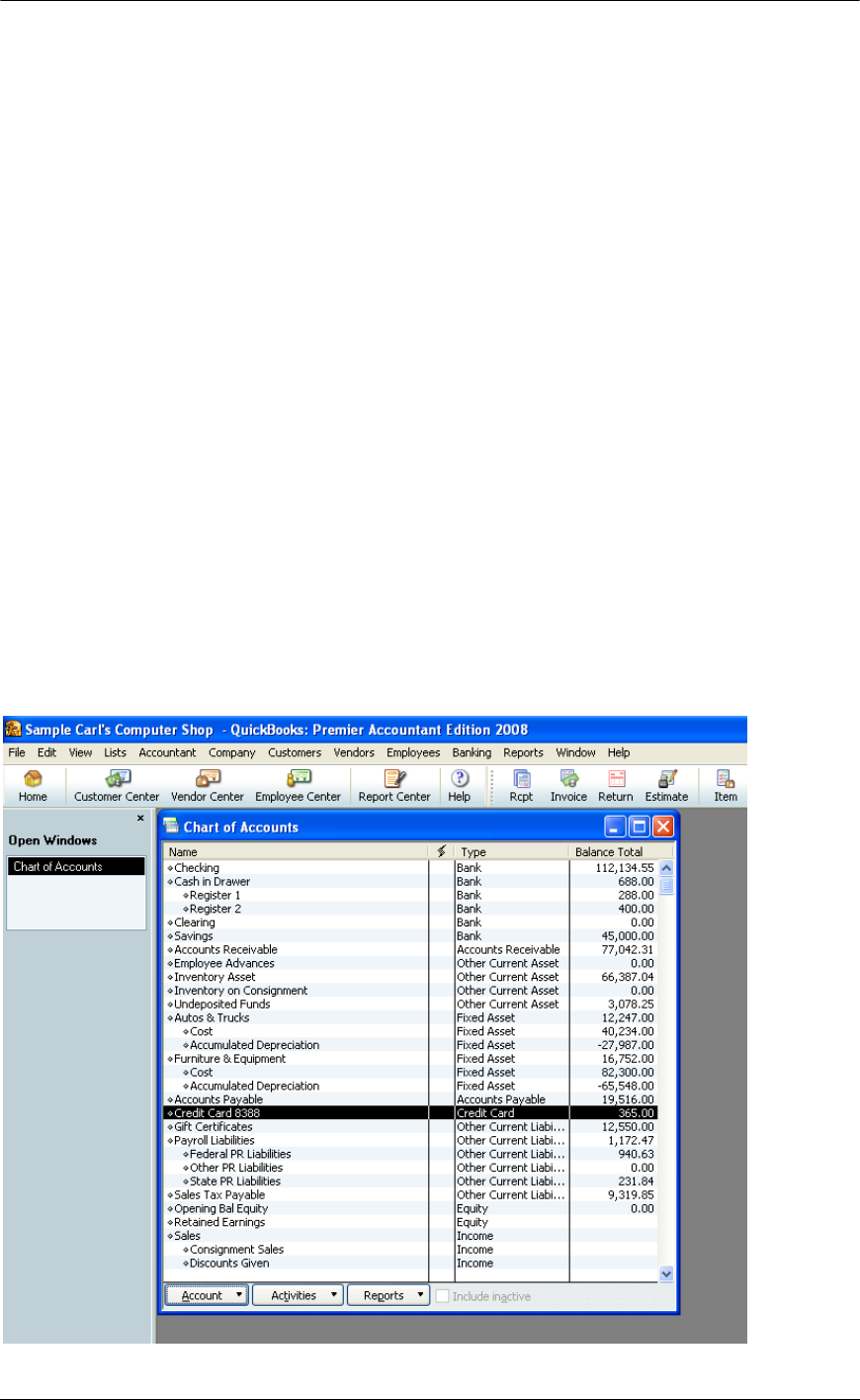

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: Lists > Chart of Accounts

11

Top 10 QuickBooks Mistakes Clients Make

12

Top 10 QuickBooks Mistakes Clients Make

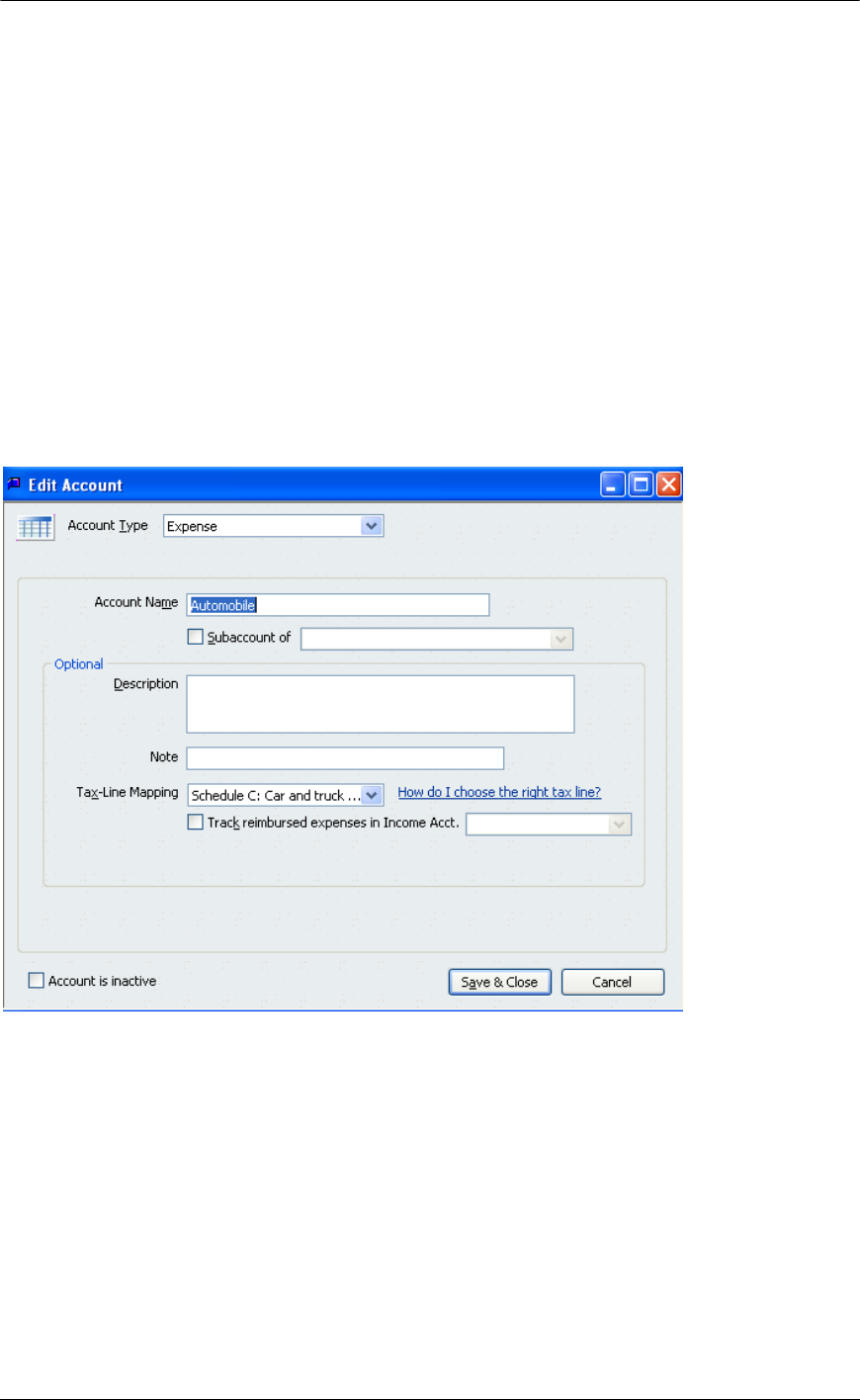

CHART OF ACCOUNTS FIXES

EDIT ACCOUNT TYPE

For the chart of accounts, the edit option permits a change of account name or a change of an

account type (except changing to or from Accounts Receivable or Accounts Payable). This

option, when used carefully, can correct data entry errors in total, rather than transaction-by-

transaction. Because this option does change the account in total, prior periods may be affected.

Depending on the timing of the change, and the magnitude, it may be better to edit the individual

transactions or do a journal entry to correctly reclassify the balance to a new account, and then

use the check box option to make the old account inactive. For a new QuickBooks client,

however, this can save countless hours and tedious corrections to correct the existing chart of

accounts.

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: Lists > Chart of Accounts >

Single click on the account to be changed > Edit > Edit Account

MERGE ACCOUNTS

A variation on the edit procedure is to edit the name to match another name on the same list.

When the OK button is clicked, the software states: “This name is already being used. Would you

like to merge them?” If you choose yes, all of the transactions using the name being edited will be

merged into the changed name. Use this option carefully, since there is no easy way to undo a

merge, except transaction-by-transaction.

If accounts have been set up incorrectly, it is possible to edit or merge the information. To edit an

account permits a change of account name or a change of an account type (except changing to

or from Accounts Receivable or Accounts Payable). This option, when used carefully, can correct

data entry errors in total, rather than transaction-by-transaction. Because this option does change

the account in total, prior periods may be affected. Depending on the timing of the change, and

13

Top 10 QuickBooks Mistakes Clients Make

the magnitude, it may be better to edit the individual transactions or do a journal entry to correctly

reclassify the balance, and then use the option to make the account inactive.

A variation on the edit procedure is to edit the name to match another account of the same type.

When the OK button is clicked, the software states: “This name is already being used. Would you

like to merge them?” If you choose yes, all of the transactions in the account being edited will be

merged into the account with the same name. Use this option carefully, since there is no easy

way to undo a merge, except transaction-by-transaction.

PATH: Lists > Chart of Accounts > Single click on the account to be merged > Edit > Edit Account >

Change name or number > OK

TIP: If the two accounts on the chart of accounts list to be merged are different account types,

changing the name and the type cannot be done in one step. First change the account type and then

change the name to merge the accounts together.

NOTE: Be very careful when merging. The information will remain for the account that the name is

being changed to, not the name that is being changed. For example, if an account has been created

that is called B of A Checking and the account number from the bank has been entered on the edit

account screen, then a new account just called Checking has been created without the account

number. If B of A Checking is merged into Checking, the remaining account will not have the

account number. If Checking is merged into B of A Checking, the account number will remain. The

same is true for the other lists. For example, a customer with the address is merged into a customer

without the address; the previous information will be lost!

TRICK: When the accounting preference for account numbers has been turned on, it is possible to

merge accounts simply by having the same account number. The name will not matter. Again, just

like in the previous example, the account name will remain for the account number that the changed

account will be merged into.

NOTE: When Balance Sheet accounts are merged, any cleared transactions are merged into the new

account as uncleared.

EDIT ACCOUNT DETAILS

In addition to using the edit feature to change the account type and merge accounts together, the

edit feature also controls sub-accounts and inactive status.

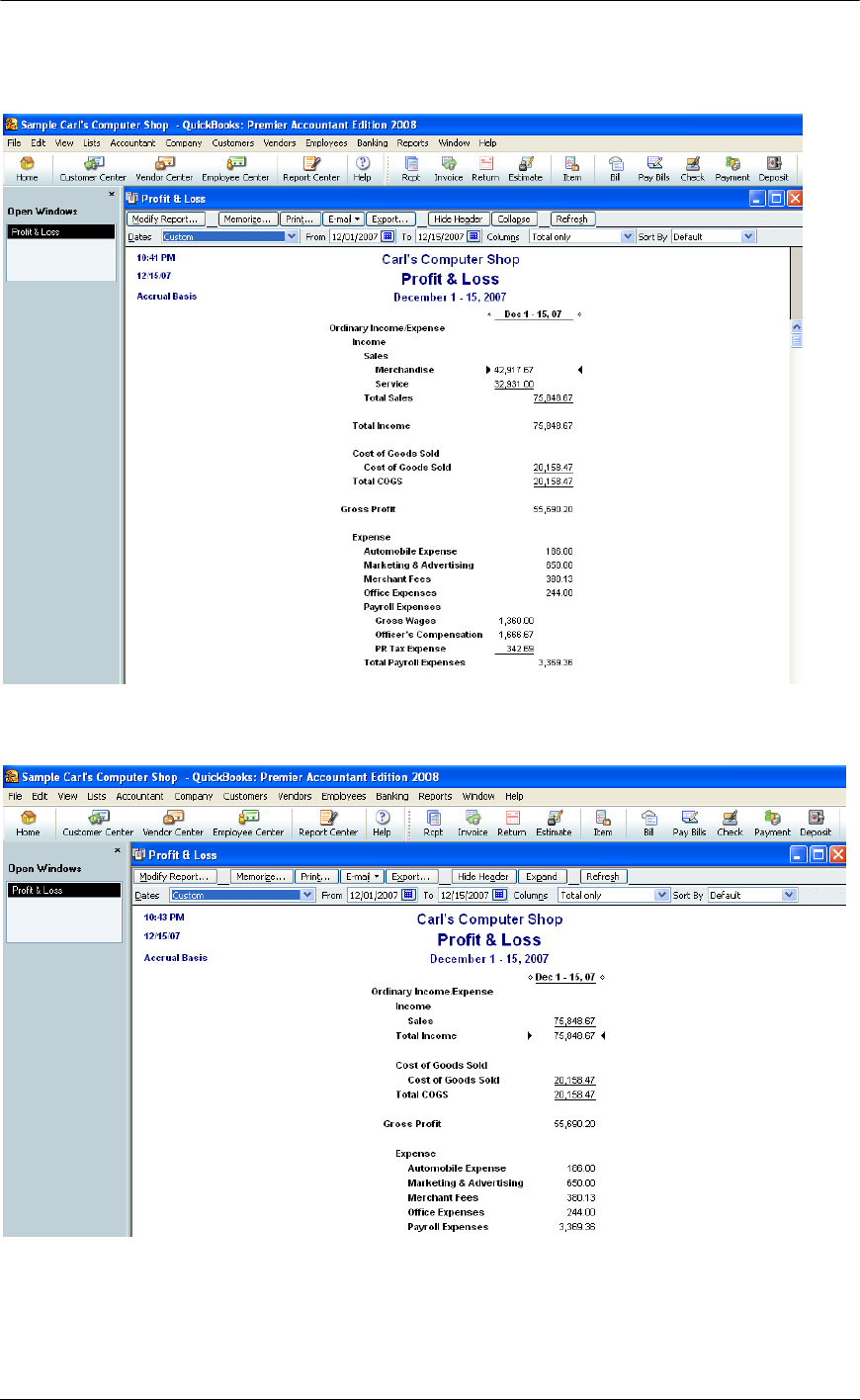

Sub-accounts

The advantage of sub-accounts is that the detail can be displayed on financial statement reports

for management purposes. But with the simple click of a button, the sub-accounts can be “rolled

up” into the “main” account for summarized presentation.

PATH: Lists > Chart of Accounts > Single click on the account to be changed > Edit > Edit Account >

Mark checkbox for sub-account of > Choose account > OK

TRICK: In addition to using the edit feature to make the account a sub-account, it is also possible to

use the mouse to click on the diamond to the left of the account name, drag it below the “main”

account and then drag it “under” the main account to have it remain as a sub-account.

14

Top 10 QuickBooks Mistakes Clients Make

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: Reports > Company & Financial >

Profit & Loss Standard

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: Reports > Company & Financial >

Profit & Loss Standard > Collapse

15

Top 10 QuickBooks Mistakes Clients Make

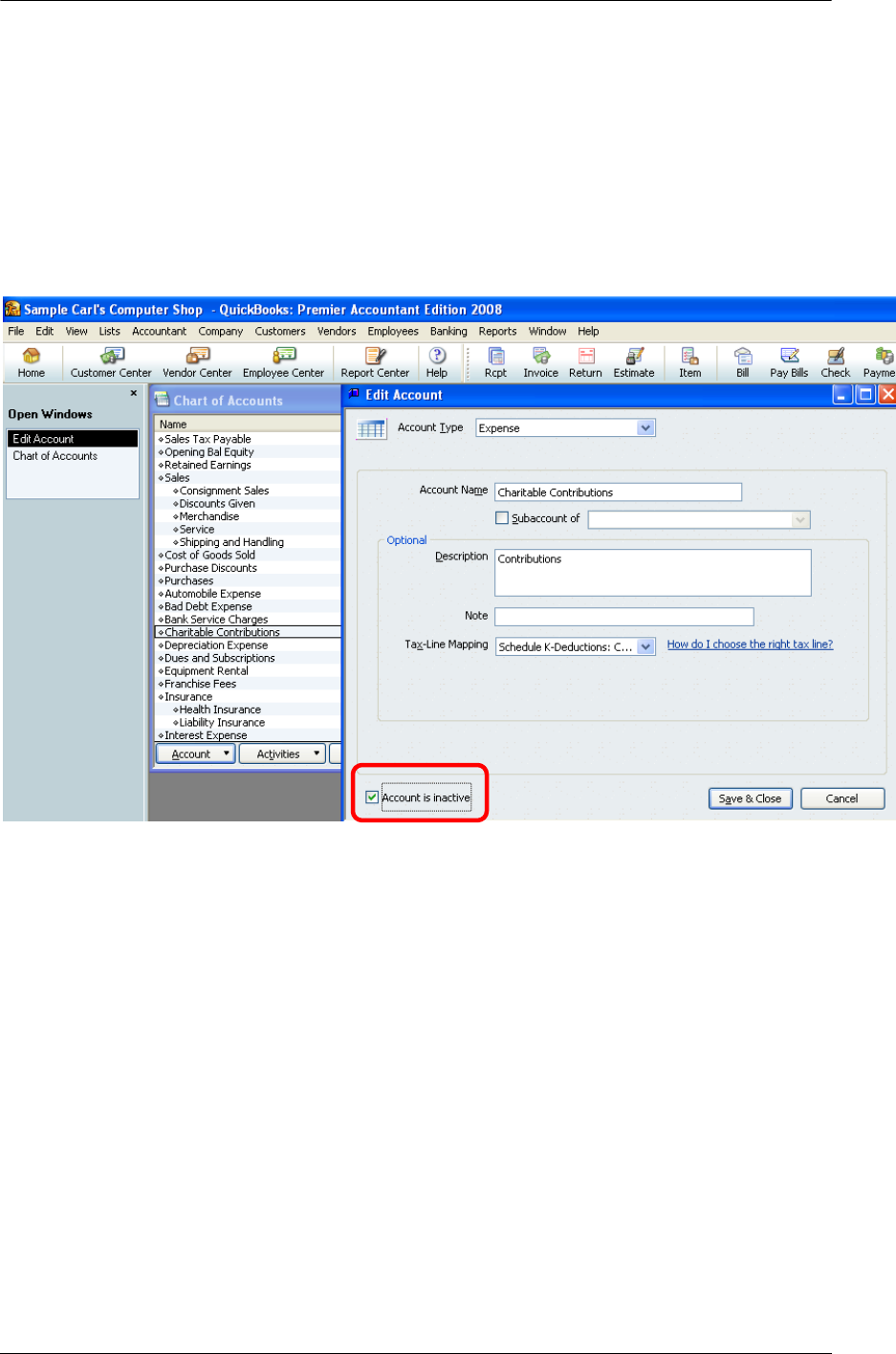

INACTIVE ACCOUNTS

Accounts with activity cannot be deleted since those transactions will have “nowhere to go.” The

most important advantage to making an account inactive is that an inactive account no longer

appears on the pull down list when entering transactions. The accounts will still appear on

reports if they are needed.

PATH: Lists > Chart of Accounts > Single click on the account to be changed > Edit > Edit Account >

Mark checkbox for inactive > OK

TIP: In addition to using the edit feature to make an account inactive, the inactive choice is available

by right clicking with the mouse on the account. Also, if all of the inactive accounts are displayed on

the chart of accounts list, clicking in the “X” column is a quick and easy to make accounts inactive.

NOTE: If a memorized transaction has been coded to an account that is subsequently marked as

inactive, that transaction will continue to use the inactive account.

16

Top 10 QuickBooks Mistakes Clients Make

ACCOUNTS PAYABLE ERROR

ERROR & SYMPTOMS

• Common error: Client enters bills, and then writes checks

• Primary Indication: The AP Aging Reports shows many very old bills

• Supplemental Symptoms:

o Accounts Payable balance is very high

o Expenses seem unreasonably high

o The bank account balance looks right

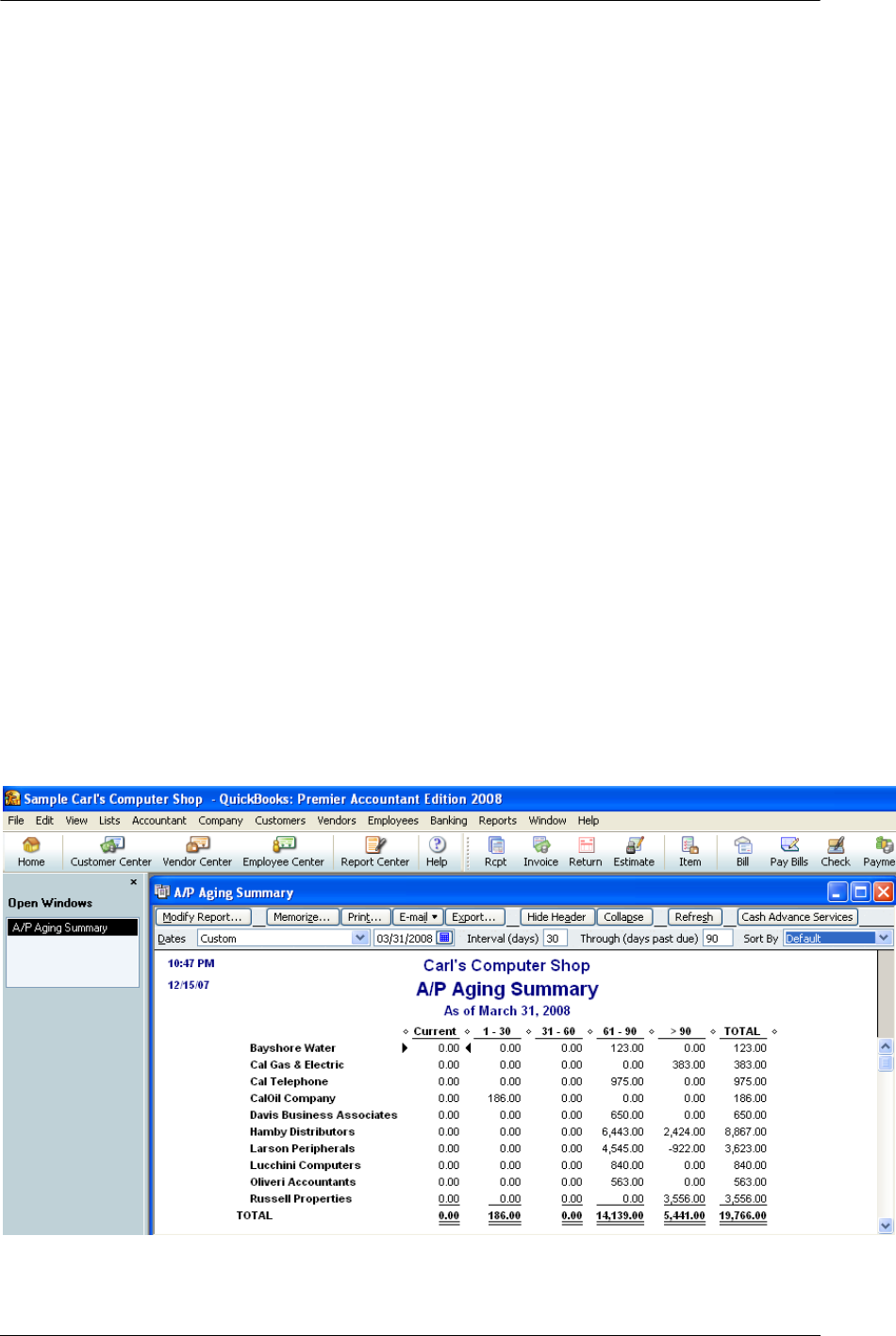

The quickest and easiest way to look for this Accounts Payable error is to review the A/P Aging

Summary report.

The Accounts Payable Aging Summary provides a quick snapshot on the outstanding bills as of a

specific date. Most of the amounts should be relatively current. An extremely old amount may

indicate an error or a situation that requires an adjustment. Consistently old amounts due can

indicate a profitability or cash flow situation that should be addressed immediately. Any lines that

have a zero balance in total show that all transactions have not been “linked.” (Credits have not

been applied to the bills in question.)

Excessive amounts in the >90 days column is an indication something is wrong: It is either a

QuickBooks data entry procedural issue, which is what we will address here, or it could be

indicative of a bigger problem with management or going concern issues, which we will not be

addressing.

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: Reports > Vendors & Payables >

A/P Aging Summary

17

Top 10 QuickBooks Mistakes Clients Make

ACCOUNTS PAYABLE FIXES

The most efficient fix will vary based on several factors. Most notable is determining if the client

needs to prepare reports on the cash or accrual basis. The second most important factor will be

if the bank reconciliation has been completed or not.

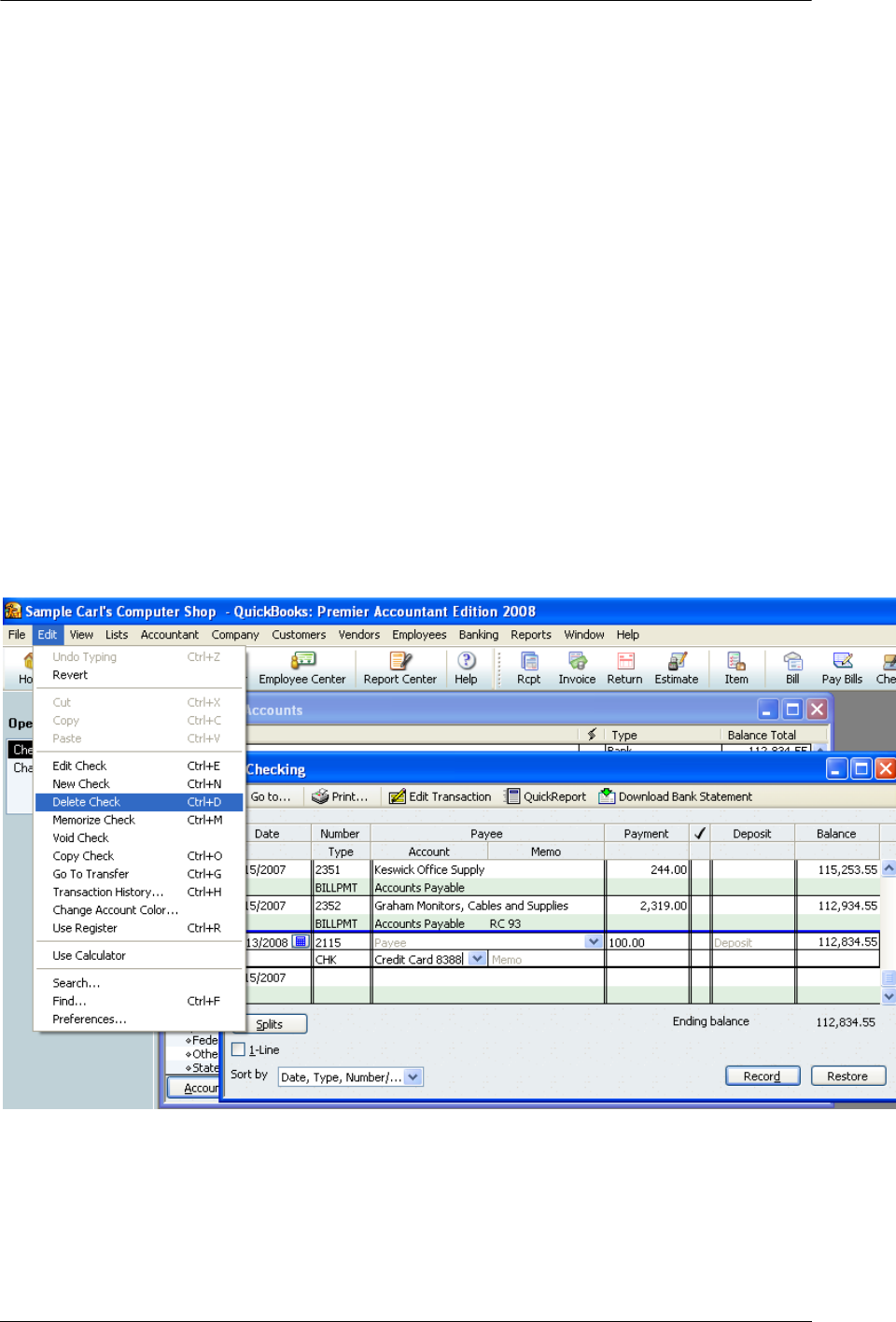

ACCRUAL BASIS – NO BANK RECONCILIATION

If the client is on the accrual basis of accounting and the bank reconciliation has not been

completed, the incorrectly entered checks can be simply deleted and you can re-enter them using

the Pay Bills function. One of the beauties of QuickBooks is that you can delete transactions and

re-enter them correctly. Don’t forget to back up the data file and print the check register or have

the check copies in hand prior to pressing the delete button. There is no “undo” or “undelete”

available so be careful when using this alternative. Once you delete the checks you must then go

in and Pay Bills to record the payment to the vendor. Having the check register printed up before

you delete the checks will help you assign the correct check numbers and dates to the new bill

payments.

PATHS: Edit > Delete Check > Vendors > Pay Bills

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: Lists > Chart of Accounts > Double click on

Bank account > Single click on check to be deleted > Edit from the menu bar > Delete check

18

Top 10 QuickBooks Mistakes Clients Make

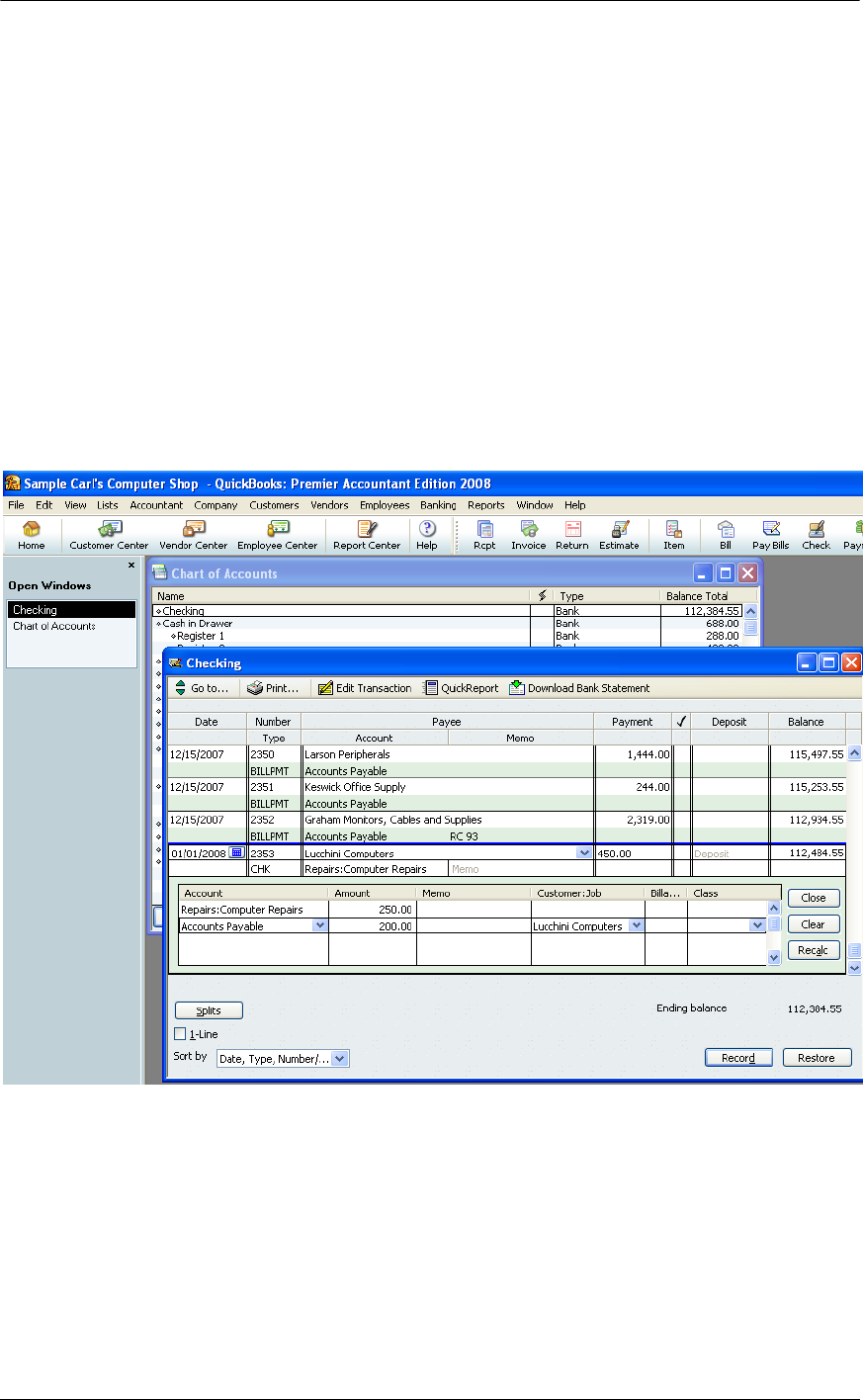

ACCRUAL BASIS – BANK RECONCILIATION COMPLETED

For accrual basis reports, the bill and bill payment dates are critical. If the payment to the vendor

has already been entered as a check and the bank reconciliation has been completed, deleting

the check as described above will change the beginning bank balance and with extensive delete

and re-enter procedures, the likelihood of an error increases. For this reason, the

recommendation is to change the account code on the check to Accounts Payable. This will

create a credit on the Accounts Payable reports, which can then be linked to the bill. The main

trick to know when completing the correction in this way is that the vendor name will be required

on the check detail line that contains the account of Accounts Payable.

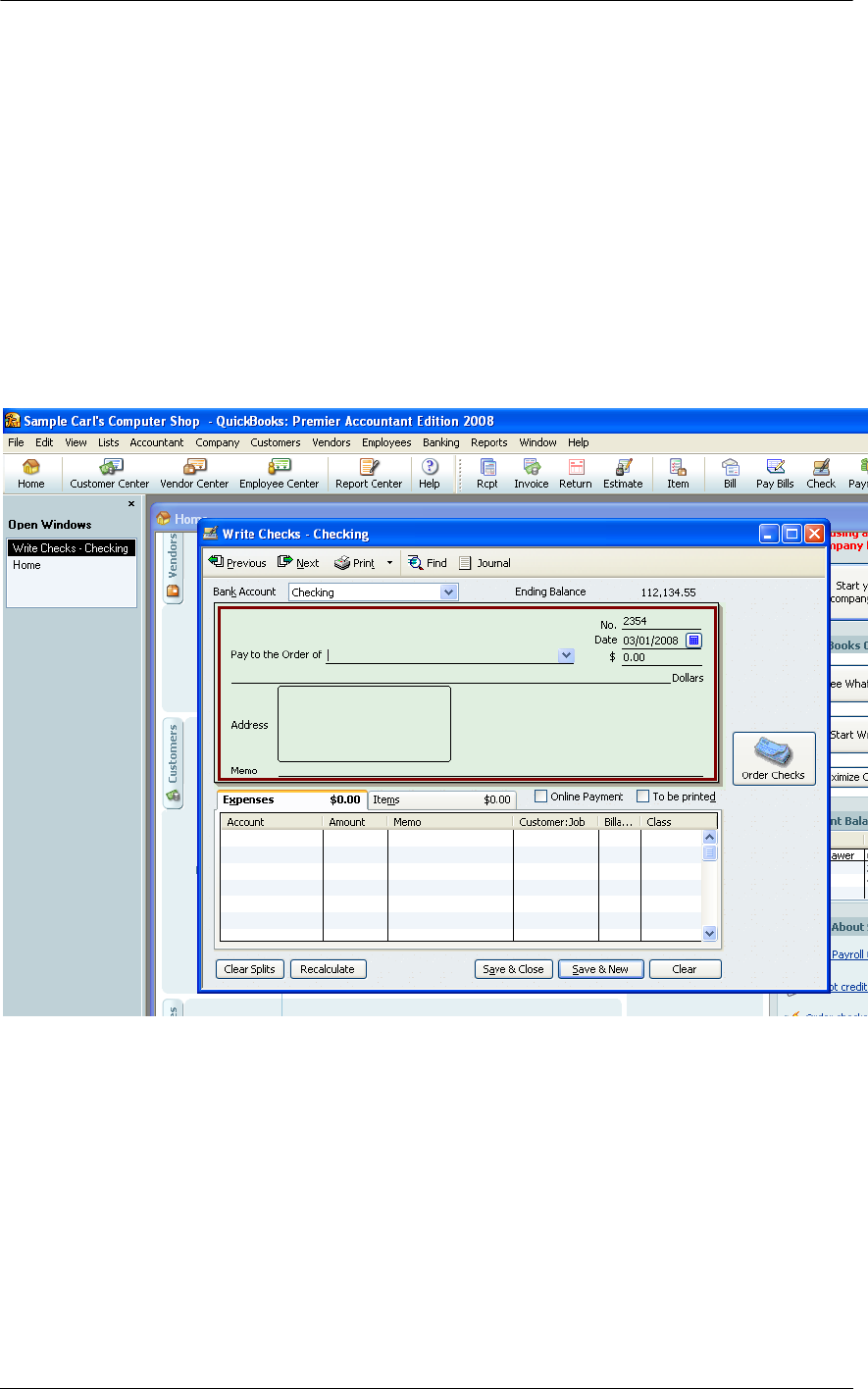

Step 1 – Correct Coding of Check

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: Lists > Chart of Accounts > Double click on

Bank account > Single click on check to be edited > Click on splits > Edit account to be Accounts

Payable > Enter vendor in name column

Record the change. Complete this same procedure for all checks that should be linked to a bill.

19

Top 10 QuickBooks Mistakes Clients Make

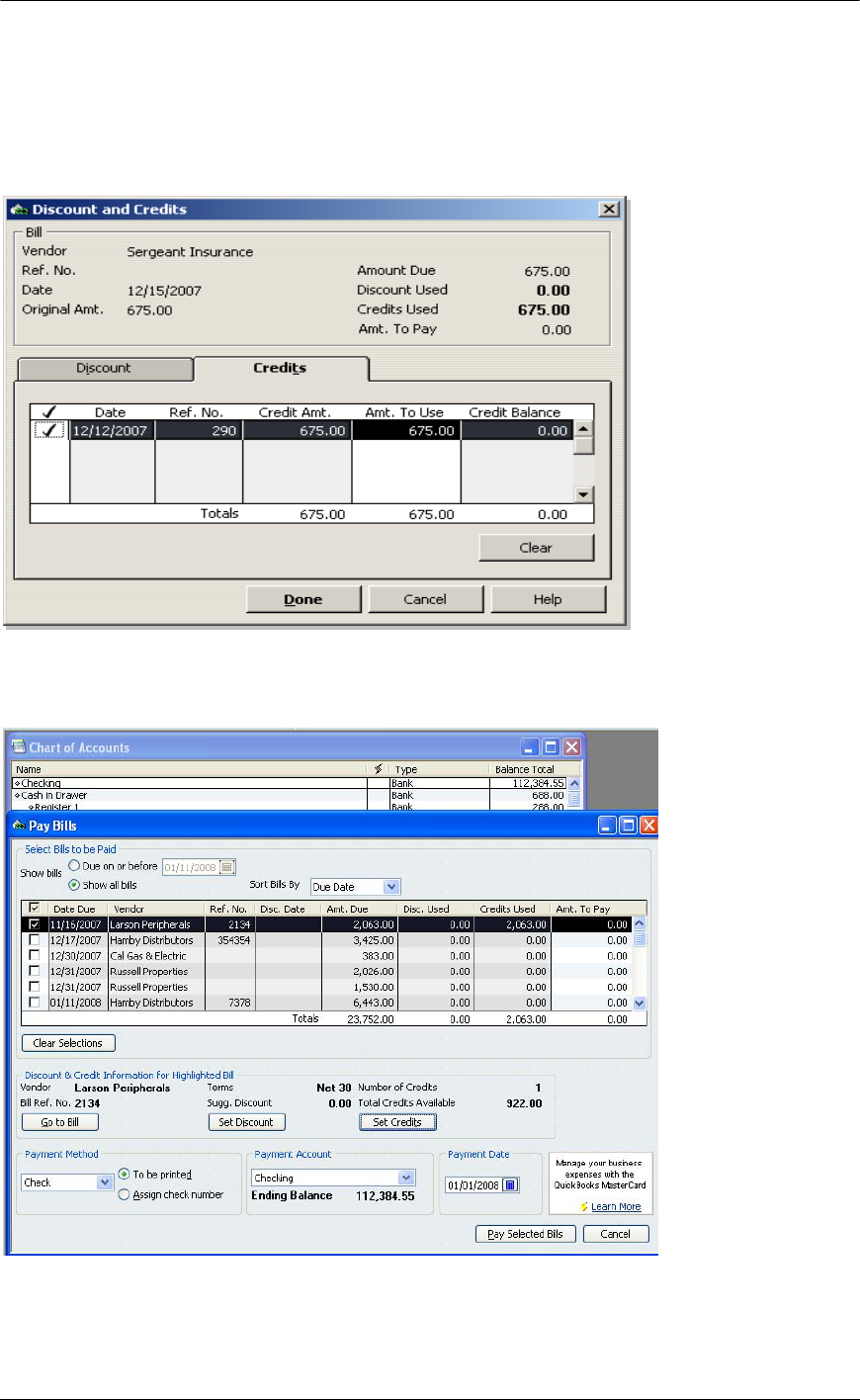

Step 2 – Link Check to Bill

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: Vendors > Pay Bills >

Single click on the bill to be linked > Set Credits

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: Vendors > Pay Bills > Single click on the bill

to be linked > Set Credits > Choose credit to be used (note the same check number is in the Ref. No.

column) > Done > Note that the credit used appears and the amount to pay is now zero

Continue this process for all the bills and checks that need to be linked. When the process is

complete for all the transactions, click on the “Pay & Close” button.

20

Top 10 QuickBooks Mistakes Clients Make

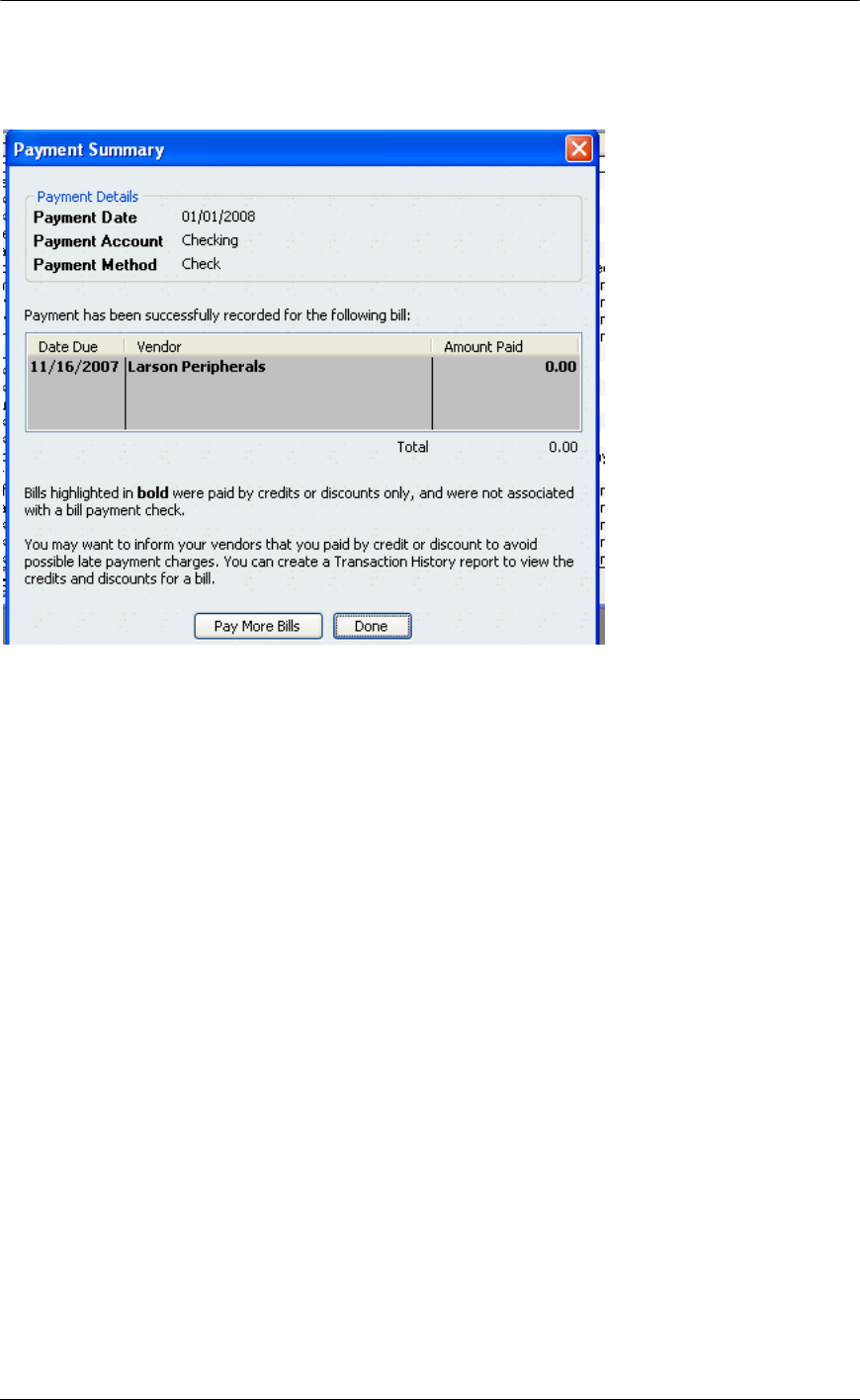

A warning may appear that can be acknowledged that states in the older versions that no check

will be generated. The message in the newest version is:

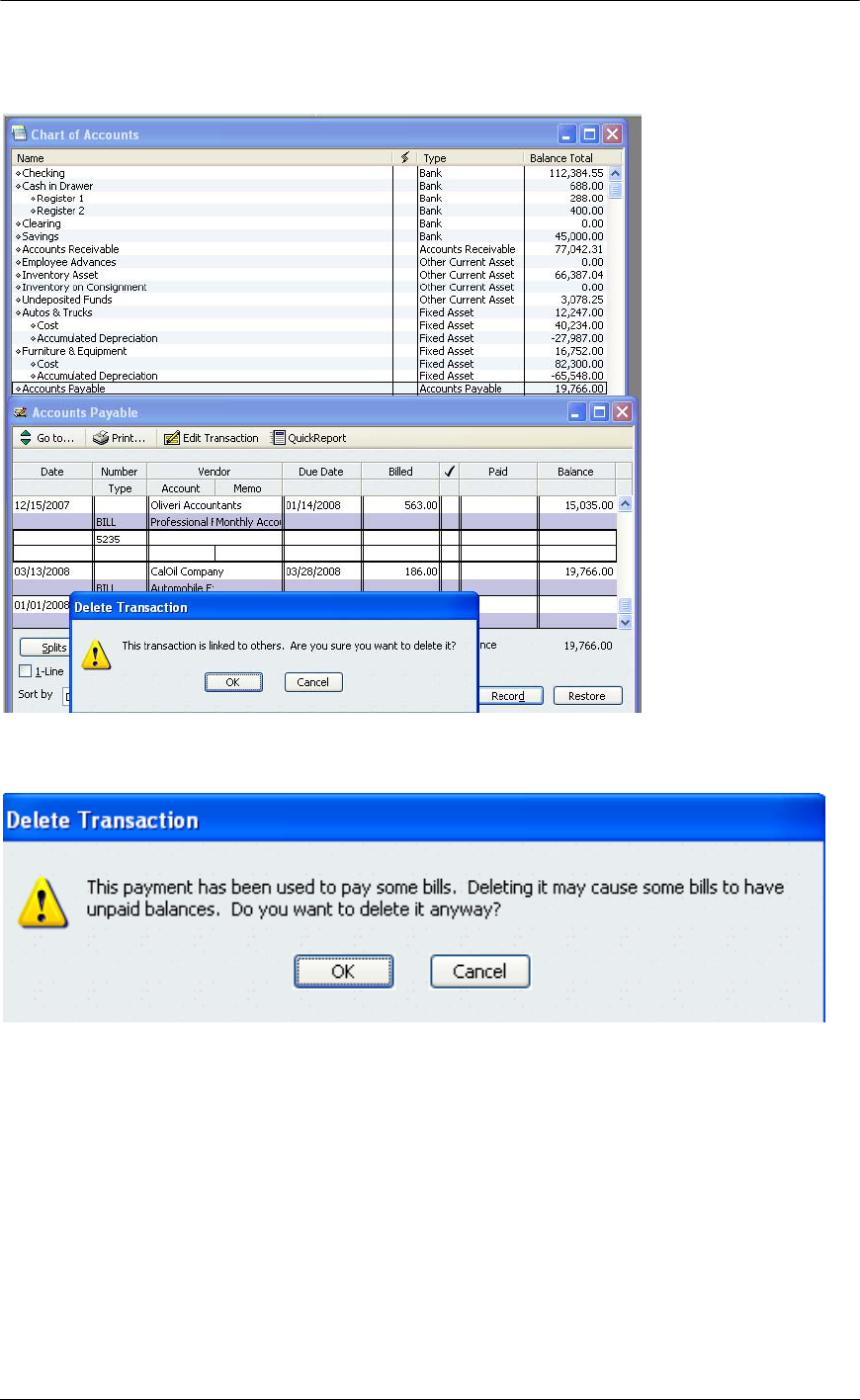

CASH BASIS – BILLS NOT NEEDED

If the client is on the cash basis and accrual reports will not be needed for management, historical

or any other purpose, it is possible to delete the bills. The easiest way to delete the bills is to go

to the Accounts Payable register and delete them. By doing it in this way, it is easy to make sure

the bill has, in fact, not been completely or partially paid.

21

Top 10 QuickBooks Mistakes Clients Make

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: Lists > Chart of Accounts > Accounts

Payable > Activities > Use Register > Single click on the bill to be deleted > Edit > Delete Bill

If there has been a complete or partial payment linked to the bill, a different pop up box will

appear:

Once this process is complete, create the Reports > Vendors & Payables > Unpaid Bills Detail

report to confirm everything looks OK. Note that the checks themselves are still listed in the

Check Register – you may wish to review the expense account coding on the check to ensure

accuracy on the P&L.

22

Top 10 QuickBooks Mistakes Clients Make

23

Top 10 QuickBooks Mistakes Clients Make

ACCOUNTS RECEIVABLE ERROR

ERRORS & SYMPTOMS

• Common Error: Make Deposit feature has been used rather than Receive Payments

• Primary Indication: The A/R Aging report shows many old invoices.

• Supplemental Symptoms:

o Accounts Receivable is very high

o Income is unreasonably high

o The bank account balance looks right

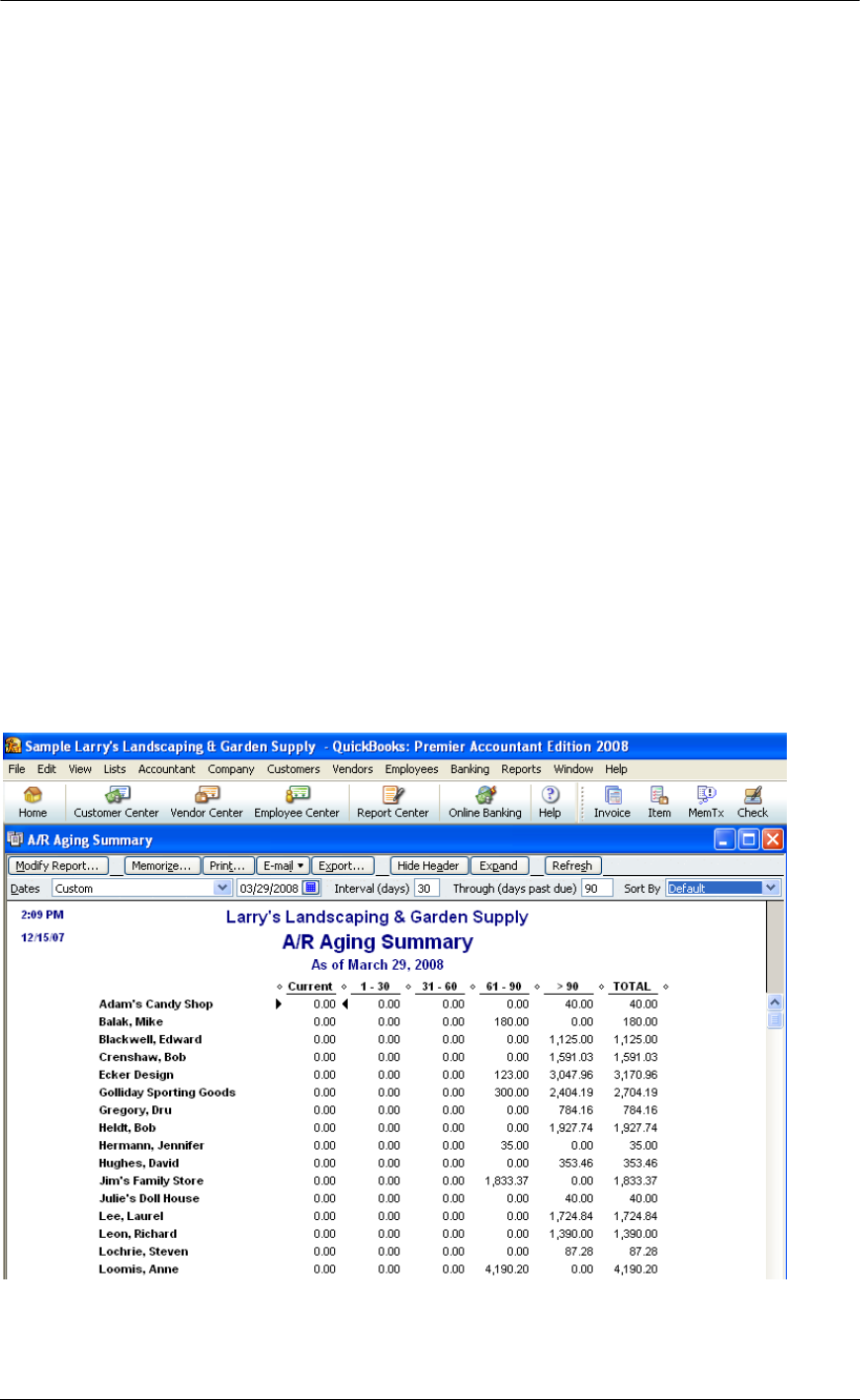

The quickest and easiest way to look for Accounts Receivable errors is to review the A/R Aging

Summary report.

This report shows, at a glance, who owes the business money. It can be collapsed to show the

amounts due by customer, or expanded to show the amounts due by job.

Excessive amounts in the >90 days column is an indication something is wrong: It is either a

QuickBooks data entry procedural issue, which is what we will address here, or it could be

indicative of a bigger problem with management or going concern issues, which we will not be

addressing.

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: Reports > Customers & Receivables >

A/R Aging Summary

24

Top 10 QuickBooks Mistakes Clients Make

25

Top 10 QuickBooks Mistakes Clients Make

ACCOUNTS RECEIVABLE FIXES

This fix is a little more complicated than that for Accounts Payable because typically the deposit

includes several customers and there is a limitation within QuickBooks that a single transaction

can only have one A/R or A/P type account. For this reason, using the receive payment feature is

recommended.

NOTE: The only exception would be if a client is so excited every time they receive a payment they

run to the bank immediately. If each amount is deposited separately, similar procedures of changing

the account code to Accounts Receivable would be possible. This, however, is the exception rather

than the general rule.

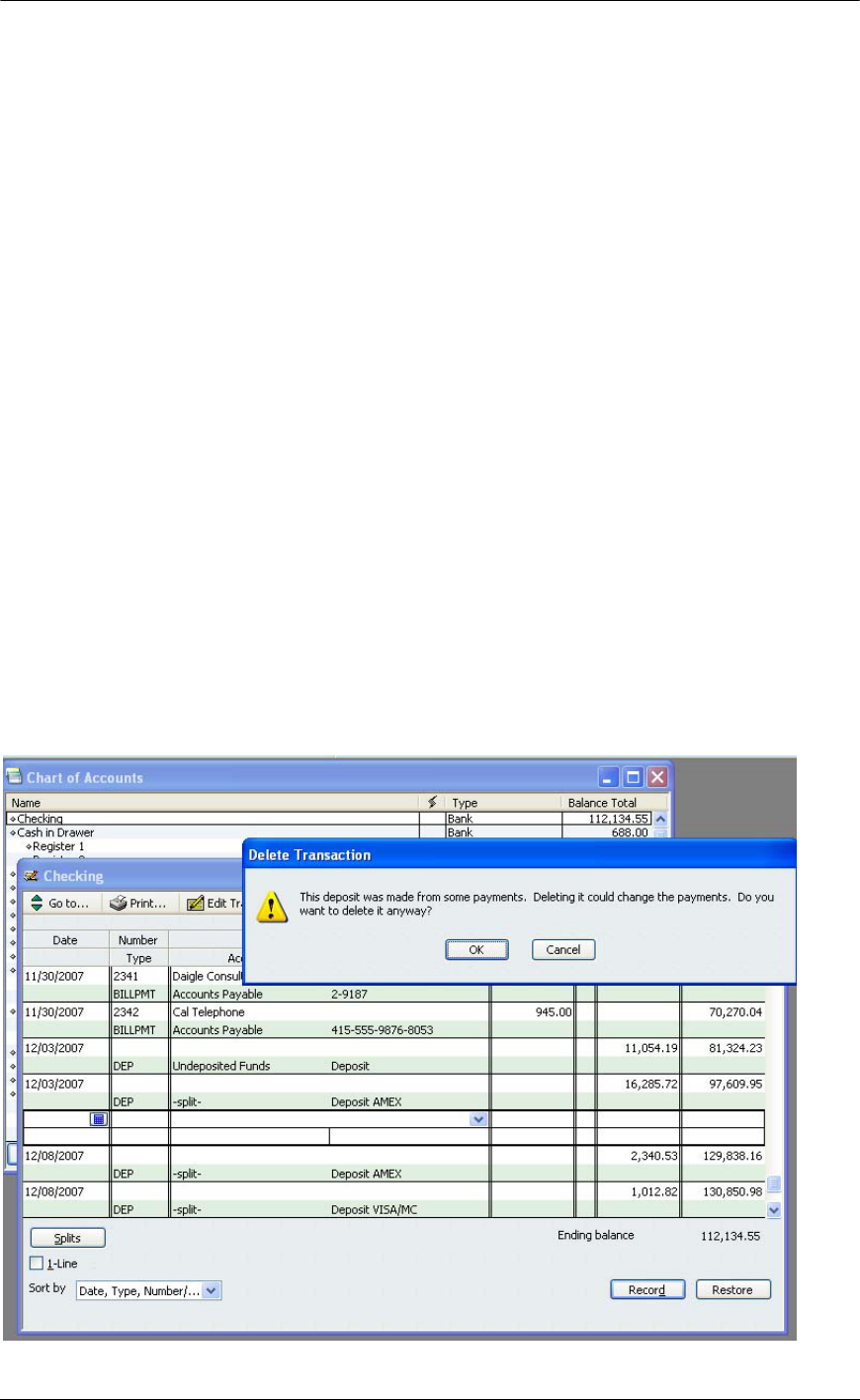

BANK RECONCILIATION NOT COMPLETED

If the bank reconciliation has not been completed, the easiest way to deal with the issue is to

delete the existing deposits. Re-enter the amount received using Receive Payments and

undeposited funds. And then make the deposit to link all the payments together as one

transaction in the check register, to match what was actually deposited in the bank.

Step 1 – Delete Deposit

This step will remove the incorrect deposit from the QuickBooks data file. As with any other fix,

be sure you know everything there is to know about the transaction prior to deleting it. This

includes the date, amount, check number, customer/job, and any other information that may have

been entered. This information will be needed when the transaction is re-entered correctly.

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: Lists > Chart of Accounts > Double click on

Bank account > Single click on deposit to be deleted > Edit from the menu bar > Delete deposit

26

Top 10 QuickBooks Mistakes Clients Make

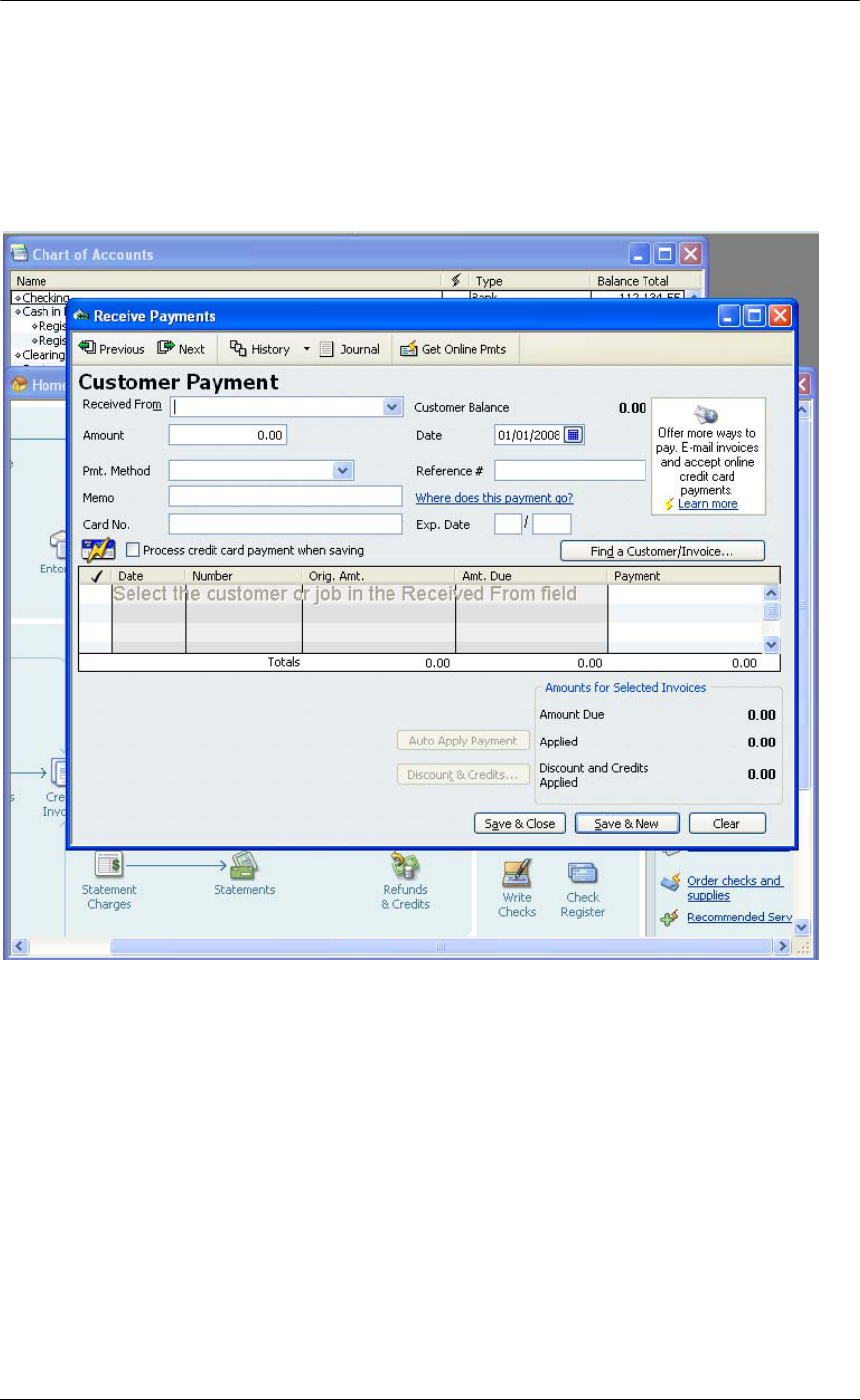

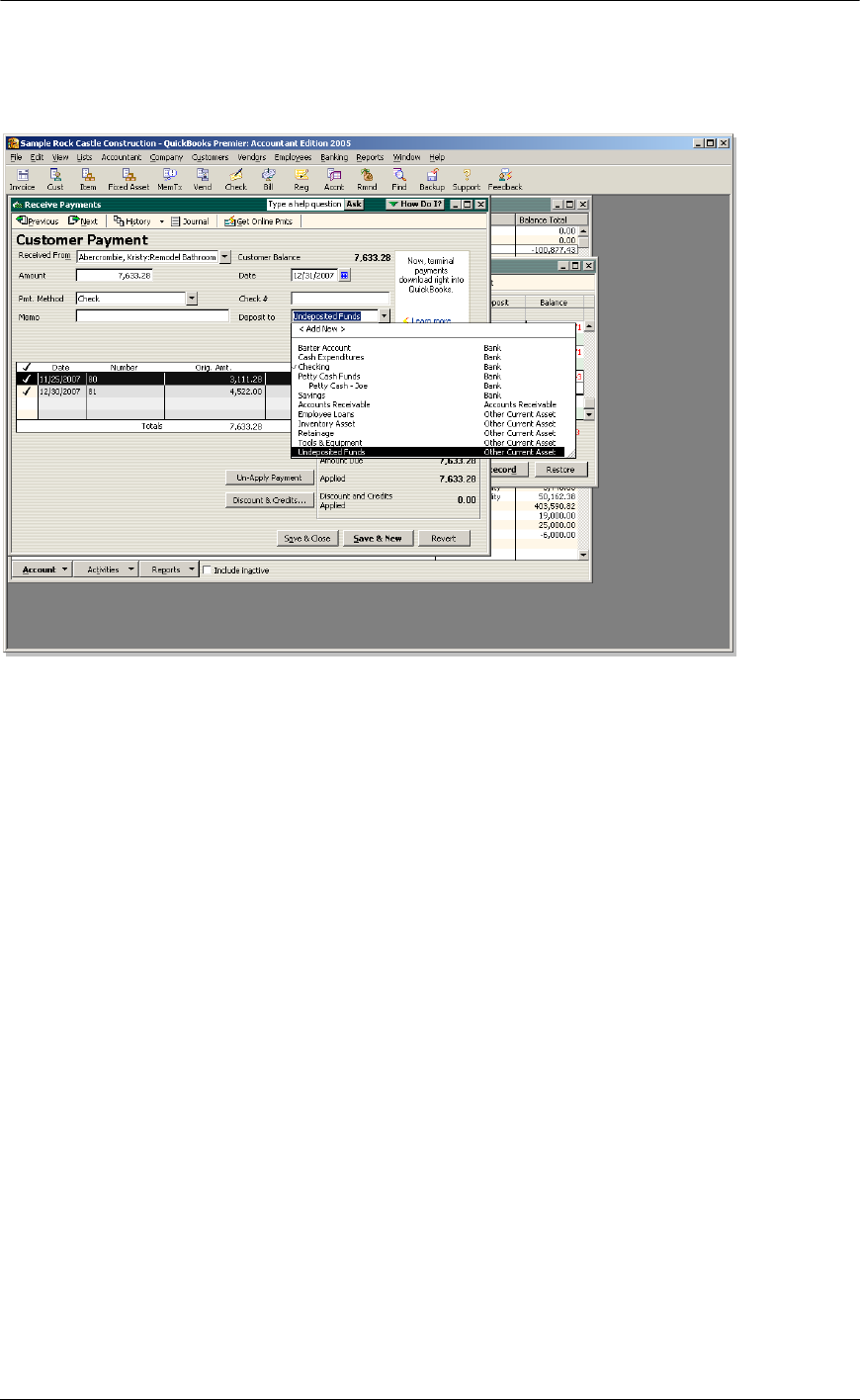

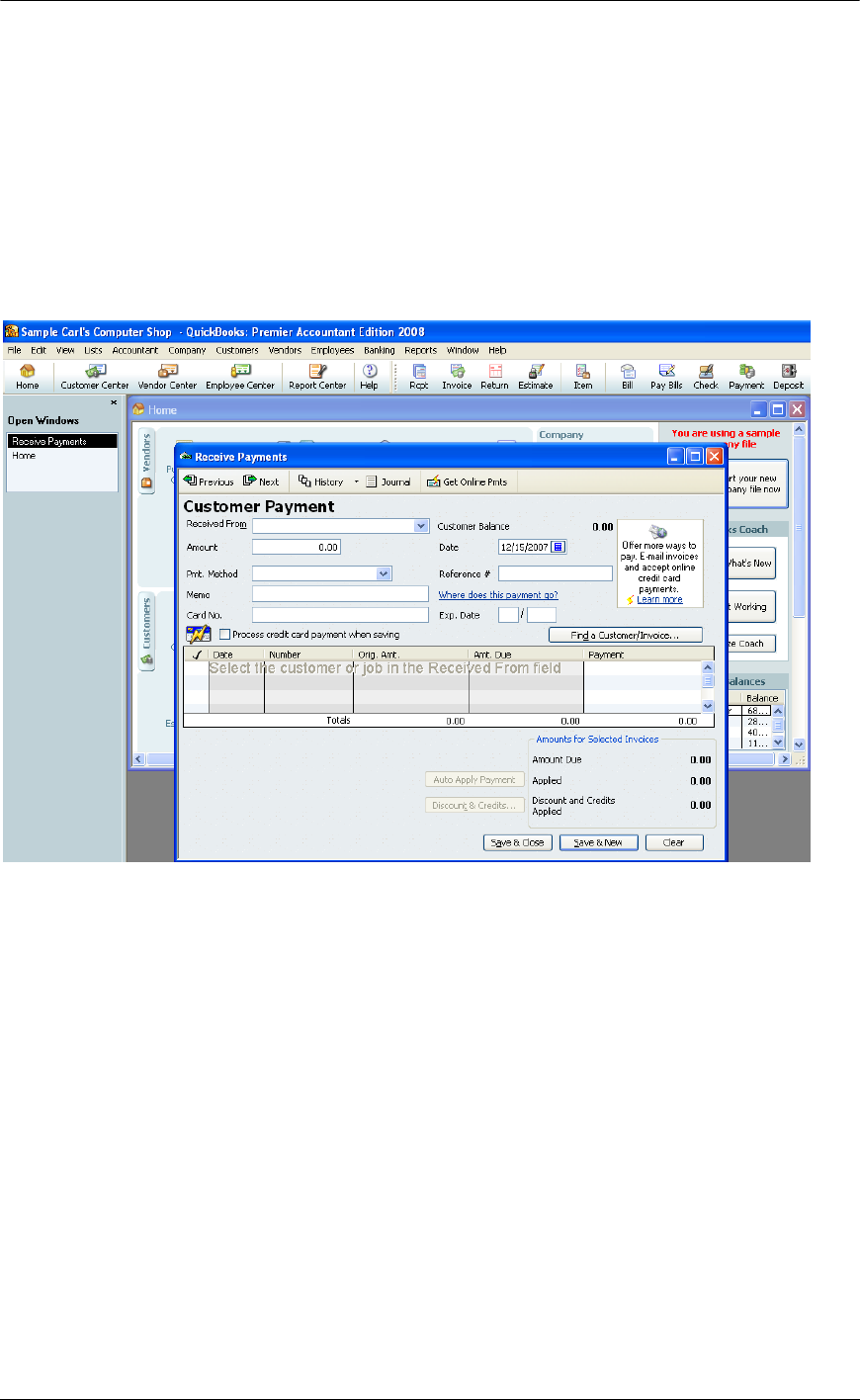

Step 2 – Receive Payment

This is the step that records the link between the money that was received and the invoice

previously generated for the customer: job. As was mentioned above, the general rule is that all

receive payments should be recorded as grouped with undeposited funds.

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: Customers > Receive Payments

27

Top 10 QuickBooks Mistakes Clients Make

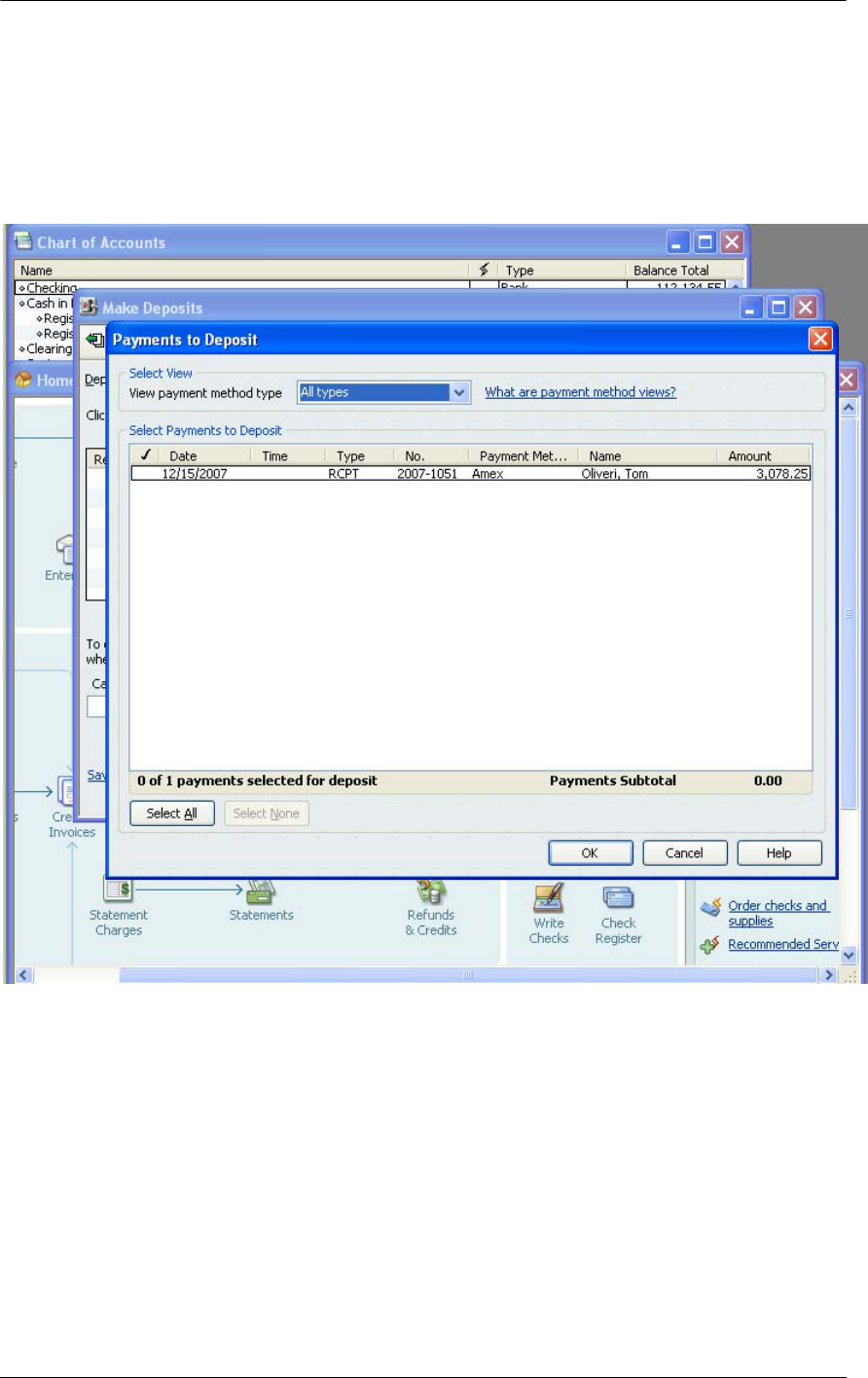

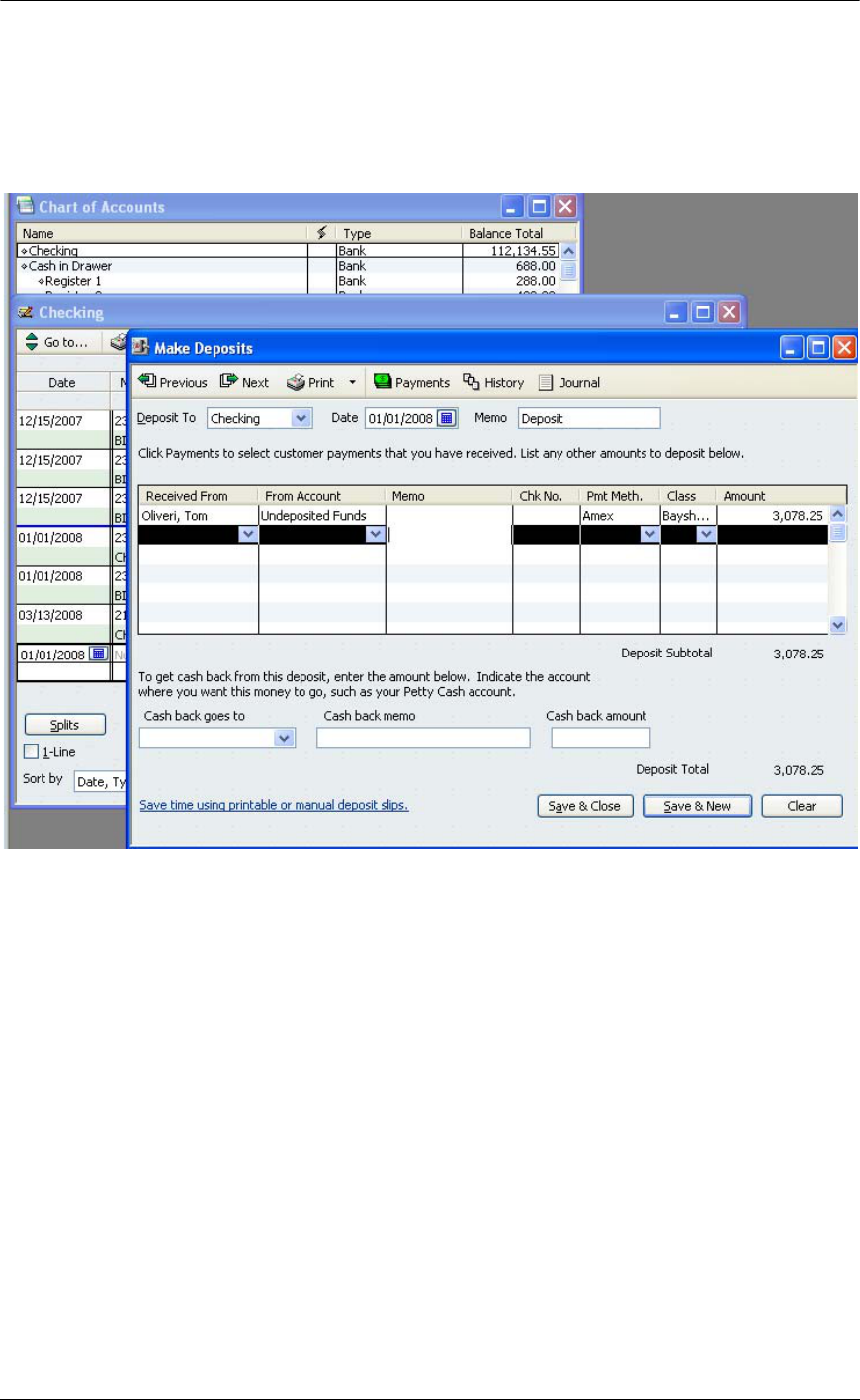

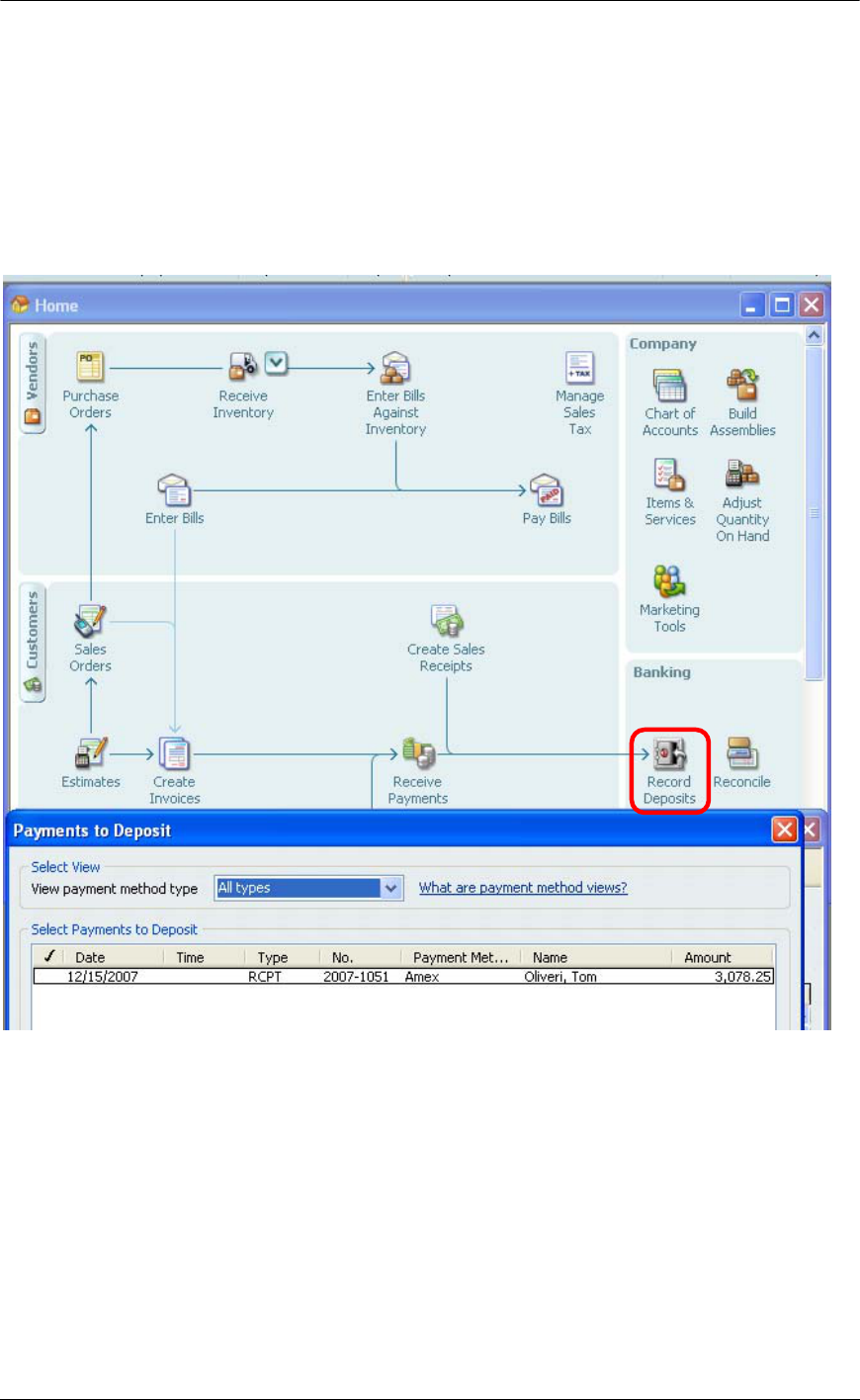

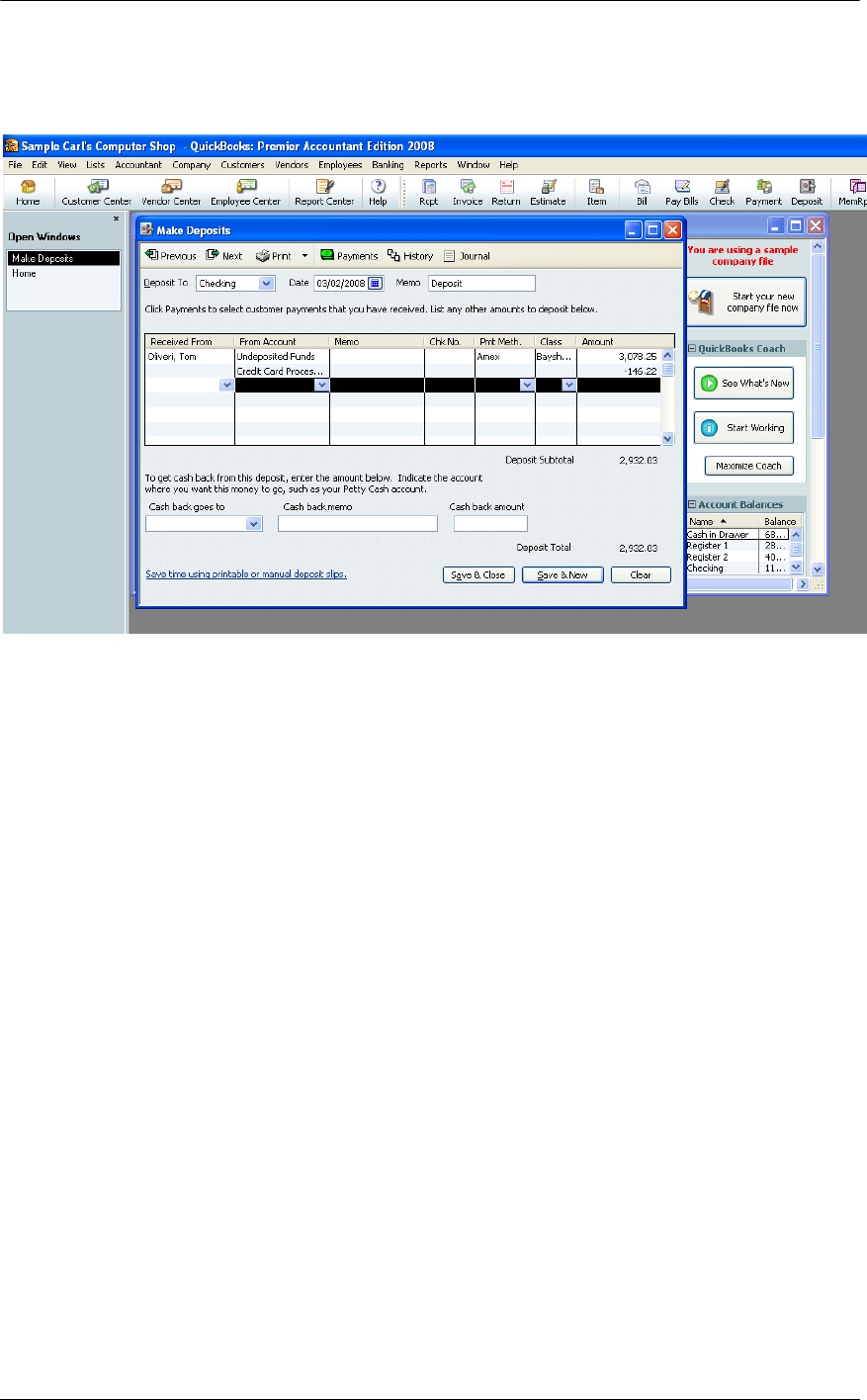

Step 3 – Make Deposit

This step is the process that combines several payments that have been received from various

customer: jobs into one deposit that will match the amount received by the bank.

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: Banking > Make Deposit

28

Top 10 QuickBooks Mistakes Clients Make

BANK RECONCILIATION HAS BEEN COMPLETED

If the bank reconciliation has been completed, the easiest way to deal with the issue is to enter

the amount received using Receive Payments and undeposited funds. And then edit the deposit

to link all the payments together as one transaction in the check register.

Step 1 – Receive Payment

Follow the same procedures as Step 2 above.

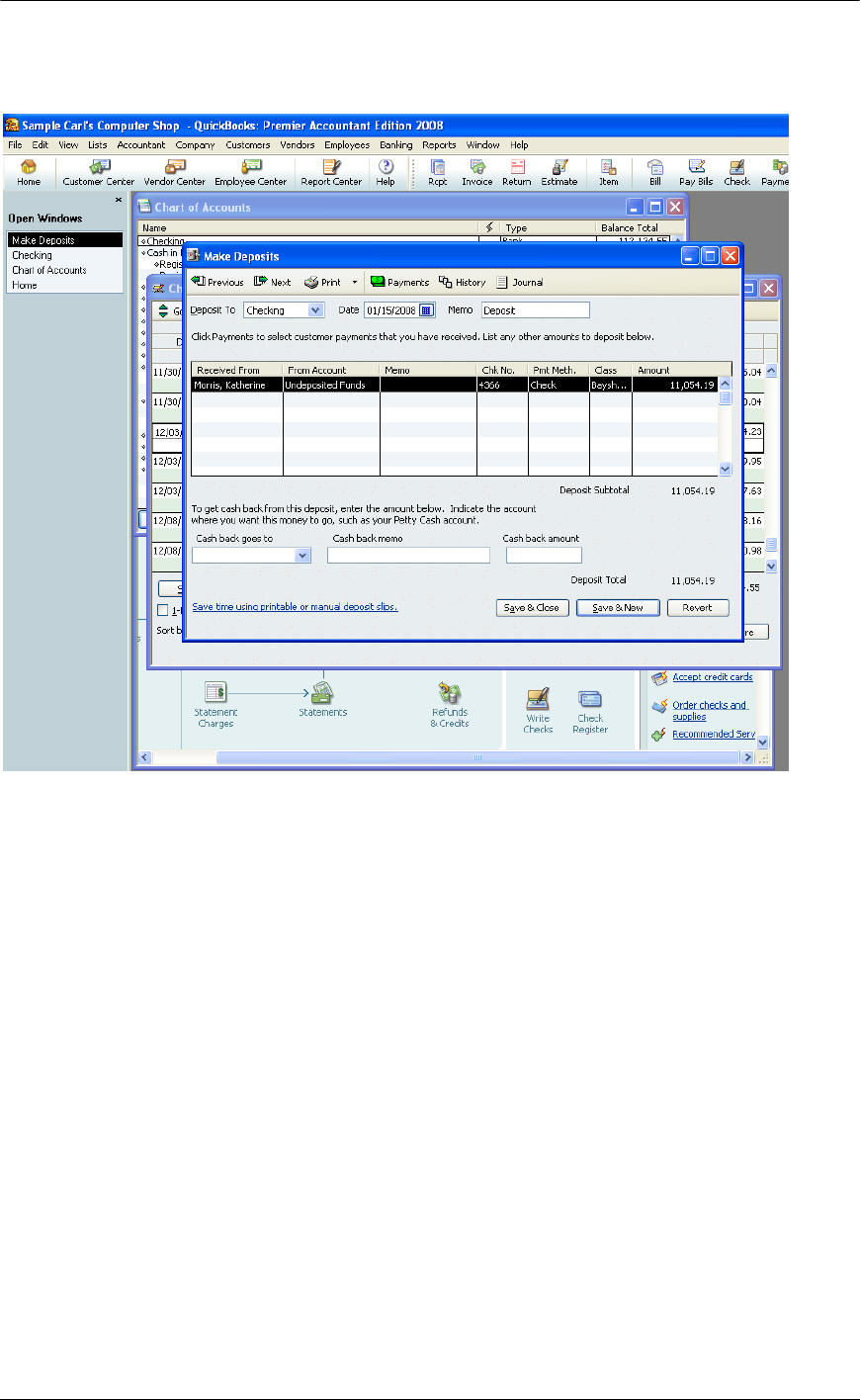

Step 2 – Edit Deposit

With the deposit on the screen, note the deposit total amount. This is critical to keeping the

beginning bank balance amount on the reconciliation unchanged.

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: Lists > Chart of Accounts >

Single Click on the deposit > Edit > Edit Deposit

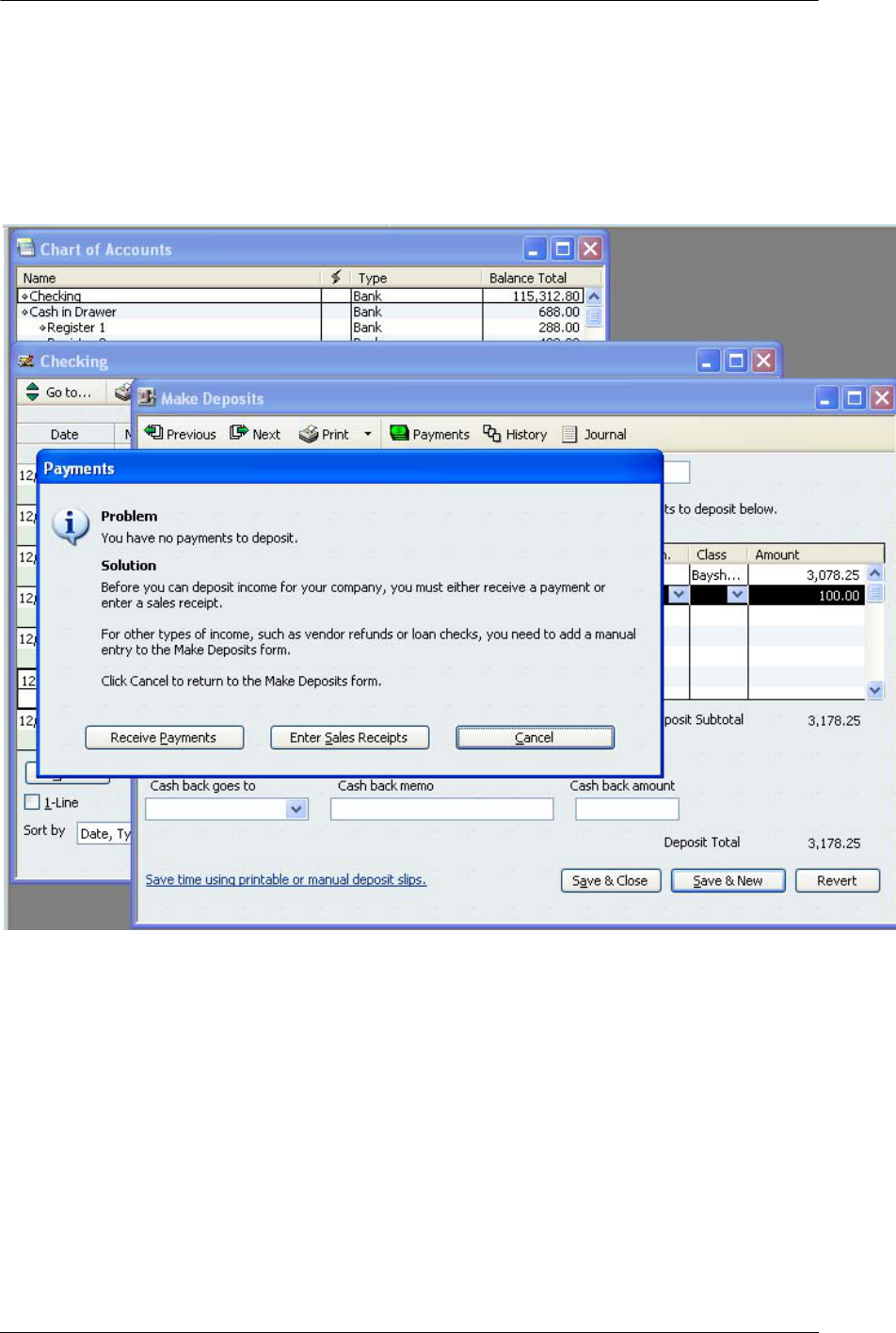

Next, click on the payments button (at the top of the “Make Deposit” pop-up screen) to permit

including payments that should be included on the deposit.

29

Top 10 QuickBooks Mistakes Clients Make

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: Lists > Chart of Accounts >

Single Click on the deposit > Edit > Edit Deposit > Click on Payments Button

30

Top 10 QuickBooks Mistakes Clients Make

This next step will “pull” the receive payment onto the deposit slip.

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: Lists > Chart of Accounts >

Single Click on the deposit > Edit > Edit Deposit > Click on Payments Button >

Select payments to be included on deposit > OK

Note that the deposit is now listed twice.

31

Top 10 QuickBooks Mistakes Clients Make

This next procedure will clean up the deposit slip and delete the previous incorrect entries. Single

click on the deposit to be deleted, and from the edit menu, choose delete line.

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: Lists > Chart of Accounts > Single Click on

the deposit > Edit > Edit Deposit > Click on Payments Button > Select payments to be included on

deposit > OK > single click on the incorrect line > Edit > Delete Line (repeat if there are multiple

detail lines to be deleted), confirm the deposit total agrees with the starting deposit

NOTE: Be sure only to delete the deposit that does

not

have a “Received From” name associated with

it! Otherwise you will be deleting the deposit you just entered in the prior “Receive Payments” step.

32

Top 10 QuickBooks Mistakes Clients Make

DEPOSIT DATA ENTRY CASE STUDY

Q

– My accountant just informed me that I have been doing my deposits all wrong. I had been

entering an invoice to send to the customer then receiving the payment to show the invoice was

paid. I looked in the check register and did not see the money, so I entered a deposit which

agrees to the bank statement. Now I have a big mess because the income has been recorded

twice (once from the invoice and once from the deposit). What can I do now to fix the problem?

A – There are two alternatives, depending on the volume of transactions. One is to "reconcile"

the deposits as of specific dates; the other is to fix the detail.

The fastest solution is to make a deposit each month by checking off all the receive payments for

the month. Then say OK to "pull" these transactions onto the deposit slip, and then enter one line

as a negative amount coded to the general ledger account where the previous deposits have

been recorded. This will, in effect, reclassify the undeposited funds amount against the incorrectly

recorded income.

The solution that will provide a clean trail of what has actually happened would be to "pull" the

receive payments onto the deposit slips. This can be done by editing the deposit, click on the

payments button at the top, place a check mark next to each receive payment that should be

included for the deposit, say OK to return to the deposit slip, delete the incorrect detail line (note

that the deposit amount should still be the same as when the process began). The disadvantage

is that this process can be time consuming. However, if the deposit total does not change, it will

not affect any of the bank reconciliation work already completed. That is the reason for changing

the deposit as opposed to deleting it.

NOTE: If the receive payment option had not been used (i.e., the invoices were entered and the

deposits entered directly onto a deposit slip or into the register) and there was only one payment per

deposit slip, the most efficient correction may be to change the general ledger account code to

Accounts Receivable. This method would require the customer: job in the name column. If multiple

payments were deposited together, one of the options above would be needed. A second step of

"linking" the invoice to the credit/payment would be required through the receive payments form.

33

Top 10 QuickBooks Mistakes Clients Make

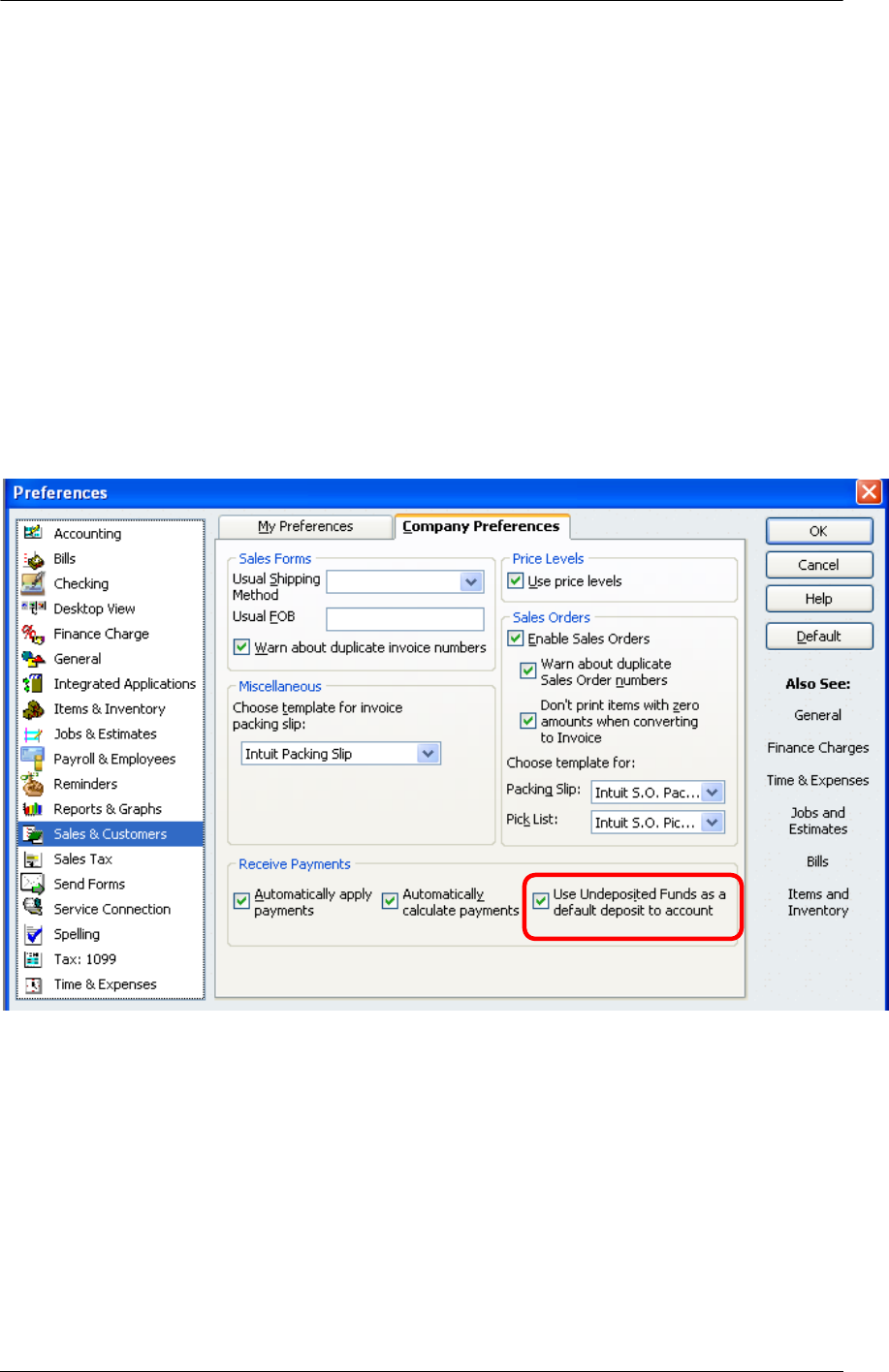

ACCOUNTS RECEIVABLE/BANKING BONUS TIP

Since the 2007 version, there have been additional receive payment preferences. In addition to

some layout changes, the most significant change is the ability to automatically calculate

payments and use undeposited funds as a default deposit account. This is a company

preference, so in order to make any changes; the user must be logged in with the “Admin”

password.

PATH: QUICKBOOKS: PREMIER 2008: ACCOUNTANT EDITION Edit > Preferences > Sales &

Customers > Company Preferences

Select to “Use Undeposited Funds as a default deposit to account. Previously the choice to

group with undeposited funds or deposit directly into the bank account was on each receive

payment and sales receipt form.

34

Top 10 QuickBooks Mistakes Clients Make

35

Top 10 QuickBooks Mistakes Clients Make

BANK DEPOSIT ERRORS

ERRORS & SYMPTOMS

• Common Error: User has followed an incorrect procedure, or simply is not familiar with

QuickBooks.

• Primary Indication: Deposits do not match bank statement

o Individual amounts appear in QuickBooks versus total deposit amount on bank

statement

o Net credit card deposits appear on the bank statement but gross deposits appear

in QuickBooks

o Miscellaneous deposit information is missing (i.e., vendor refund, loan proceeds,

etc.)

Most of the bank deposit related errors are the result of incorrect procedures or users who are

unfamiliar with QuickBooks features. The more closely the deposits in the bank account register

match the statement that is received from the bank, the more efficient the bank reconciliation

process becomes.

Some typical reasons why deposits do not match bank statement:

• Individual amounts appear in QuickBooks versus total deposit amount on bank statement

• Net credit card deposits appear on the bank statement but gross deposits appear in

QuickBooks

• Miscellaneous deposit information is missing (i.e., vendor refund, loan proceeds, etc)

Simple changes such as calling the bank to request month end cut off (the bank statement cycles

on the final day of the month) and the statement in check number order can greatly enhance the

ease of using QuickBooks to reconcile the data with the bank’s reports.

Other differences, such as those listed above, require a little training for the client, but the result is

a much more effective use of QuickBooks in the long term.

36

Top 10 QuickBooks Mistakes Clients Make

37

Top 10 QuickBooks Mistakes Clients Make

BANK DEPOSIT FIXES

Most clients arrive at the right answer (assuming they are completing the bank reconciliation

process with a difference of zero) even if they do not follow the procedures below. For this

reason, the “fix” should only be used for correcting the information since the last bank

reconciliation. This serves as a training exercise so the client follows the correct procedures

going forward and will make the next bank reconciliation easier. The importance of this approach

is that it is much easier to record deposits that match the bank statement amounts as the

information is entered, rather than trying to go back and “guess” what is included when

completing the bank reconciliation.

To implement these fixes, first edit Receive Payments and Sales Receipts transactions to group

with undeposited funds for the time period that has not yet been reconciled then complete the

Make Deposit

procedures, and finally, reconcile the bank statement.

PATH: Banking > Make Deposits

Once payment detail, if any, has been “pulled” onto a deposit slip, enter additional money

deposited from non-customer sources and/or credit card fees to be deducted to arrive at the net

deposit amount received by the bank. You can use the cash-back area to deduct any money the

business owner took form the deposit when he/she was at the bank.

CORRECT CODING ON RECEIVE PAYMENT OR SALES RECEIPT FORM

The easiest way to correct the previous receive payments and sales receipts forms is to start at

the end of the register and double click on the amount in the deposit column. This will “drill down”

to the actual transaction which can then be re-coded by clicking on the pull down list and

choosing undeposited funds. At that point, the amount has been removed from the register and

is now available on the Make Deposit screen.

38

Top 10 QuickBooks Mistakes Clients Make

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: Home Page > Use Register > Choose

correct bank account > Find deposit in question > Click on Deposit > Choose Edit Transaction” >

Choose Undeposited Funds for the “Deposit To” account.

TIP: This procedure is only used if the “Use Undeposited Funds as “Deposit To”

bank account is not checked. If this selection is not checked, there is an option on

the “Receive Payment” window. In addition, do not follow these procedures if the

bank reconciliation has already been completed or there will be a beginning balance

variance with the next reconciliation.

39

Top 10 QuickBooks Mistakes Clients Make

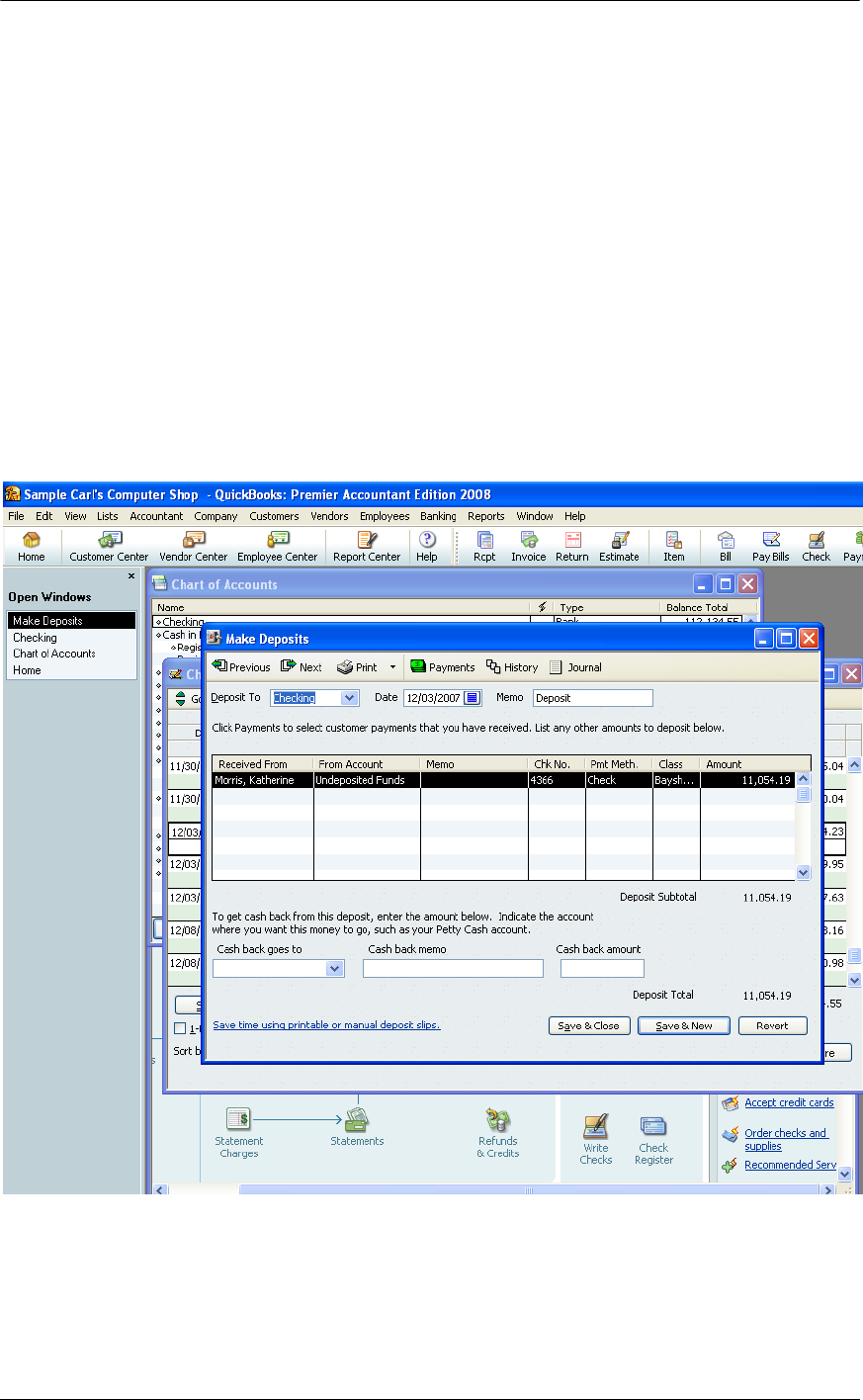

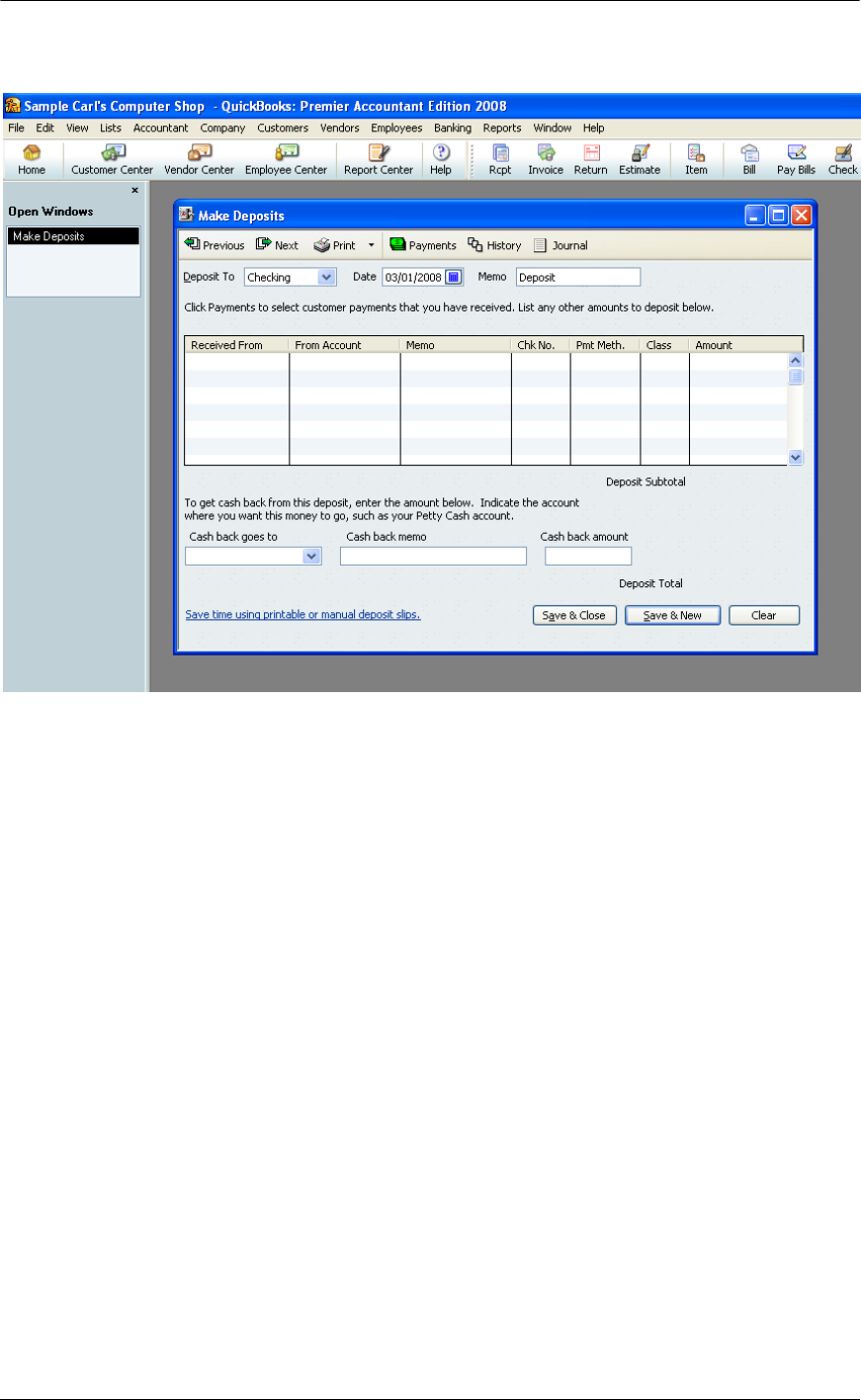

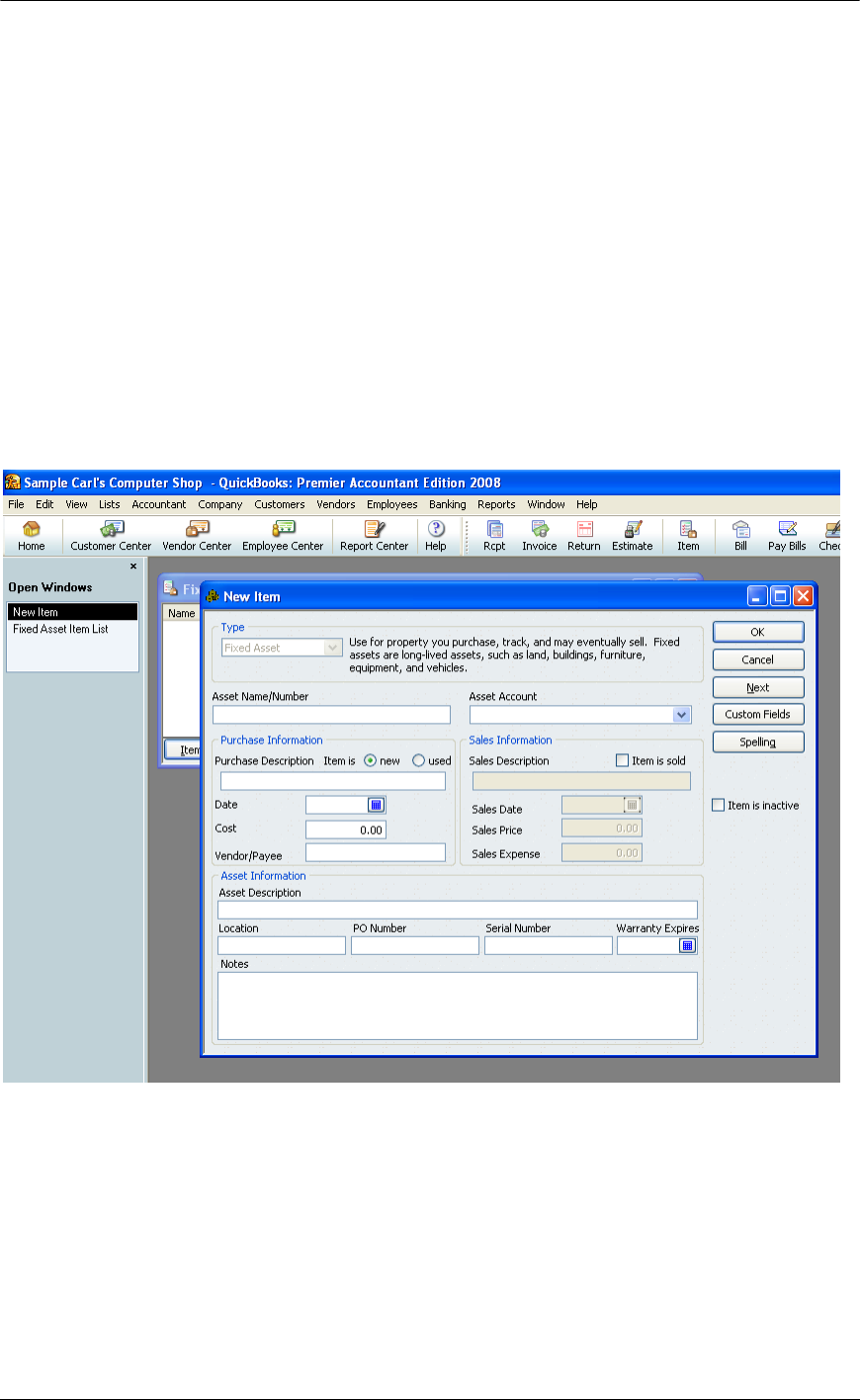

MAKE DEPOSIT PROCEDURE

This function is for depositing checks received from customers or for recording miscellaneous

amounts received from sources other than customers, such as loan proceeds, rebates, etc. The

latter can be added to a deposit slip that has been created from undeposited funds or as a

separate transaction.

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: Home Page > Make Deposit

NOTE: The “Payments to Deposit” screen appear only if there are payments that have been entered

and posted to undeposited funds; once the appropriate amounts have been marked for the deposit slip

and OK has been chosen the “Make Deposits” screen will appear.

40

Top 10 QuickBooks Mistakes Clients Make

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: Banking > Make Deposit

NOTE: If the screen is empty, it means there are no undeposited funds waiting to be deposited. If you

have in fact received payments from customers, and are expecting to see deposits here, it probably

means you have invoked a bank account or the Receive Payments screen. Go to the Register for that

bank account and drill down to correct the deposit to Undeposited Funds, then Make Deposits.

TIP: As an internal control procedure, print the deposit slip from within QuickBooks and attach the

bank receipt to the printout of the deposit slip. This also makes investigation of any bank

discrepancies much easier.

41

Top 10 QuickBooks Mistakes Clients Make

NON-CUSTOMER DEPOSITS

Non-customer deposits are relatively rare in most QuickBooks files, but for some businesses they

are common. The main trick to remember is that the amounts can be subsequently included on a

deposit slip with customer receipts.

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: Banking > Make Deposits > Check the

customer payments to be deposited together > OK > Click on the first blank line of the deposit slip

(may require scrolling down and/or clicking on the last undeposited funds line then using the down

arrow) > Enter the non-customer deposit information

BONUS INFORMATION: VENDOR REFUND OF OVERPAYMENT

Depending on how the original payment was made will dictate how the refund will need to be

recorded.

A) If the bill/bill payment method was used, the vendor should currently show an overpayment on

the account. To record the return of the overpayment, the amount can be entered on a deposit

slip with the vendor name

and coded to Accounts Payable.

B) If the amount was originally paid with the write check method, the deposit will still be recorded

on a deposit slip. The change will be that the code should be to the same expense account as

the original overpayment. The two amounts will then “net” leaving the remaining true expenditure

balance in the affected GL expense account.

BONUS INFORMATION: REFUND FROM VENDOR FOR RETURN

Return of an item – First enter a credit for the item(s) to be returned by placing the mark next to

credit at the top of the bill form and complete the bottom of the form based on the details of what

42

Top 10 QuickBooks Mistakes Clients Make

was returned. Typically this will be the same information as the original transaction. Then enter

the refund as detailed in part A above.

Return other than items – If the return was for something other than an item, part B above will

provide the steps necessary to correctly record the refund.

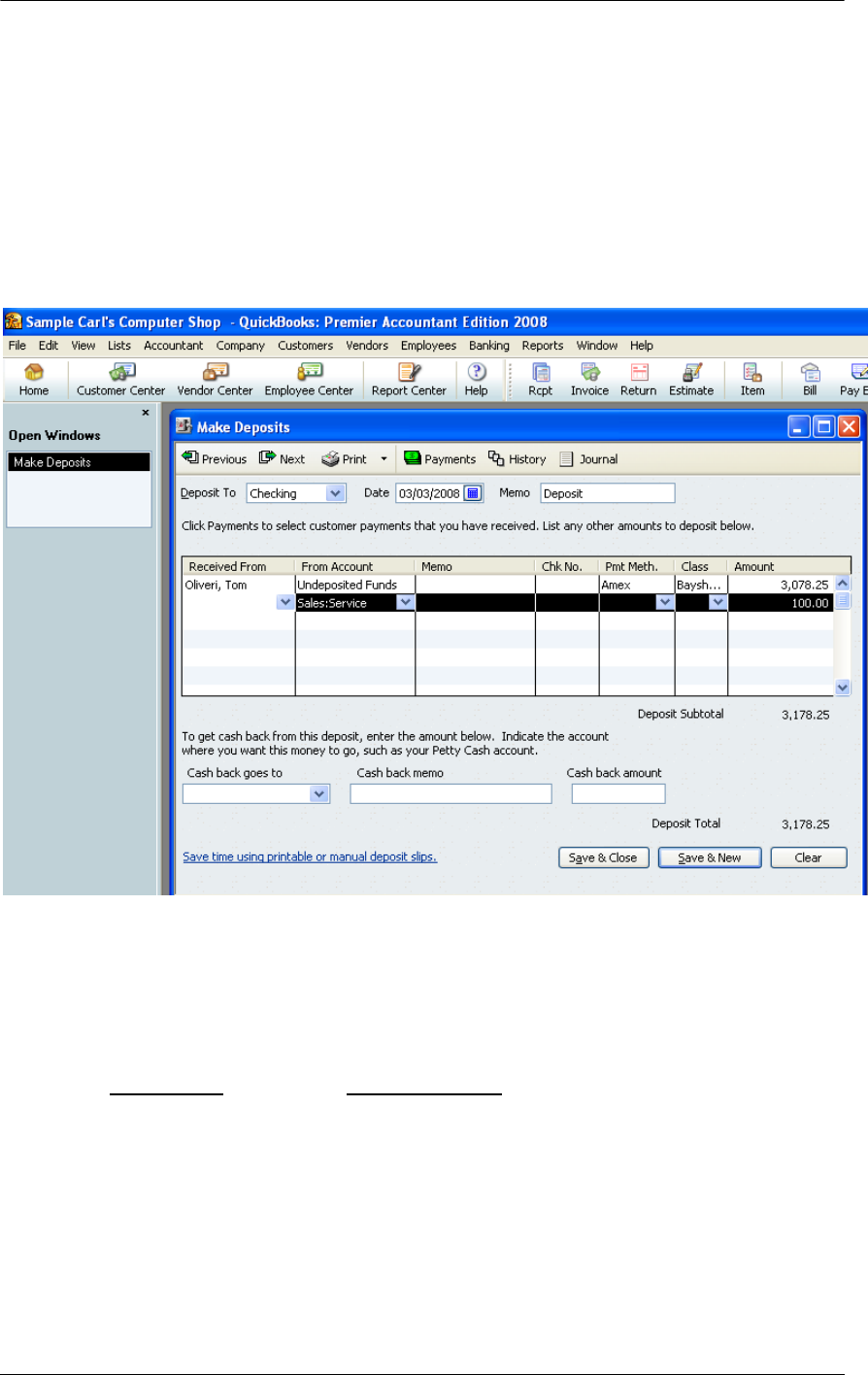

NET CREDIT CARD DEPOSITS

As you process the credit cards as either sales receipts or through the receive payment function,

be sure to mark the radial circle to “group with other undeposited funds.” Entering the payment

method is helpful since different credit card types are typically transferred to the bank account in

total.

The next step is to choose to make deposit from the banking pull down. All the customer

payments will appear and those to be deposited together can be chosen by placing a check mark

next to each one, or by choosing the select all button towards the bottom of the screen. New with

version 2004 is the ability to only show payments of a certain type. This helps to streamline the

process of choosing those payments that are included in one deposit into the bank account.

If the amount is received from the credit card company net (i.e., the credit card company keeps

their fee from each deposit) it is possible to enter the fee directly onto the deposit slip with a

negative amount. There is a calculator function built in, so if the fee is a percentage of the total

deposit, press – then type the number, then press the * key to multiply and then the percentage

as a decimal (i.e., 3.45% is .0345) and then enter to have the computer calculate the fee. The

fee will appear as a negative number to reduce the total deposit amount. The result is a total

deposit that should match the bank statement.

TIP: If there is a discount fee and a transaction fee, it may be easier to sign up for on-line banking and

complete the make deposit function once the deposit is actually received into the bank account if the

day to day balance is important. With most credit card processing companies they also have an online

reporting function to see the actual deposit detail information in real time.

TIP: If the business does not need an “up to minute” accurate bank balance, it may be acceptable to

enter the deposit at gross (amount received from the customer in total) and then enter the credit card

processing fees monthly (keeping in mind that QuickBooks will always be a little higher than the

bank until the adjustment is entered). Each credit card company supplies a statement either on-line

or through the mail that will show the individual charges less the fee for each deposit that can be used

to reconcile the deposits manually.

43

Top 10 QuickBooks Mistakes Clients Make

NET CREDIT CARD DEPOSIT CASE STUDY

Customer ABC owes invoice 123 in the amount of $1,000.00. They call and say they would like

to pay for the invoice using their American Express Credit Card. The business accepts American

Express as a form of payment and receives the amount net of an American Express fee of

3.45%. The credit card number and related information is obtained from Customer ABC and a

Receive Payment is entered into QuickBooks for $1,000.00 with the payment method of

American Express.

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: Home Page> Receive Payment

NOTE: If the Merchant Service is provided by QuickBooks, the payment will be automatically

processed when saving the transaction by marking the checkbox. Otherwise, the appropriate method

of processing will need to be completed (for some businesses it is processing the charge through a

machine, for others there is an on-line alternative).

In this case the deposit will be received net, but the discount is known (keep in mind there may be

a transaction fee or other fees in addition to the discount fee for some credit card merchant

accounts). In this type of circumstance (or if the deposit was received gross and the fees taken

out separately) it would possible to process the deposit immediately in QuickBooks. First choose

the Receive Payment that was just entered — this will “pull” the amount onto the deposit slip —

then click on the line below the Receive Payment and enter the account (typically bank service

charges, credit card processing fees, or something similar), optionally enter American Express as

the payment method and -34.50 in the amount column. Tab or click to the next line and the net

deposit amount should be $965.50.

44

Top 10 QuickBooks Mistakes Clients Make

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: Banking > Make Deposits > Click on

Payment to be deposited > Click on line below undeposited funds > Enter credit card fee information

> Click on the next line > Confirm the deposit total that will be received by the bank

This process will correctly show the customer balance paid in full (i.e., the customer paid $1000 in

full using their American Express), the discount is correctly reflected as a business expense, and

the deposit into the bank account is also correctly reflected. The only other issue to keep in mind

is that typically the deposit will take several days to “clear” the bank from the credit card company

(so don’t spend the money too quickly).

45

Top 10 QuickBooks Mistakes Clients Make

PAYROLL LIABILITIES ERROR

Payroll (and inventory which we will discuss later) are the two areas where QuickBooks is less

forgiving and clients are more likely to make mistakes.

Most often the errors are the result of incorrect or inconsistent procedures.

The most common error in this area is that the “Pay Payroll Liabilities” feature was not used;

rather payroll tax payments were entered using “Write Checks.”

Common Symptoms are:

• Payroll Liabilities are higher than expected

• Payroll Tax Expense are higher than expected

• Bank account balance is OK

• Payroll tax returns have been prepared and filed showing no balance due (and no notices

to the contrary have been received)

46

Top 10 QuickBooks Mistakes Clients Make

47

Top 10 QuickBooks Mistakes Clients Make

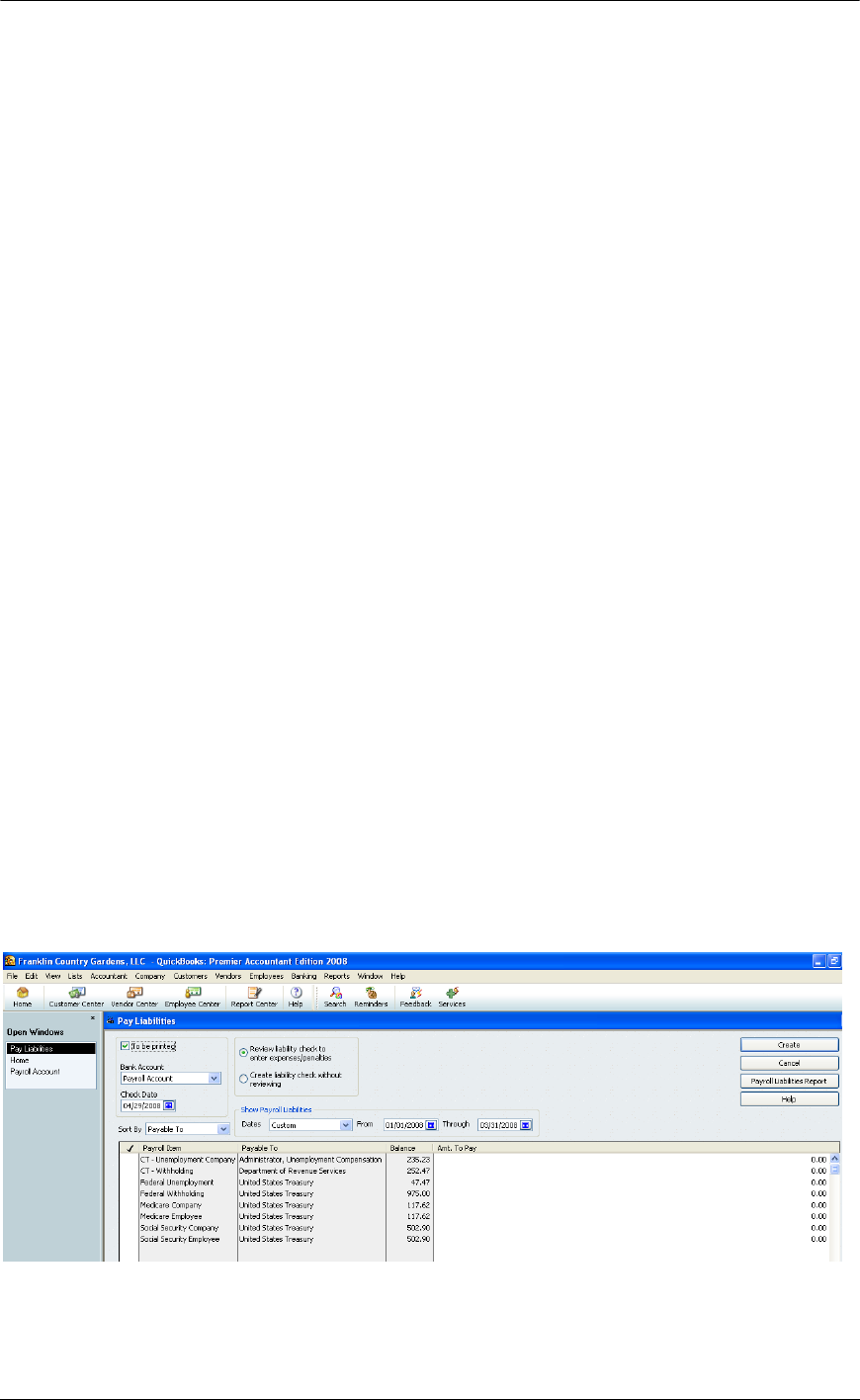

PAYROLL LIABILITIES FIXES

PAYROLL LIABILITY PAYMENT

Following proper procedures for the payment of payroll tax liabilities is imperative. If the

procedures are not followed, the payroll liability report, as well as the payroll tax returns, will not

be accurate. There is no way on the bill or check screens to tell the software which specific

payroll items are being paid. The Pay Payroll liabilities feature must be used to correctly

designate the payroll items that are being paid.

Other liabilities, such as garnishments, union dues, health insurance, 401K, etc. should also be

paid regularly using the pay payroll liabilities option shown below. If these amounts are not paid

in this way, it is possible to do a payroll liability adjustment and not affect the accounts (update

the items but not the general ledger).

The steps to follow are:

• Correctly process the payroll liability check payments using the dates and marking the

liabilities for amount actually paid.

• Assign the appropriate check number in the register

• Delete the incorrect check

NOTE: It may be necessary to clear the liability checks with the next bank reconciliation

(i.e., beginning balance will be off by the amount of these checks)

The date range for the liabilities is important for the payroll liability reports and subsequent payroll

tax returns. This is the way that QuickBooks knows which period the payment should be applied

to. (Bonus Tip: Clients often do not understand the “period end” versus “check date” concept)

The second critical date is the check date. This is the date the payment is generated and will be

recorded as a reduction in the liability and reduction in the bank account balance.

QuickBooks will accept alpha-numeric check numbers so EFT, for example, is acceptable if the

payment was made electronically.

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: Employees > Payroll Taxes and Liabilities >

Create Custom Liability Payments > Choose date range

NOTE: If the QuickBooks Standard Service (previously the Do It Yourself Payroll Tax Service) is

used, the software will show the amounts due for the time period, but will not remind the user to

actually pay the payroll taxes and liabilities. Use the look back period test to see if the client needs to

48

Top 10 QuickBooks Mistakes Clients Make

change their payroll tax liability payment frequency. The state agencies also have their own

guidelines. If the business bookkeeper or owner is unsure as to when the taxes should be paid, a call

to the accountant or governmental agency should clarify the situation. Penalties and interest add up

fast, so tax payments become very expensive if they are paid late.

TIP: To make sure everything is in balance with the payroll, compare the general ledger liability

balances, the payroll liability summary for the year to date, and the payroll liability summary with the

date changed to “All”. All three reports should be the same.

NOTE: Electronic Tax Payments and Electronic Returns – If the Assisted Payroll Tax Service

(previously Deluxe) is being used, the service pays the Federal and State taxes electronically on behalf

of the company. If other liability checks need to be issued, the same procedures as detailed earlier

should be followed. When the Employee > Pay Payroll Liabilities option is chosen; the federal and

state amounts will not appear. Only any additional liabilities will be available for payment (such as

health insurance, 401K, etc).

TIP: New with version 2008 is a new payroll service called Enhanced Payroll Service. There is also an

edition available to Accountants knows as Enhanced Payroll Plus for Accountants. The expanded

functionality of this service includes net-to-gross calculations, workers compensation tracking, state

payroll returns for approximately 40 states, and processing payroll for up to 50 clients when done on

the same registered copy of QuickBooks. For a comparison of all the Intuit Payroll Services, visit

http://www.payroll.com/comparisonchart.html

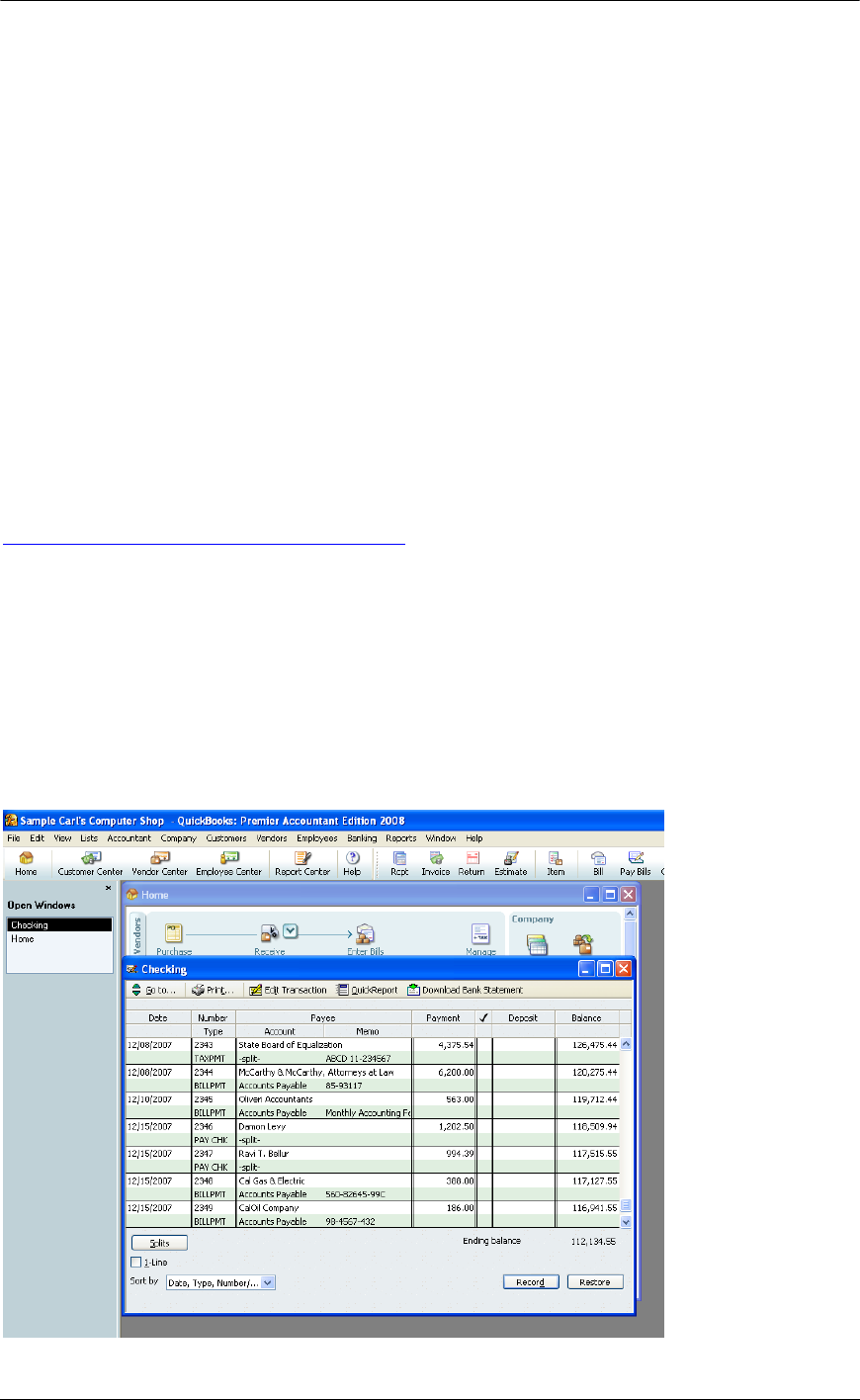

CORRECTING THE BANK REGISTER

When the payroll liability check was entered correctly, the result was two payments in the bank

register. When deleting the previous entry, the double entered check is that has the “CHK” type

payment should be deleted; the “LIAB CHK” type payment is the correct payroll liability payment

and should remain.

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: Home Page > Check Register

49

Top 10 QuickBooks Mistakes Clients Make

Although the bank reconciliation beginning balance may be off if the erroneous checks were

already marked as cleared, there is not any way to avoid this. The beginning balance should be

too high for the amount of the liability checks, mark those liability checks as cleared as part of the

reconciliation, and the difference at the end of the process should be zero. Your next bank

reconciliation should be fine.

50

Top 10 QuickBooks Mistakes Clients Make

51

Top 10 QuickBooks Mistakes Clients Make

LOAN BALANCE ERRORS

Loan related transactions are always more challenging for clients, and as a result, errors are quite

common. Often the loan was not recorded to begin with so the payments are simply expensed as

they are paid. Or, the entire payment is assigned to the liability if the loan has been recorded

(typically by the Accountant).

Some indications may be:

• loan balance or interest expenses do not look reasonable

• loan balance or interest expenses are too high for both if entire payment coded to the

expense account

• loan balance or interest expenses are too low for both if the entire payment was coded to

the liability account

The existence of the loan may be discovered because of an increase in an expense account such

as Automobile expense or Office expense.

Some accountants choose to handle this issue themselves each time they do the work, others

choose to provide the loan amortization schedule to the client (or have the client obtain it from the

lender or from loan statements) and train them to correctly split the transactions going forward.

52

Top 10 QuickBooks Mistakes Clients Make

53

Top 10 QuickBooks Mistakes Clients Make

LOAN BALANCE FIXES

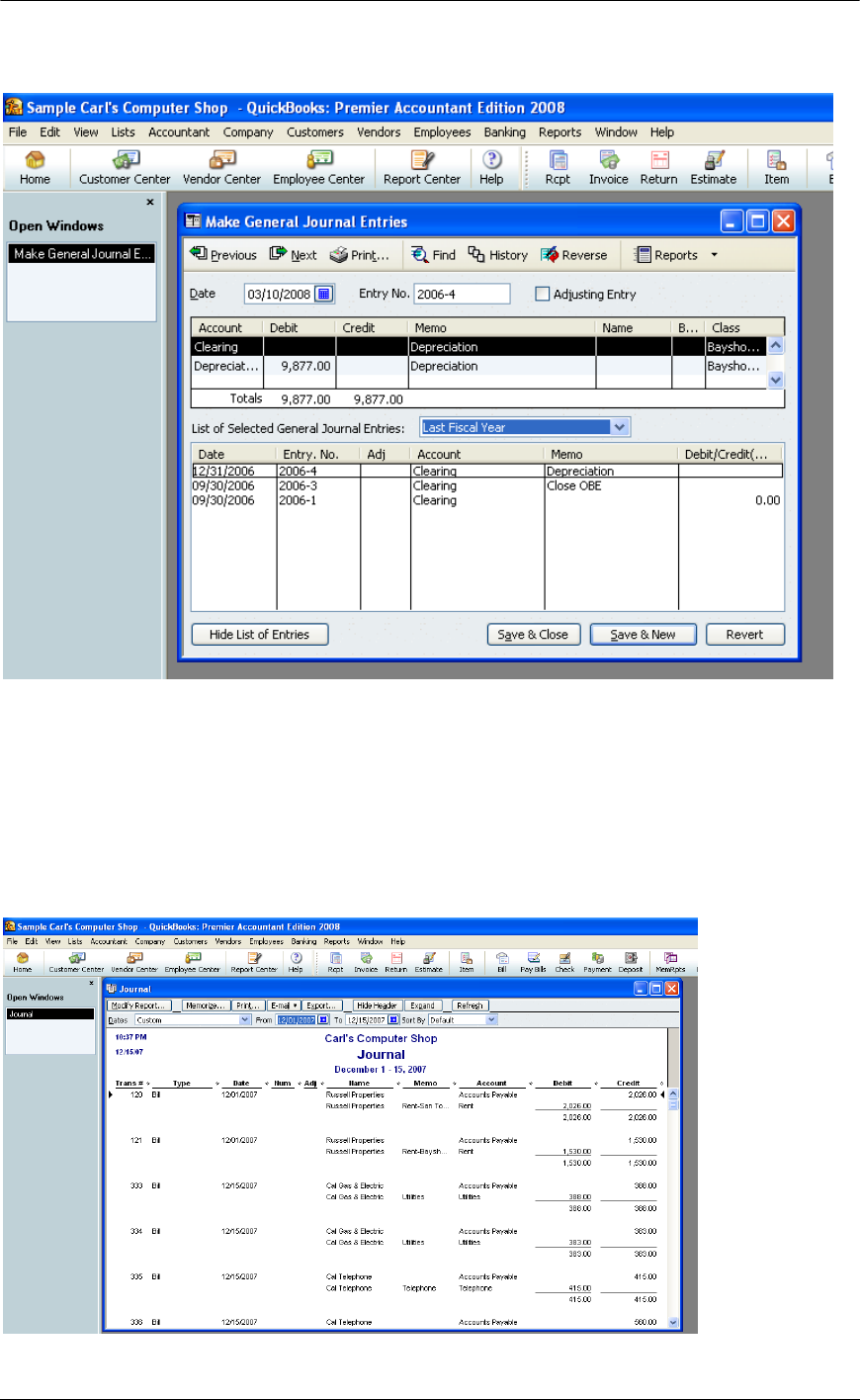

JOURNAL ENTRY

General journal entries have long been the accountant’s “domain.” Although many of the

adjustments that need to be made are handled more effectively by using a QuickBooks form (i.e.,

payroll, inventory, information for sales reports, etc), there are certain instances when creating a

journal entry is the only way to enter the transaction. This includes Accountants who are using

the Accountant’s Review Copy with their clients, loan adjustments, depreciation, fixed asset

correcting entries, etc. Assuming entering the transaction as a journal entry does not have any

reporting or feature implications; the adjusting journal entry feature expands the reporting

capability for work paper preparation for the accountant:

• Adjusting Journal Entries Report

• Adjusted Trial Balance, and

• Working Trial Balance.

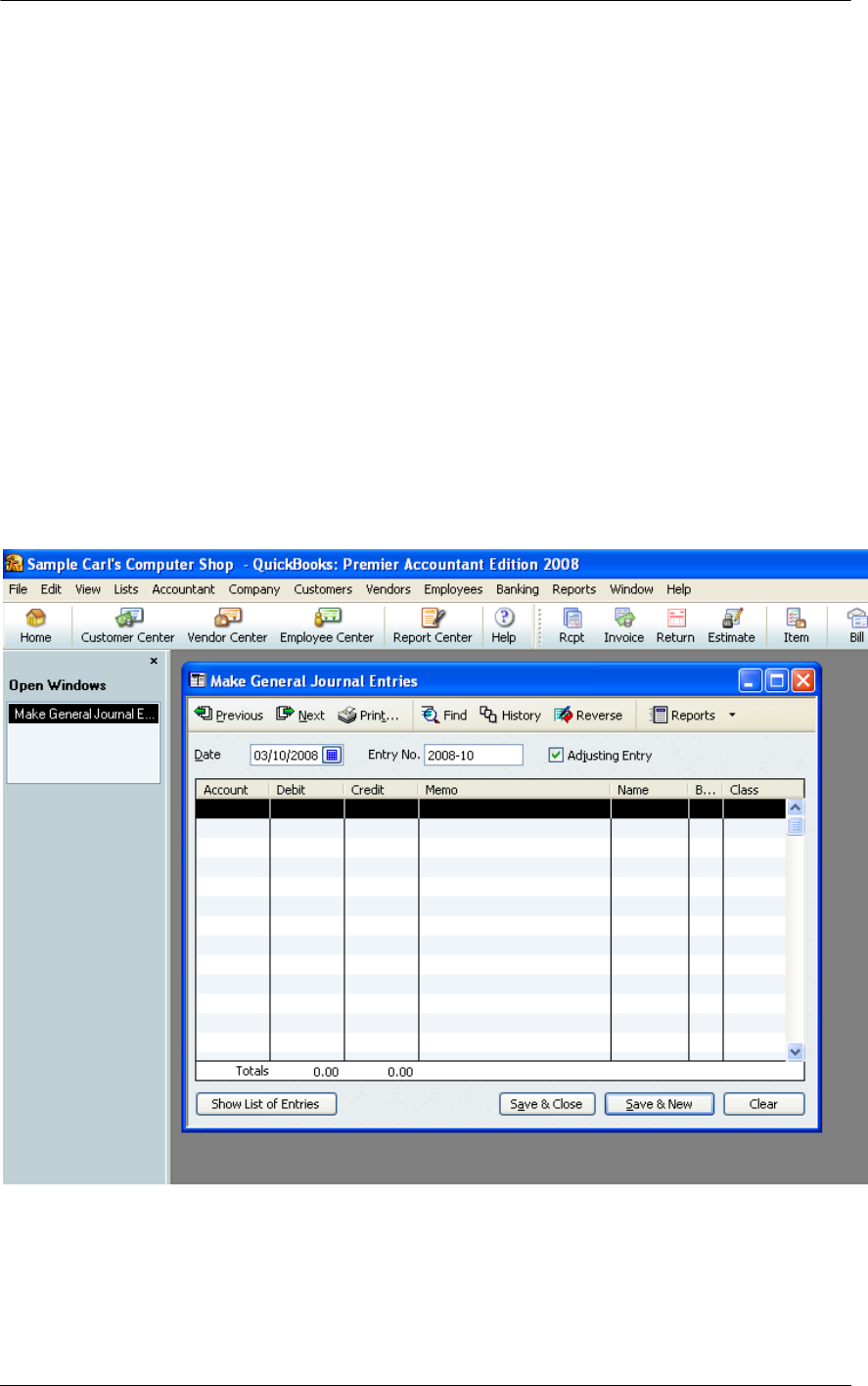

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: Company > Make General Journal Entries

TIP: The ability to set a preference to have the software automatically, sequentially number the

journal entries was new with version 2002. New with version 2003 was the ability to see a specific date

range of journal entries on the screen below the journal entry input screen.

54

Top 10 QuickBooks Mistakes Clients Make

The new addition for QuickBooks: Premier – Accountant Edition version 2004 is the ability to

mark a journal entry as an adjusting entry by clicking on the check box. This small change has

large implications to increase the flexibility of reports. For example, the adjusting column (a

check mark in this column designates the entry was an adjusting entry) has been added to the

default format for the following reports:

• General Ledger

• Journal Reports

• Profit & Loss Detail

• Balance Sheet Detail

• Transaction Detail by Account

• Transaction List by Date

• Audit Trail

• Income Tax Detail

NOTE: The ability to filter a report for only the adjusting journal entries is not available.

With Version 2003, there are also two new reports designed specifically to streamline the process

for accountants: the adjusted trial balance that includes the unadjusted balance, adjustments, and

adjusted balance columns; and the adjusting journal entries report which is a report of only the

entries for the time period that have been designated as adjusting journal entries.

New with version 2008 is the ability to have the adjusting entries appear on a working trial

balance report.

CORRECT PREVIOUS ERRORS

Alternative: Correct bills and/or checks to split each payment to the liability and expense as

necessary

Correcting the previous errors will provide a clean historical record. Correcting coding errors with

subsequent journal entries will result in a more complicated audit trail. Plus the client is more

likely to continue to make the same mistakes if they go back and look at a previous transaction,

so ideally each transaction would be corrected individually and properly coded. There are several

ways to find the previous transactions to make the corrections when using QuickBooks.

Find Feature

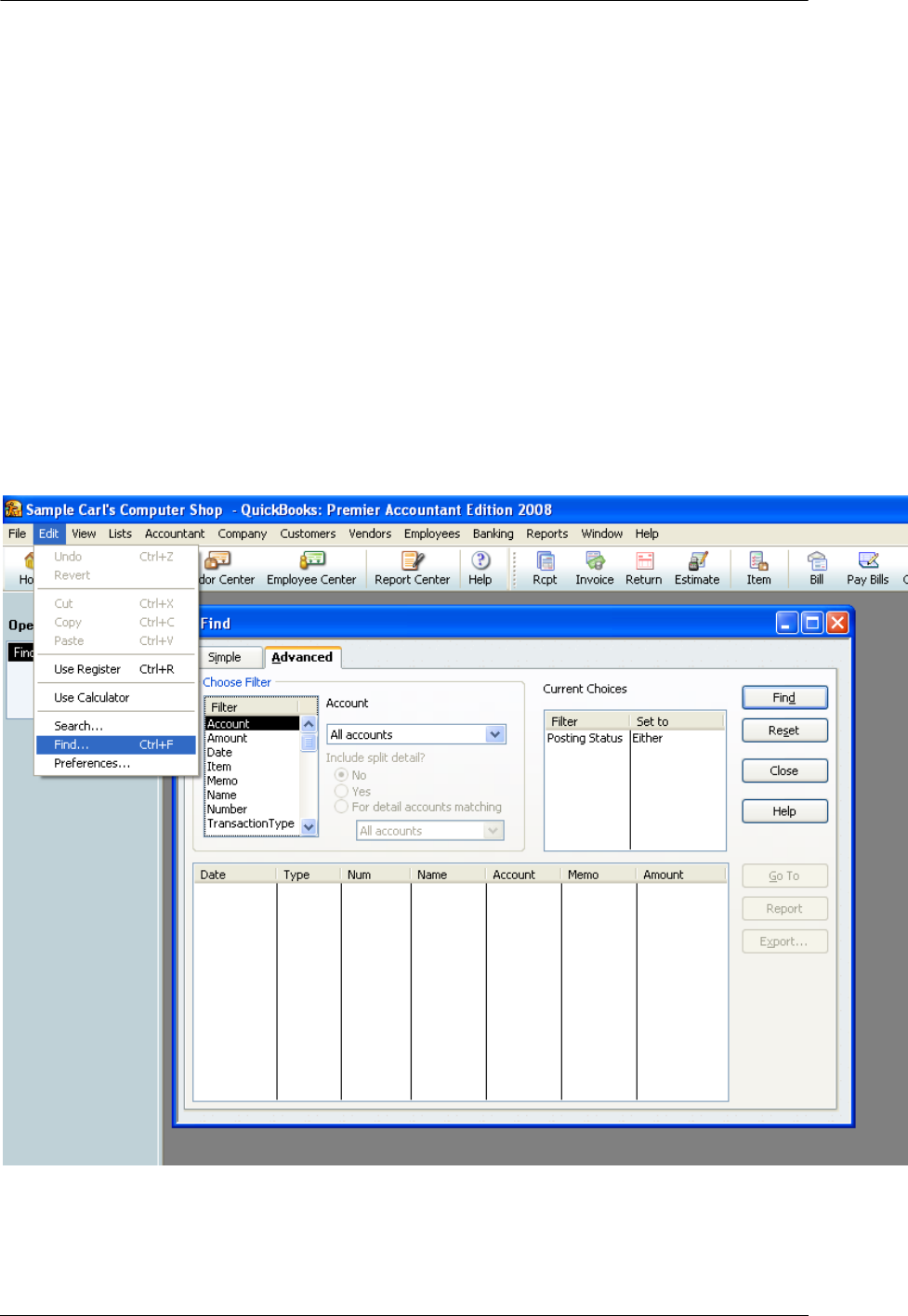

The find feature is so easy to use compared to many other software packages. The “Ctrl+F” is

the key stroke for the feature. The advanced tab is for general look ups (and is the only option

available in older versions) whereas the simple tab is to find specific types of transactions. With

either tab, enter what you know and QuickBooks will find the transactions that match the criteria.

New with Version 2008 the find feature will default to tab that was used last. With 2008 the Detail

Level default was changed back to “All” rather than “Summary” as was the case in a few of the

previous versions.

55

Top 10 QuickBooks Mistakes Clients Make

Besides the find feature, there are several ways to find a transaction that has already been

entered.

• On all of the forms there is a previous and next button that can be useful. This is not

usually the most efficient method since QuickBooks places all the transactions in date

order as they are entered. This is not in the order entered, so if bills have been entered

through 8/31/03 and a bill is entered dated 7/30/03, to find it would require pressing

previous through all the August transactions.

• A more efficient method may be to use the register. This is also in date order, but it is

easier to scroll up and down through the list. If a form is open on the screen (a bill for

example) pressing Ctrl>R will open the appropriate register (in our example the Accounts

Payable register). Once you find the transaction, double click to open the specific

transactional form. The register can also be entered from the chart of accounts list.

• If you see a transaction on a report and would like to see detail about it, place the cursor

on the line of the transaction. It will change into a magnifying glass. Double click and you

will zoom to the detail.

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: Edit > Find > Advanced

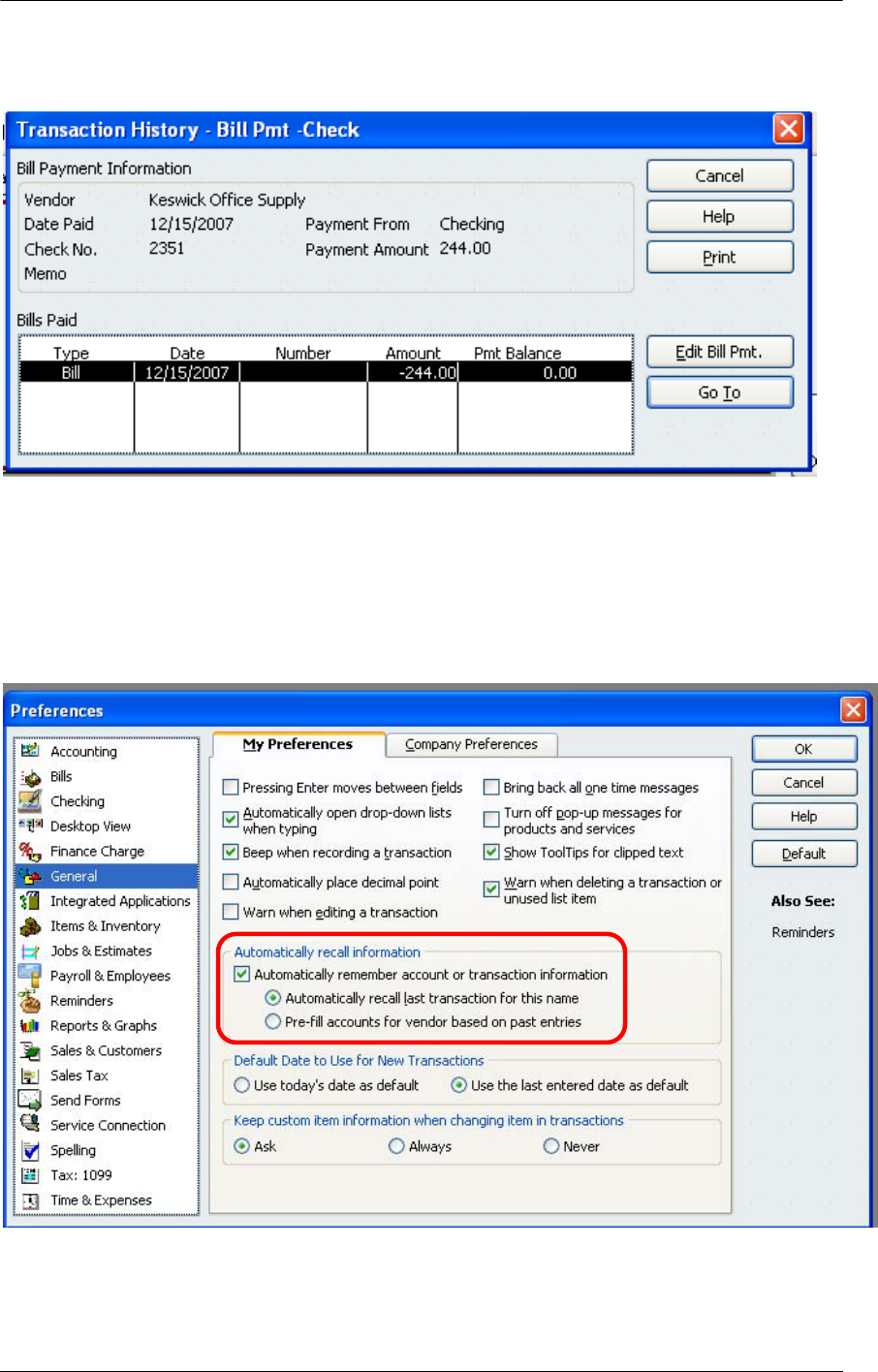

NOTE: It may be necessary to click on the history to drill down to the bill from the bill payment check

to correct the coding.

56

Top 10 QuickBooks Mistakes Clients Make

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: Home Page> Check Register > Find Bill

Payment > Edit Transaction> History

The benefit of finding the incorrectly recorded transaction and fixing it is that with the automatic

recall preference turned on, the change in account and coding will automatically appear when the

next payment is entered. By default this preference is not checked so to use the feature will

require turning it on.

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: Edit > Preferences> General >

Automatically recall last transaction for this name or Pre-fill accounts for vendor based on past

entries

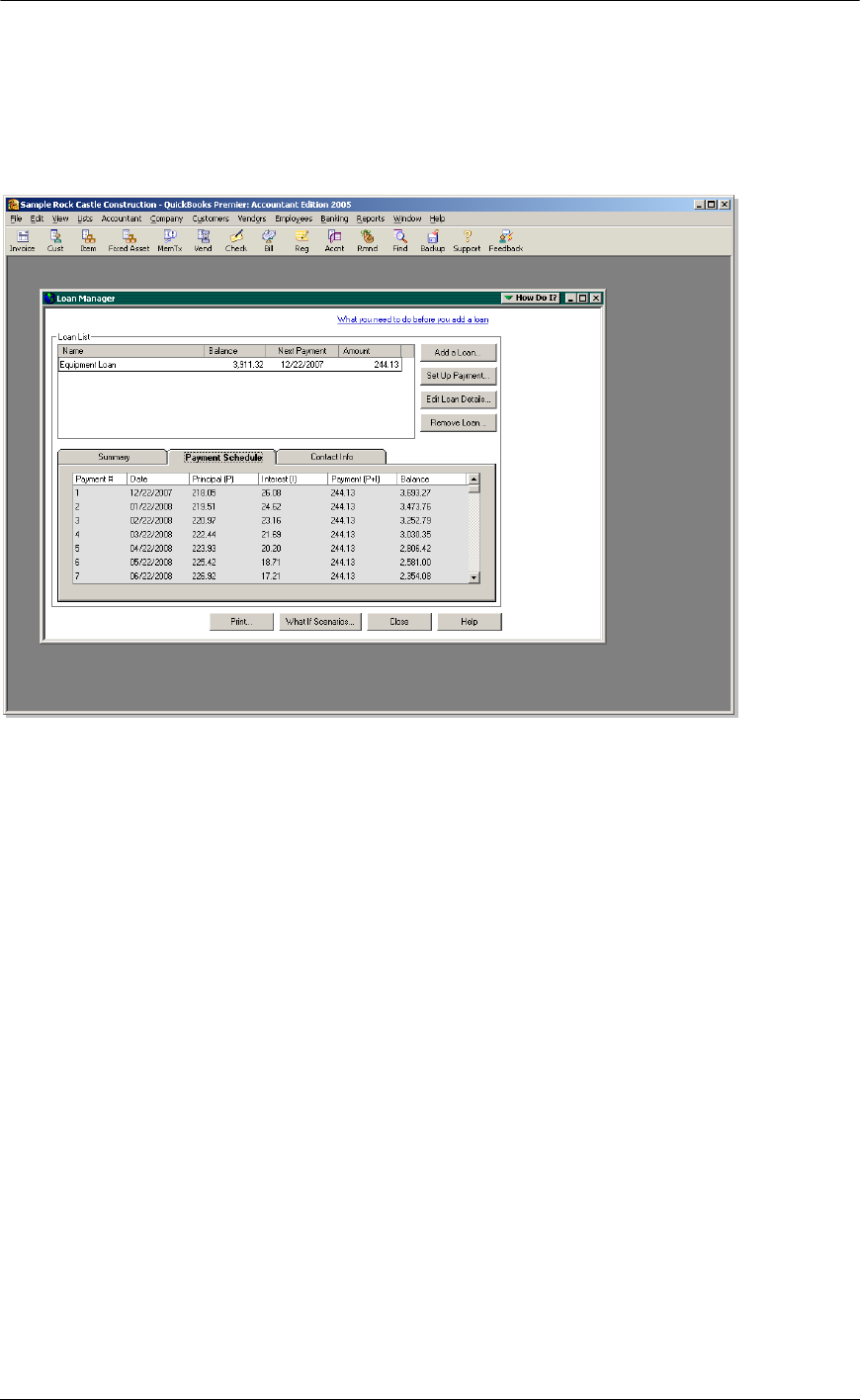

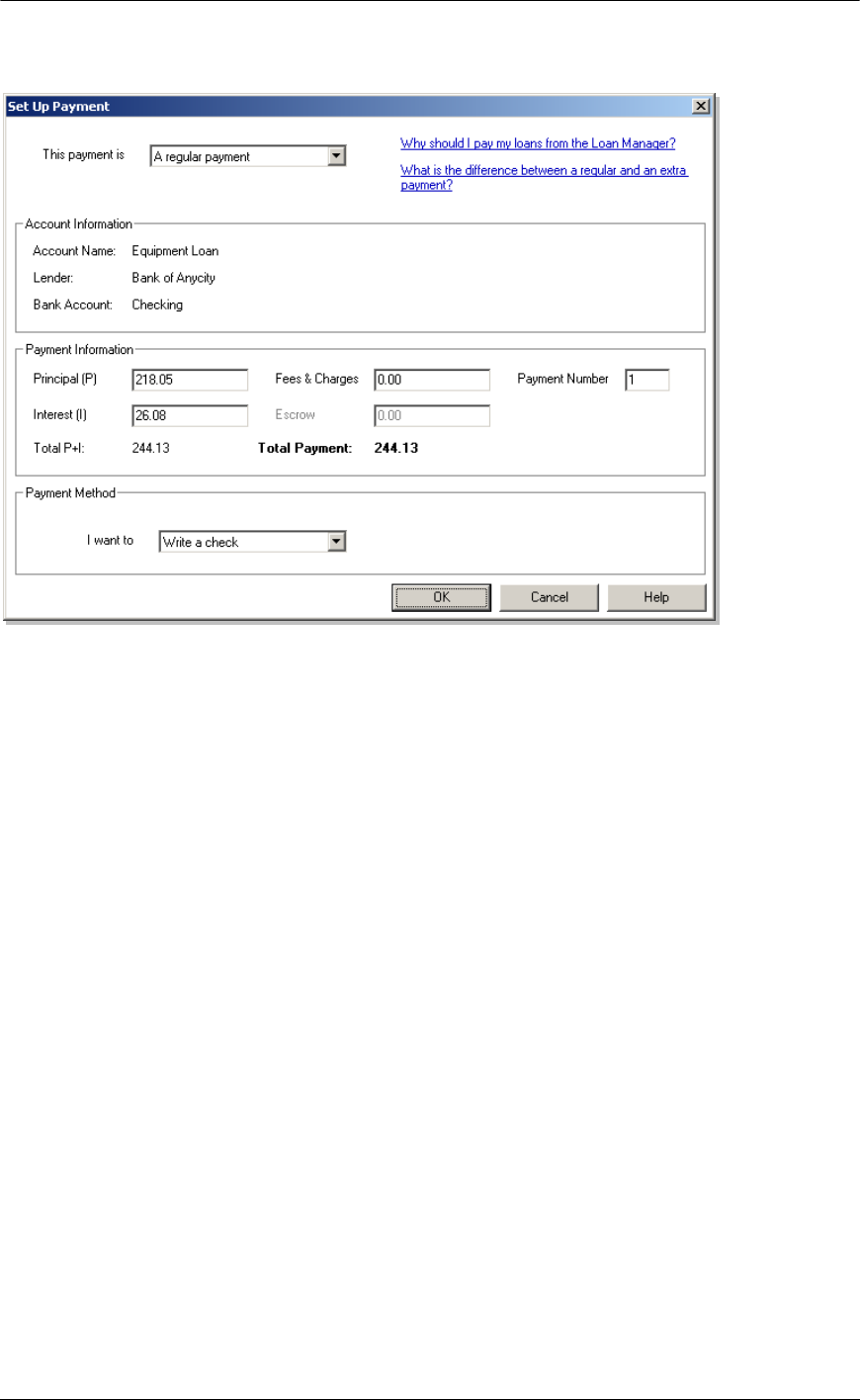

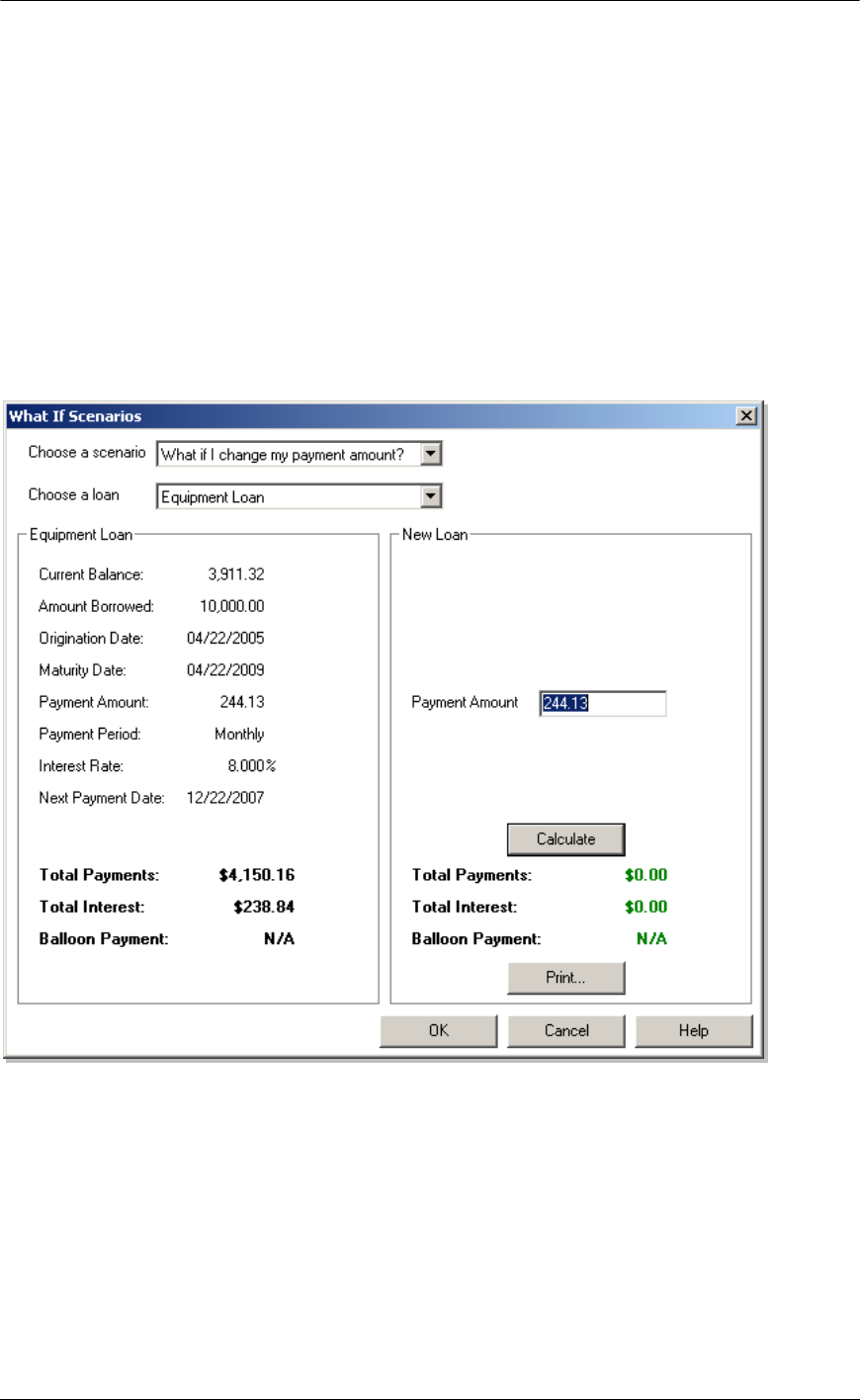

Bonus Fix – Use the Loan Manager (2004 - Pro and higher) in the future to automatically

amortize the loan payments (Banking > Loan Manager)

57

Top 10 QuickBooks Mistakes Clients Make

FIXED ASSET ERRORS

• Common Errors:

o Expense has been recorded for the loan payments but the asset and liability

have not been recorded

o The loan account was created with an opening balance on the new account set

up screen

• Primary Indications:

o Review Accumulated Depreciation for appropriate balance and entries

o Balance Sheet figures are incorrect in Fixed Asset area

• Supplementary Symptom: Consider operating versus capital leases

• Bonus Errors:

o Purchases that should be capitalized are expensed

o Purchases that should be expensed are recorded to the fixed asset account

Recording the fixed asset purchase is not usually a transaction that the client thinks about, or, if

they do, they do not know how to record it correctly. Due to the infrequent nature of this type of

activity, do not assume consistency on the part of your client.

The first step is to figure out what has and has not been recorded

The next step is to determine if the accounts that will be needed exist on the chart of accounts

(i.e., fixed asset, other current liability, long term liability, loan interest)

Then you can begin to figure out how to fix it.

58

Top 10 QuickBooks Mistakes Clients Make

59

Top 10 QuickBooks Mistakes Clients Make

FIXED ASSET FIXES

JOURNAL ENTRY

As was described in the previous section, a journal entry is an effective way to deal with

reclassifying and/or recording a fixed asset transaction. To record the transaction correctly,

obtain the bill of sale or other paperwork that supports the purchase. This paperwork should

detail any additional costs that should be capitalized (such as delivery and/or installation), as well

as any amounts that can be expensed in the current period (for example the license fee for a

vehicle purchase). Prior to making the entry, it is also important to discover what has been

already recorded in QuickBooks: was there a down payment, if so, how was it recorded; have

there been loan payments made already, how were they recorded; has the fixed asset and/or

loan accounts been created on the chart of accounts, if so, was any activity already entered onto

the register? Once the determination has been made as to what was recorded, it is simply a

matter of creating a journal entry to reclassify everything correctly.

PATH: Company > Make Journal Entries; see also Loan Errors

FIXED ASSETS CAPITALIZATION POLICY

Although this question is primarily accounting policy in nature, the answer is important when

determining if the fixed asset section has been handled properly. A capitalization policy is a

materiality threshold for when a purchase is recorded as an asset versus expensed in the current

period.

The general rule is: If an asset has a life that exceeds one year, it is an asset. For example, a

computer or a garbage can has a life of greater than one year where as a pad of paper does not.

The capitalization policy is determined based on the size of the company and the typical size of

expenditures. In our previous example, capitalizing a $10 garbage can (and depreciating it $2 a

year for the next five years) does not make sense from the standpoint of keeping track of it,

placing it on the schedule for tax return purposes, and making the entry each year to depreciate

it. A $2,500 computer system, on the other hand, should be handled properly. For most small

businesses, the limit is usually around $500, but this can vary depending on the type of business,

typical expenditures, etc.

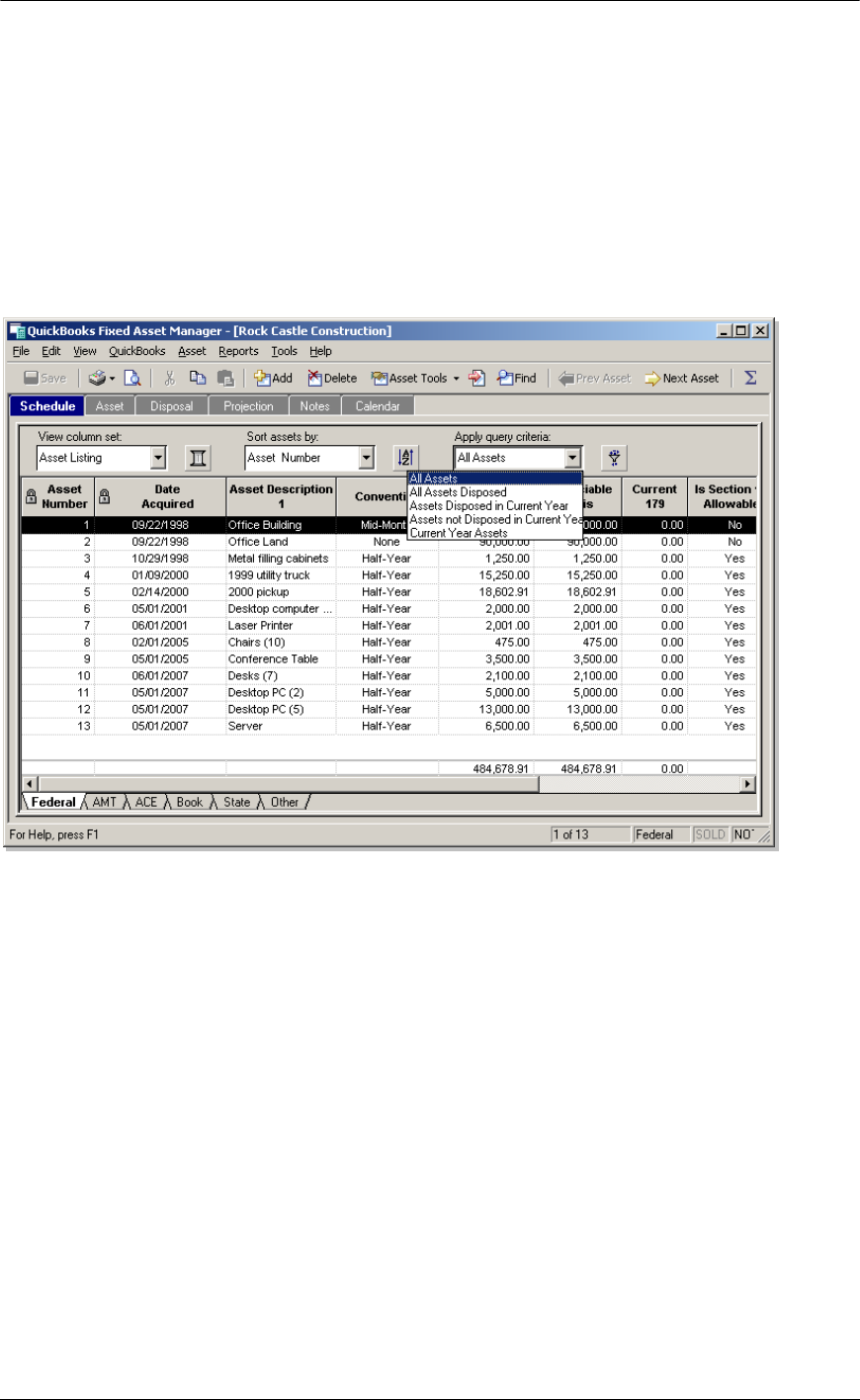

FIXED ASSET MANAGER

In QuickBooks: Premier 2004 (and higher): Accountant Edition, there is a built-in Fixed Asset

Manager that you can use to easily track your clients’ fixed assets and generate automatic

depreciation journal entries into their books each month.

60

Top 10 QuickBooks Mistakes Clients Make

61

Top 10 QuickBooks Mistakes Clients Make

PRIOR PERIOD CHANGES

One of the most frustrating things for Accountants using any software is when they begin the

work for the new period and the prior period balances have changed.

In QuickBooks this is part of the double edged sword of easy to use and correct, but incorrect use

of the safeguards and good accounting controls can be problematic.

The solution involves a more active role by the accountant to ensure that their entries have been

processed and recorded correctly. More extensive client training might be needed. Next use the

tools available within the software to discover what has been done, and then fix it.

62

Top 10 QuickBooks Mistakes Clients Make

63

Top 10 QuickBooks Mistakes Clients Make

PRIOR PERIOD FIXES

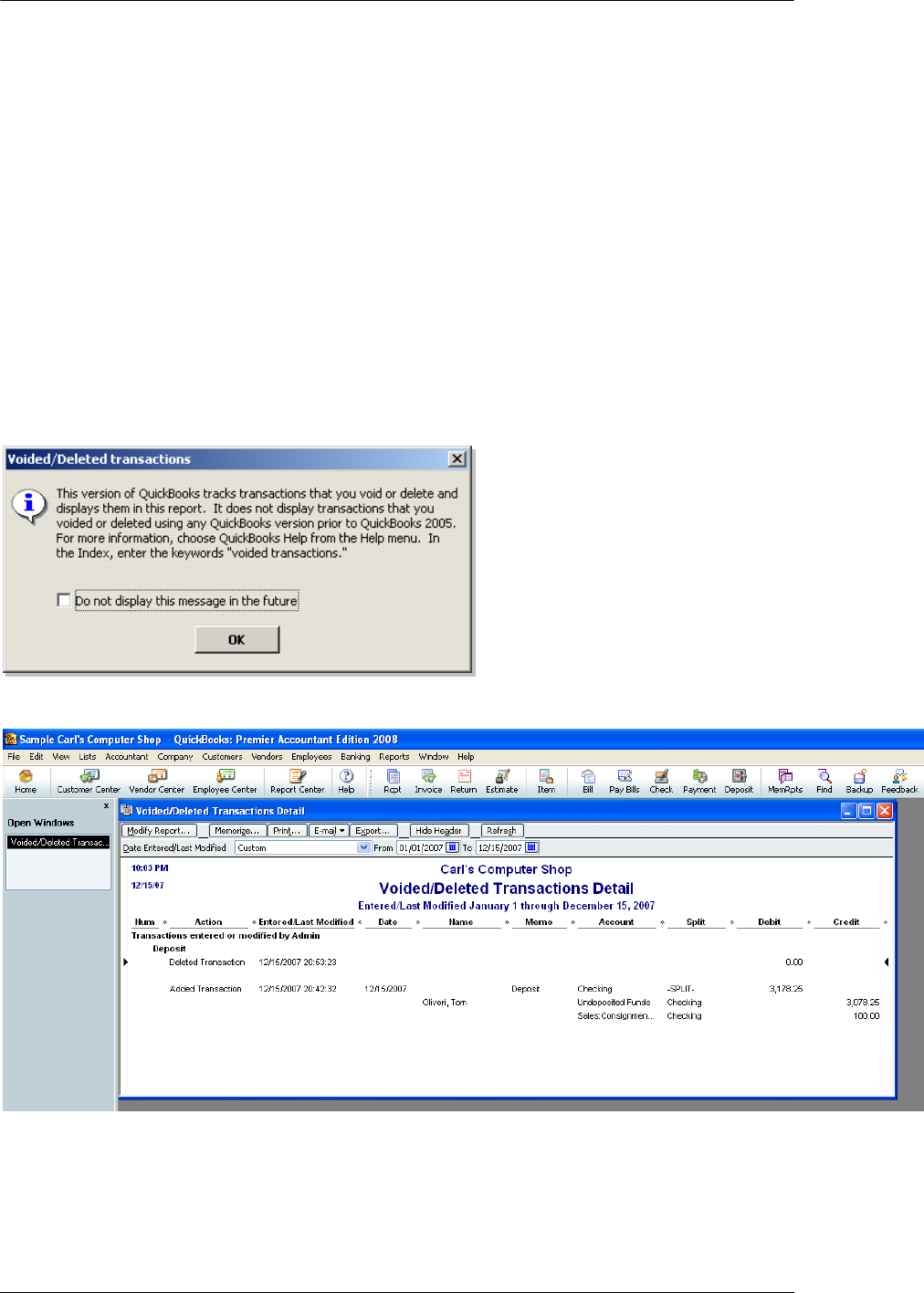

VOIDED/DELETED TRANSACTIONS

With version 2007 (Pro and higher) is the Voided/Transactions Report. This is an easier way to

see which transactions have been voided or deleted for a specific time period. This is a summary

report so it is possible to double click on the specific entries to drill down to the transactional

history report to see the detail.

REPORT PATH: Reports > Accountant & Taxes > Voided/Deleted Transactions Summary or Detail

When the report is opened for the first time, a warning pop up box appears:

“This version of QuickBooks tracks transactions that you void or delete and displays them in this

report. It does not display transactions that you voided or deleted using any QuickBooks version

prior to QuickBooks 2008. . . “

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: Reports > Voided/Deleted Transactions

Internal Control Note:

This report does show transactions that were voided or deleted in the same

session.

64

Top 10 QuickBooks Mistakes Clients Make

AUDIT TRAIL

Although QuickBooks does not have the same enter, print, and post routine as many other

software packages, it does have an audit trail report. For versions 2007 and higher, the audit trail

is automatically turned on. In the past, you needed to turn on the audit trail. This is no longer

necessary.

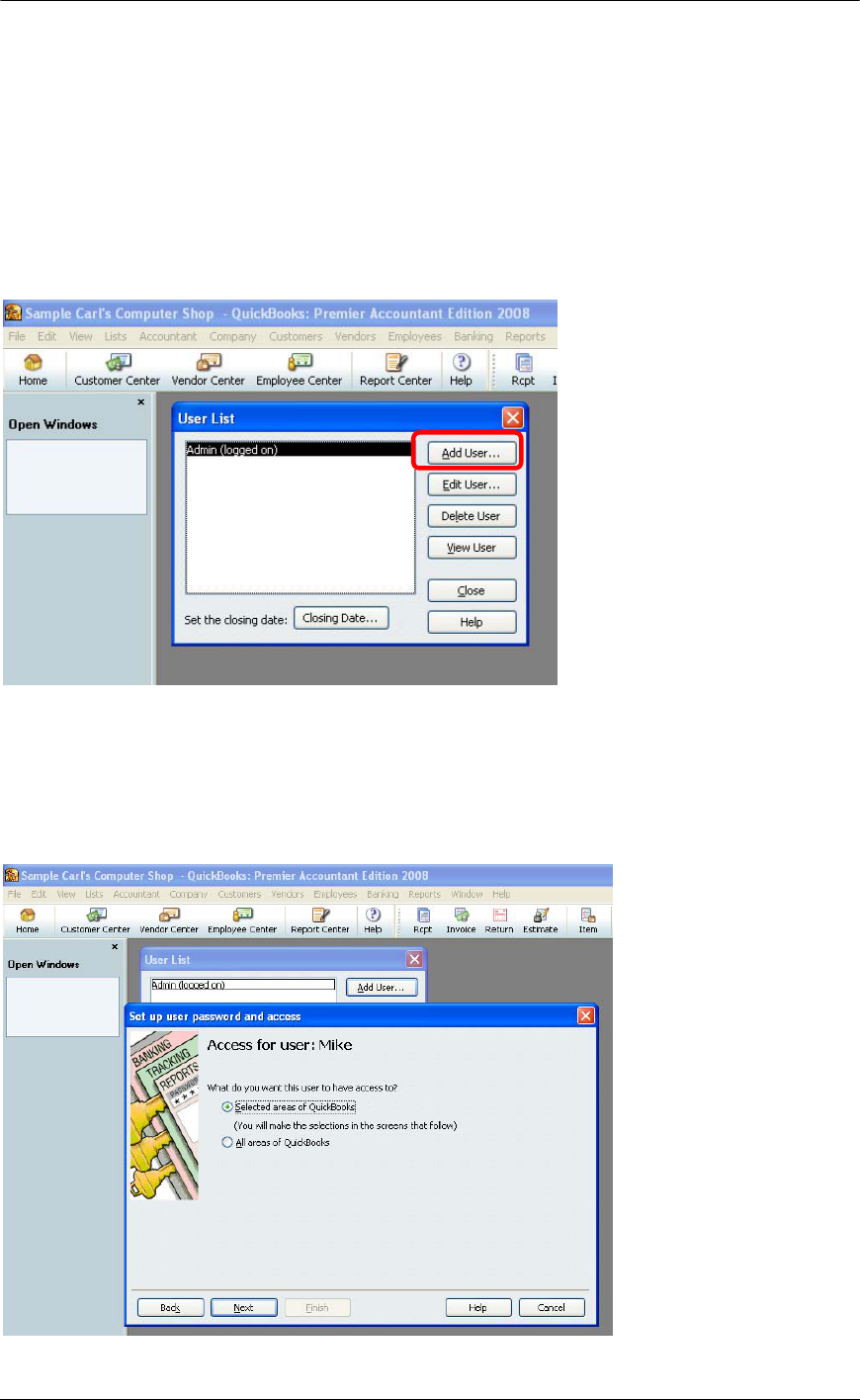

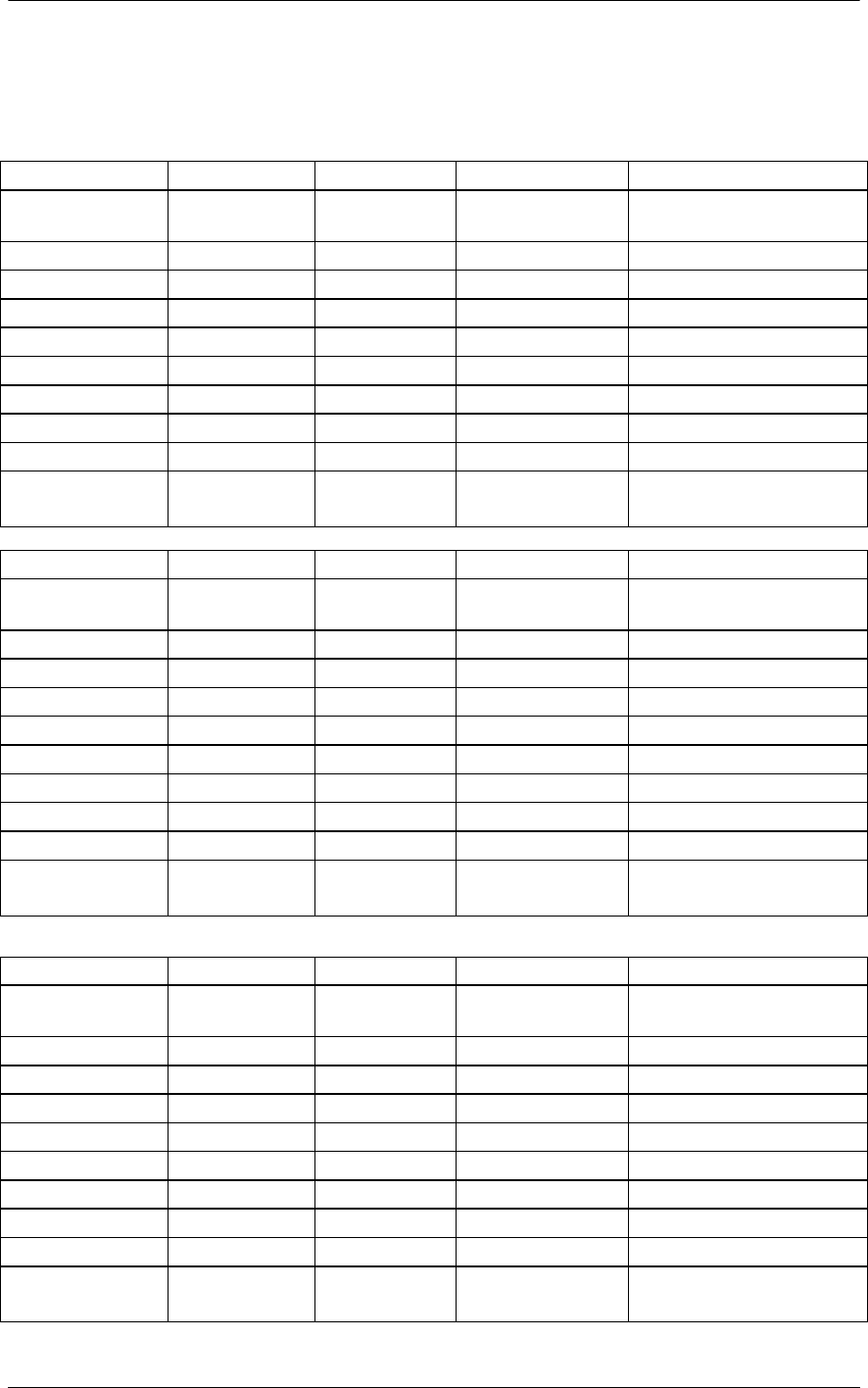

TIP: In order to make this report efficient and effective, it is imperative to set up users for all

individuals working in the data file.

Establish a user name and password unique to each person who will be using the software. In

addition to the date and time, the user is also tracked.

TIP: The audit trail function works well for supervising data entry by others since it is possible to do a

report of all the transactions entered/modified for a specific date range.

Comparison of the Financial Statement reports as prepared by the Accountant and the current

balances as of the same date in QuickBooks will often provide clues as to what transactions may

have been changed: For example, is cash significantly lower in QuickBooks? Was an old

outstanding check deleted or voided? Was a bank fee subsequently recorded in the previous

period and manually cleared?

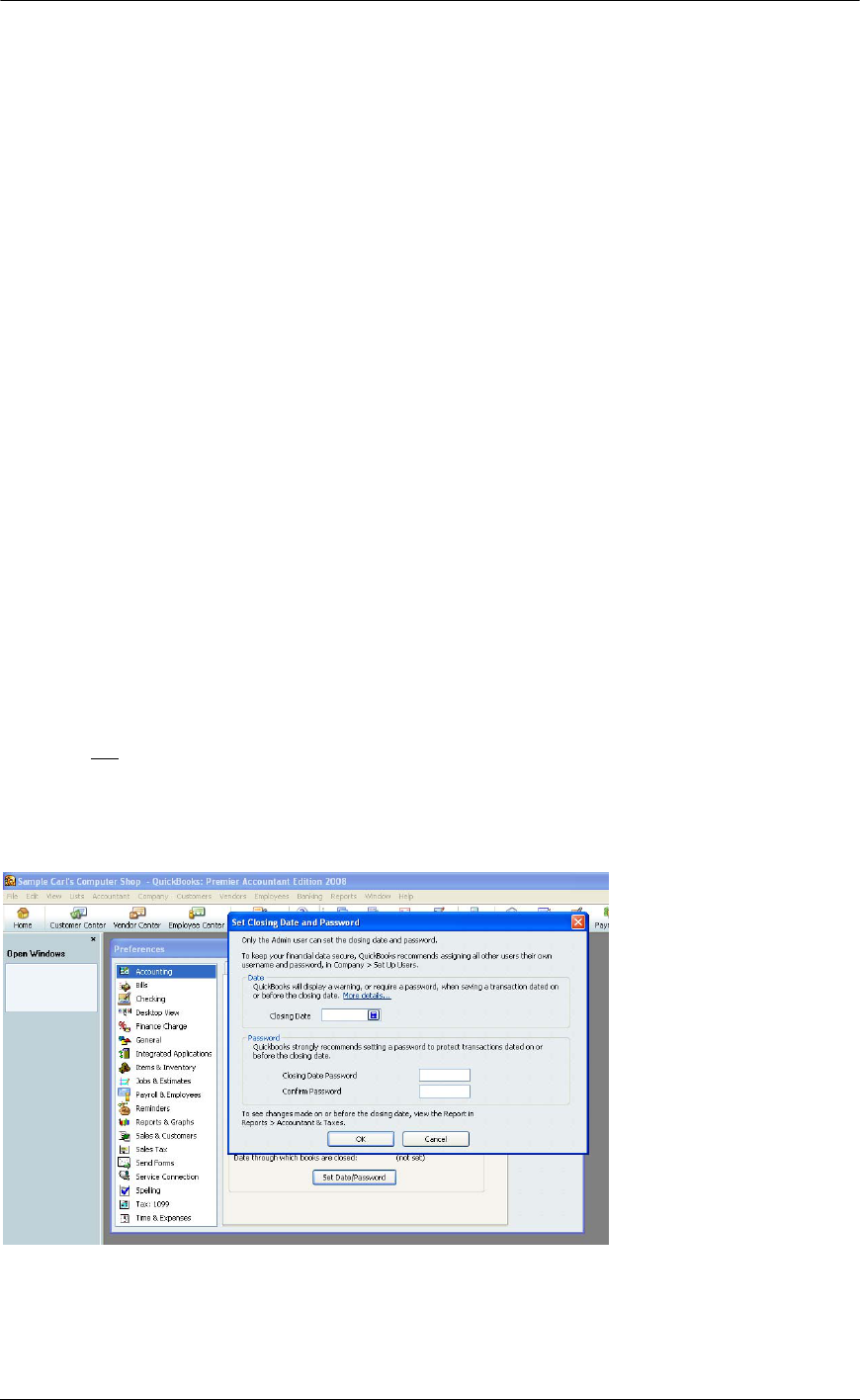

CLOSING DATE

It is recommended that the closing date be assigned regularly, usually after the bank

reconciliation and financial statements have been prepared for the previous month. Because this

information is on the company preference, only the Admin password can change it, another

reason to not

allow any other user to know the Admin user.

QUICKBOOKS: PREMIER ACCOUNTANT EDITION 2008: Edit > Preferences > Accounting > Set

Date/Password

NOTE: Since this change is a preference, the Admin is the only user who can change this password.

65

Top 10 QuickBooks Mistakes Clients Make

In a perfect world, transactions would be entered, accounts would be reconciled, and financial

statements would be issued at which time the closing date would be updated. In reality, most

small businesses do not use the reports available as often as they should and therefore do not

institute the procedure of closing the period. Instead, they take the approach that corrections and

reclassifications can be made throughout the year until the time when the accounting records are